It was more of the same for new home sales in November: "The GTA new home market continued to languish," says Edward Jegg, Research Manager with Altus Group, the company that analyses market data for the Building Industry and Land Development Association's (BILD) monthly new home marker report.

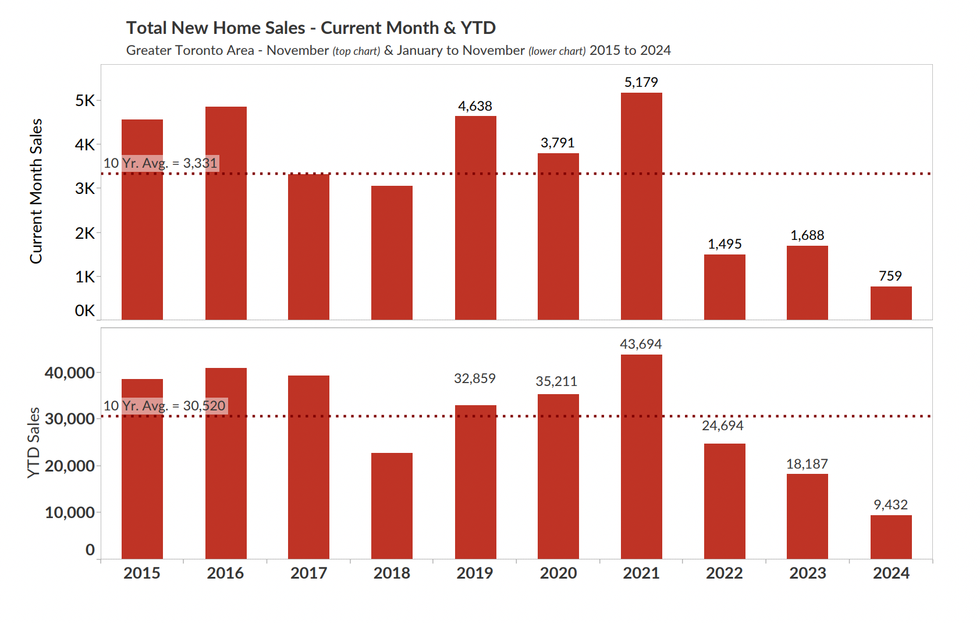

Consistent with a year-long trend in slow sales, the report finds November saw 759 new homes sales across the GTA following a mere 765 sales in October. Overall, sales in November were down a discouraging 55% year over year and 77% below the 10-year average.

The narrative for months has been that the cost to build, compounded by high interest rates, is the cause of this standstill, which continues to be flagged by BILD leadership. "The current 'cost to build' crisis is stalling the new home market," says BILD's Senior Vice President of Communications, Research, and Stakeholder Relations Justin Sherwood. "With housing starts in decline, government action to reduce the high level of government fees, taxes, and charges on new homes is one of the most viable means to quickly address the challenge and get things moving again."

Sherwood points to the City of Vaughan's late-November decision to reduce development charges on single low-rise homes as an example of an effort governments can take to lessen the economic pressure on new home builders. It's "a crucial step," he says. "And other municipalities must follow suit."

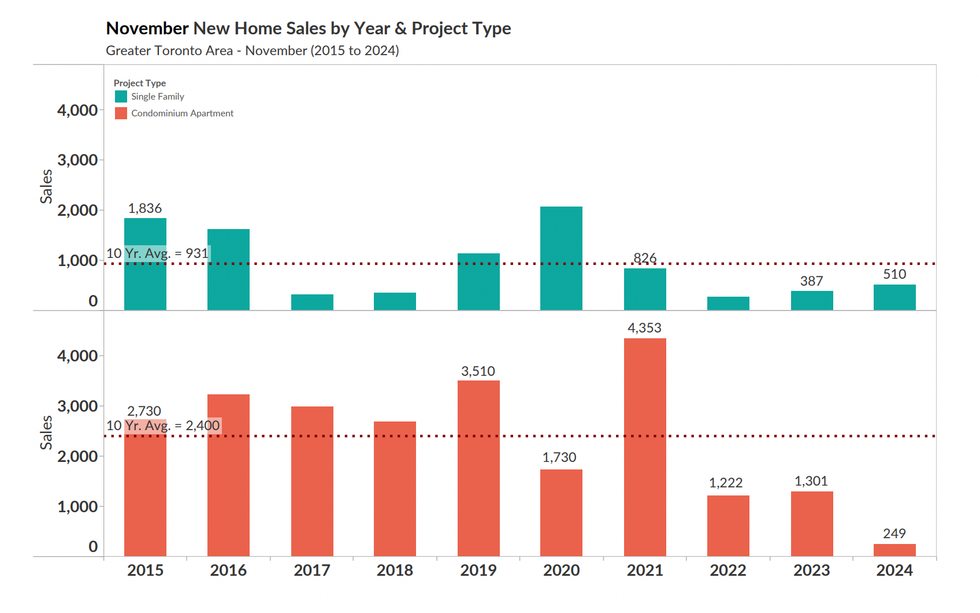

Single-family homes continued to lead new home sales in the GTA with 510 sales recorded for November, up 32% from last year but 45% below the 10-year average. Meanwhile, condominium apartments, which represent the other 249 sales, are down a dismal 81% from 2023 and 90% below the 10-year average.

On the inventory front, numbers fell from 22,299 units in October to 21,97 units in November, comprised of 17,168 condominium apartments and 4,803 single-family dwellings. This leaves the combined inventory level at 14.1 months, which is more or less consistent with what we've seen throughout 2024.

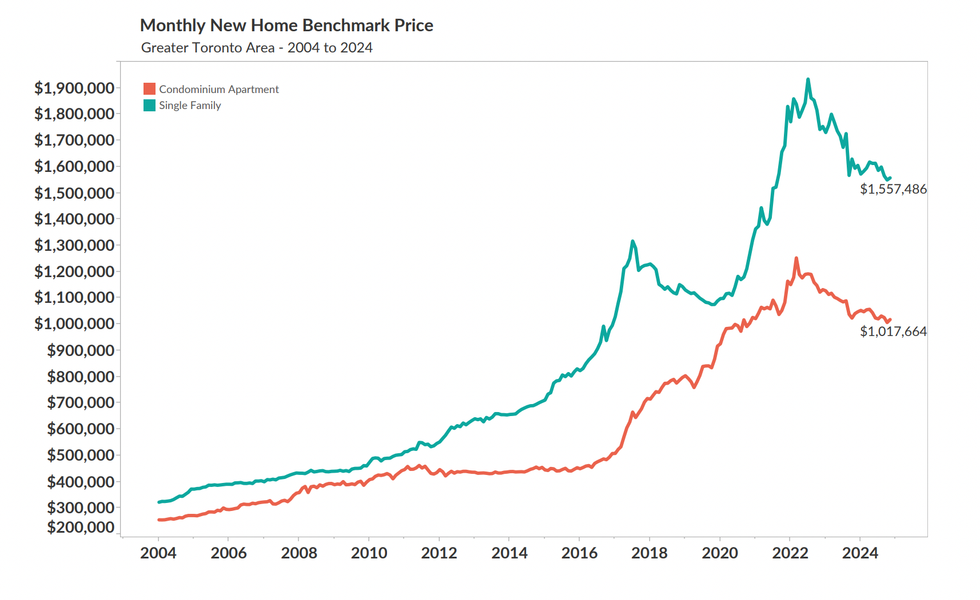

Benchmark prices also went relatively unchanged in November, posting a slight dip for both new single-family homes and condos. The new benchmark price for condos is $1,017,664, down 2.2% from last year, and $1,557,486 for single-family homes, down 2.3%.

This decline, though relatively slight, comes after the New Housing Price Index saw its largest decline since April 2009 in October. But low demand can only drive prices so far down. The closer prices get to the cost it takes to build a new home, the more new home sales and, thus, construction, will suffer, negatively impacting future supply in the midst of a housing crisis.

- November Was A "Historically Busy" Month For Housing Starts, And It's Still Not Enough ›

- New Home Construction In Trouble As Prices See Biggest Drop Since 2009 ›

- GTA New Home Sales "Notably Low," Down 60% From Last October ›

- GTA New Home Sales Have "Worst Year Since 1990" ›

- 'Prime Time For Buyers': GTA New Home Prices Down 20% From Peak ›