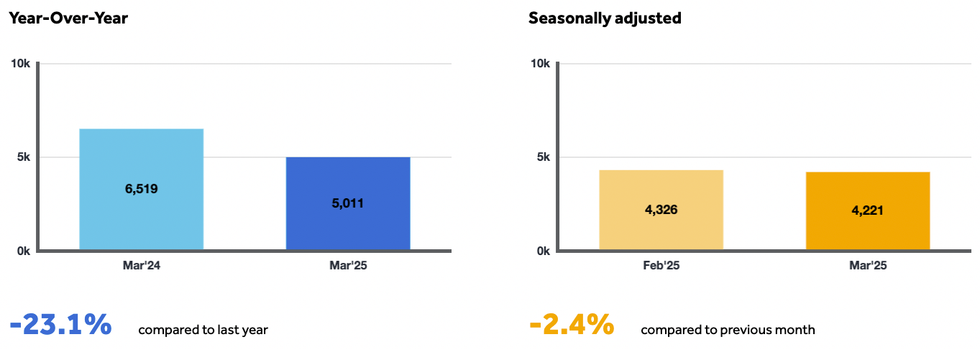

With just 5,011 transactions on the books, last month was the worst March for Greater Toronto Area home sales since 1998, according to the latest statistics from the Toronto Regional Real Estate Board (TRREB). The stats were released last Thursday amidst an ever-evolving landscape of trade dynamics.

Mind you, 27 years ago, the expectation for home sales was vastly different, and the 5,005 transactions reported at the time was considered a banner level. In fact, sales had been hovering around the 5,000-mark for the two March’s prior, and then-TRREB President Jimmy Lee even expressed being “pleased” with the 1998 numbers.

These days, however, 5,000-odd sales in any month of year, but this time of year especially, is an utter let-down, and an indication of much larger concerns. Looking at the past few months of March, there were 6,560 transactions in 2024, 6,896 in 2023, 10,955 in 2022, and a staggering 15,652 in 2021.

Although Canada seems to have dodged the tariff bullet for now, real estate dealings are rife with uncertainty, and as far as the spring market goes, the damage is probably done. And that’s to say that it’s highly unlikely that the market will spruce up this spring as buyers, sellers, and agents were at one point anticipating, with the Bank of Canada having dropped its policy rate by 225 basis points since June.

“People right now are kind of paralyzed, and nobody's really sure what they should do or shouldn't do because of all the uncertainty to the south,” says Erica Reddy-Choquette, Broker at Royal LePage Signature Realty. “Trump and tariffs and politics and Canadian politics have everybody taking a pause and waiting to see how things are going to unfold and what the impact is going to be. And the March numbers, I think, massively speak to the fear and the concern that both buyers and sellers have.”

“What's interesting is that last March was an unprecedented month as far as statistics are concerned, so with that in mind, the numbers are not good, there's no other way to put it,” Reddy-Choquette adds.

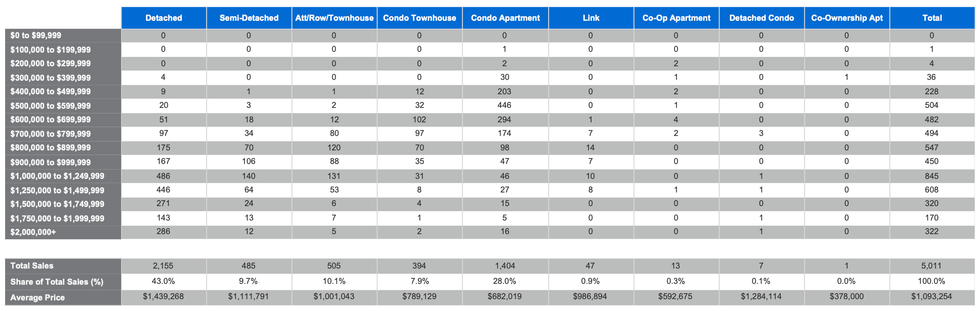

While sales were down across the board, specific property types have fared better than others. There were 2,155 sales of detached homes last month, but just 1,404 condo apartment sales, which speaks to a particular nuance that has emerged in Toronto-area real estate. Once an investor’s stomping ground, we’ve seen the GTA’s condo market crumple under the weight of higher interest rates since 2022, which compounded the price burden of developing high-rise housing in the region and has led to a stockpile of supply. Last month, new condo listings (5,488) accounted for over 30% of overall listings added to the marketplace (17,263).

“I think one of the challenges we have in the condo market is there are so many listings that I almost feel like people are just overwhelmed,” says Reddy-Choquette. “When you have 50 condos you could look at in your price range, in your desired neighbourhood… you’re not sure what to see. And even as an agent, sometimes you're like, which five should we pick?”

“A lot of the time when it comes to having luck in the market, part of it is the product,” she adds. “I had a great detached home in Leslieville, for example, last week — coveted area, coveted price-point — and it was very competitive. We had over 70 showings, multiple requests for home inspection, and it exceeded the client's expectations.”

According to Reddy-Choquette, it’s “entry-level homes in the million, million-and-a-half range” that are selling well right now — something that’s reflected in TRREB’s numbers as well. Those show that there were 845 sales between $1,000,000 and $1,249,999, and 608 sales between $1,250,000 to $1,499,999.

While the overall low level of sales is certainly cause for concern, Trevor Bond, Realtor with Bosley Real Estate, points out that what we’re seeing is much more balance in the market, which certainly has its upsides.

“We're seeing more under-$1 million sales, which we've never [seen] before. That's hallelujah for first-time homebuyers. I saw one that sold for just barely over $700,000 that was... full of trees, very hard to develop, wedge-shaped, and everything like that — and that's about what it's worth,” he says. “Most of what I'm seeing, I go, ‘Yeah, that makes sense.’ Everything is kind of explicable. Whereas sometimes, coming up to the peak, things were inexplicable. I'd come home and say to my wife, ‘I don't know what just happened.’ I would sell properties for 50% over the asking price.”

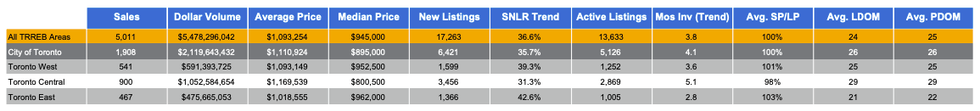

Toronto's east end, where Bond does most of his work, is where many of March’s sales were concentrated. According to Thursday’s numbers, there were 467 transactions in Toronto East, as well as 541 in Toronto West and 900 in Toronto Central. In other words, sales in the City of Toronto accounted for nearly 40% of the 5,011 sales reported by TRREB last month.

“I live in Riverdale, I work a lot in Riverdale, but I also I sold a duplex out on Brock Avenue with multiple offers. So multiple offers are still the name of the game if you have the right product, and that means strategic pricing and holding back offers,” says Bond.

“It feels like the old days without me saying, ‘This is unsustainable.’ I used to say that 20 times a day for four years because prices were just being driven up so high,” he adds. “Now... the emotions are way down, the irrational purchasing habits are non-existent.’”

Despite his optimism, Bond is well aware that the spring market is riddled with uncertainty. The tariff conversation may be haphazard and hard to follow, but it’s also relentless and always at risk of getting worse.

“Real estate is one of those industries, if there are hard times people have to sell their houses. And if there are Americans coming up with American money, we're in trouble. I just had a deposit converted for a property, and [the buyers] were like, ‘That's all I've got to give?’ They're literally getting 40% more, 42% more," he says. “So anything can happen.”

- GTA New Home Sales Plunge To "Rock Bottom Levels" In Worst February On Record ›

- A “Normal” Spring For Toronto’s Housing Market? Maybe Next Year ›

- Toronto Home Sales Slide 23% In March As Listings Pool On The Market ›

- “Tariff Turmoil” Pulls Canadian Home Sales Down 20% Since November ›

- Canadian Home Sales Sink Almost 10% Year Over Year In April ›