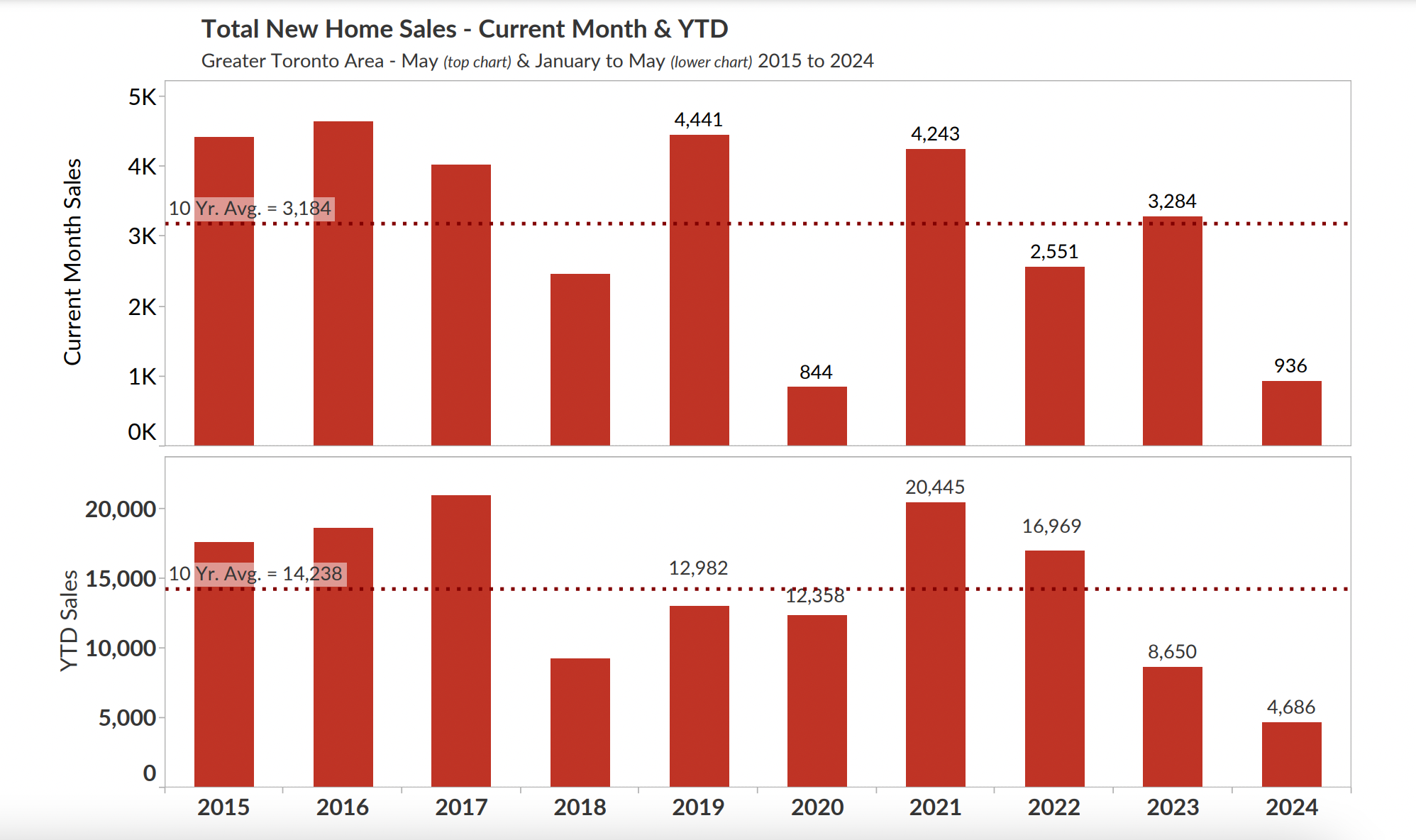

Data released by the Building Industry and Land Development (BILD) today shows that new home sales in the GTA continued to slow in the last month, nearly reaching May 2020 pandemic levels. Year-to-date sales from January–May 2024 also show a “record-breaking” 39% drop below year-to-date sales from January–May 2009 — Canada's last major recession, excluding the pandemic.

"Since we began keeping track in 1990, this May was the second lowest month for home sales behind May of 2020, and that was the pandemic," Justin Sherwood, SVP Communications & Stakeholder Relations at BILD, told STOREYS. The not-so-secret culprit: "It's all because of interest rates."

The numbers came in at a meagre 936 new home sales in May, down 71% from last May and 71% below the ten year average, according to data from Atlas Group. Of the 936 sales, 539 were condominium apartments, down 75% from May 2023 and 75% below the 10-year average; 397 were single-family homes, down 65% from May 2023 and 61% below the ten-year average.

In addition, new home remaining inventory stays “exceedingly high,” with an increase to 20,427 units, representing a combined inventory level of 14.5 months, based on average sales for the last 12 months.

“The continuing record lows in new home sales is a flashing check engine light on the dashboard,” said Sherwood in a media release. “Today’s sales are tomorrow’s starts. It is inevitable that we are entering further tight supply conditions in the next two to three years.”

Sherwood identifies rising building and owning costs to be drivers of this decline in the housing market. “Not only are high interest rates keeping buyers on the sidelines, but higher rates are making financing for new projects more difficult and expensive,” he says. “The new home industry in the GTA is slowing down precipitously, and new home supply in the 2025-2027 time period will reflect this."

As for home prices, after increasing in April to $1,056,786, benchmark condo prices dropped slightly to $1,043,861 in May, and single-family home prices ticked dropped from April’s $1,617,896 to $1,612,515, down 5% and 7% over the last 12 months, respectively. The decline follows a months long trend of home prices slowly inching down as a result of an over-saturated market, but we could be reaching the limit, Sherwood tells STOREYS. "I'm not sure how much farther they can slide, simply because of the tremendously increased cost of land, construction, and materials."

In the media release, Sherwood calls on governments to take action to boost our troubled housing market. “To avoid future lack of supply driven price appreciation, we need all parties, all levels of government, CMHC and the industry to sit down and arrive at collaborative solutions that will support those seeking to call the GTA home.”

- Q1 Sets Record Lows For New Home Sales In The GTA ›

- Home Sales Expected to Increase Following Rate Cut Despite "Another Sleepy Month" In May ›

- How Much An Interest Rate Cut Will Save Average Canadian Homeowners ›

- Signs Of Life In Housing Market, CREA Reports ›

- June Sees Another Slow Month For New Home Sales In GTA ›