"Worst February on record" reads the headline of the Building Industry and Land Development Association's (BILD) latest monthly stats report, which tracks how many new homes sales occurred in the Greater Toronto Area each month, amongst other metrics.

New home sales is a key indicator for housing market vitality not only because it reflects buyer confidence, but because it serves as a litmus test for the state of the home construction industry, since demand for new homes dictates future housing supply.

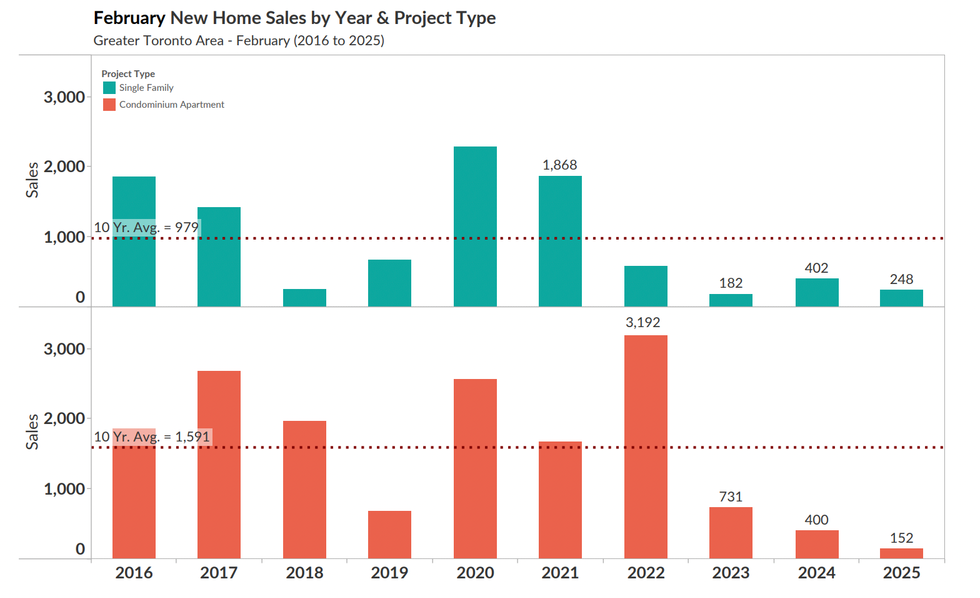

And last month, new homes in the GTA sales hit unprecedented lows, with only 400 transactions recorded in February — a 50% year-over-year decrease. For context, a typical February, based on the 10-year average, would see around 2,570 new homes sales, so February's sales are down 84% comparatively.

But the weak month isn't a one-off. Sales hit record lows multiple times in 2024, and December closed out the year with the lowest new home sales seen in 40 years.

"Make no mistake, we are at the point of a serious ‘cost to build’ crisis and we risk an entire industry shutting down with great and lasting consequences to housing supply and affordability in the GTA," said Justin Sherwood, Senior Vice President of Communications, Research, and Stakeholder Relations at BILD. "Now is the time for action."

The action Sherwood calls for includes a number of reforms the development community has been requesting from various levels of government for years now: reducing and modernizing municipal fees and charges and cutting red tape to speed up lengthy project approval timelines.

Recent policy pledges from both the Liberal and Conservative parties to eliminate GST on new homes up to $1 million or $1.3 million from Mark Carney and Pierre Poilievre, respectively, is welcomed by BILD, but Sherwood says more needs to be done.

“In this time of economic uncertainty, stimulating housing sales and starts is essential to support Canada’s economy, local jobs and industries coast to coast. However, this can only be accomplished if government policy aligns to get housing sales and construction moving again," he said. "To be successful in addressing affordability these policies must apply to the largest number of buyers, have price thresholds that are reflective of the GTA market reality and be matched by the provincial government."

At the same time, trade tensions with the US are only further deterring investment in new homes and home construction.

“New home sales across the GTA in February 2025 remained at rock bottom levels,” said Edward Jegg, Research Manager at Altus Group. “Uncertainty related to upcoming US tariff levels have further added to the reservations buyers previously had on their minds.”

Of the 400 new homes that did sell, 248 were single-family homes, down 38% from February 2024 and 75% below the 10-year average, and 152 were condominiums, down 62% from February 2024 and 90% below the 10-year average.

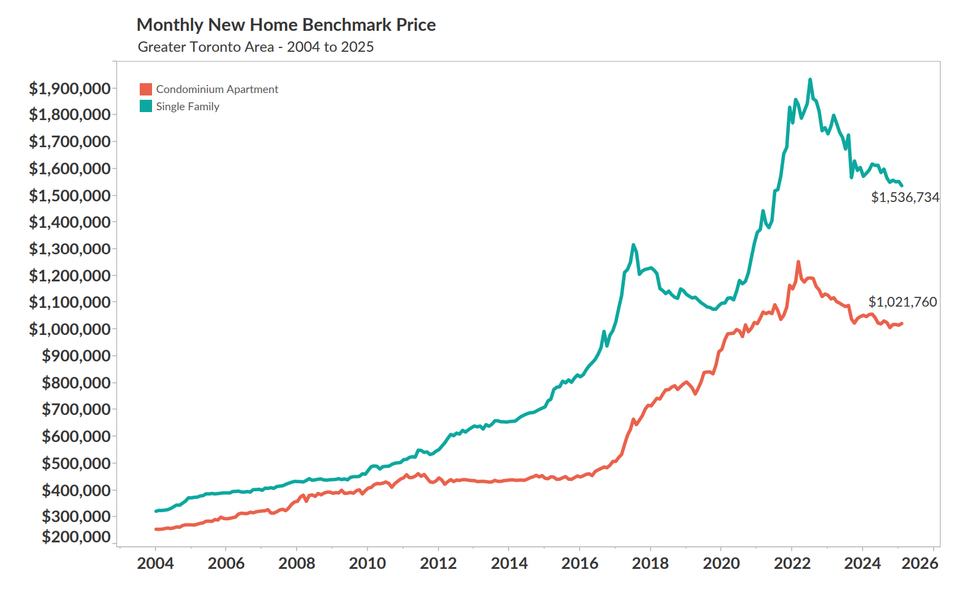

With sales low, listing inventory increased from 21,505 in January to 21,863 units, representing a combined inventory level of 14 months. On the price front, benchmark prices dipped for both single-family homes and condominium apartments in the GTA, with single-family homes falling from $1,552,846 to $1,536,734, down 2.9% over the last year and condo's falling from $1,015,231 to $1,021,760, down 2.4%.

- 'Prime Time For Buyers': GTA New Home Prices Down 20% From 2022 Peak ›

- GTA New Home Sales At 40-Year Low In December, Capping Off "Worst Year Since 1990" ›

- The GTA Just Had Its Slowest March For Home Sales Since The 90s ›

- “Tariff Turmoil” Pulls Canadian Home Sales Down 20% Since November ›

- GTA New Home Sales Hit "Rock Bottom" (Again) In March ›