Amid high interest rates and rising construction costs, real estate investors shied away from the Greater Toronto Area (GTA) in the first half of 2023.

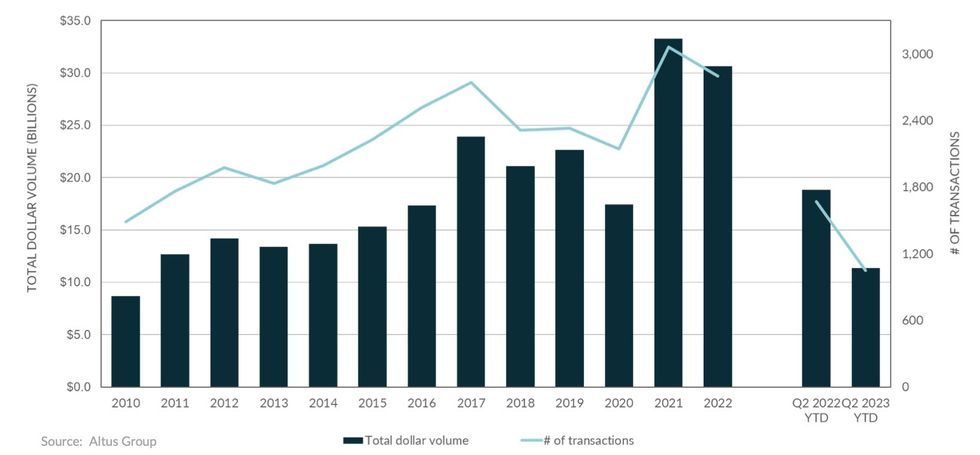

According to Altus Group’s GTA Q2 2023 Market Report, commercial investment activity declined 27% year over year in the second quarter, with transaction volume dropping to $6.68B compared to $9.21B in Q2 2022.

Given the high interest rate environment and looming recession, it’s "not surprising" that investors have paused, Raymond Wong, Vice President of Data Solutions Delivery at Altus, told STOREYS.

Following the frenzy of activity seen throughout 2021 and 2022, there exists a discrepancy between the price sellers want and what buyers are willing to pay, Wong said, which has weighed further on investment activity.

"There are still definitely investors who want to purchase assets in the GTA, but at the right price," he said.

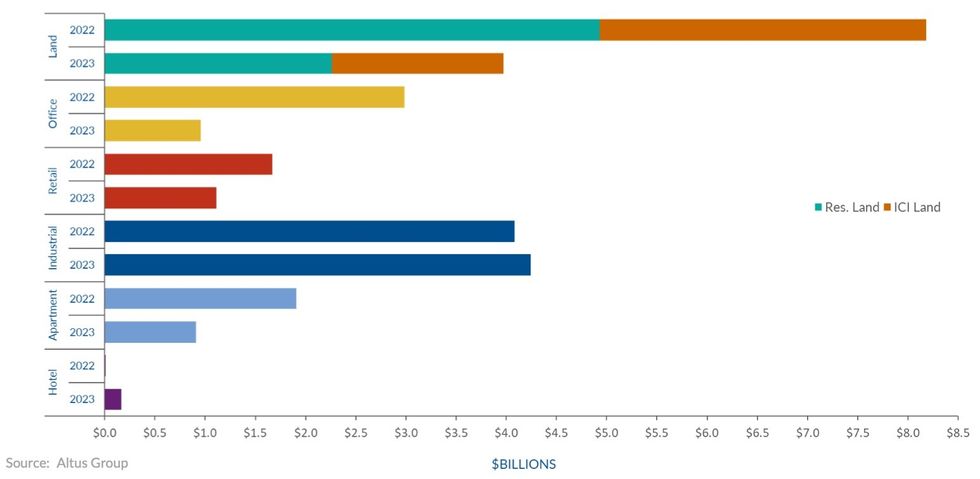

The only sector to experience growth on an annual basis was industrial, which reported $3.39B in dollar volume in Q2 2023, a 36% increase from Q2 2022. However, the uncertain economic climate has led investors to take a more cautious approach. As such, the availability rate jumped from 1.3% to 2.3% on an annual basis in Q2 2023.

Approximately 3 million sq. ft of new industrial supply came to market in Q2, but, unlike quarters past, a significant portion has not been pre-leased. Despite the apparently dwindling demand, new supply under construction rose from 17.3M million sq. ft In Q1 to 18.7 million sq. ft In Q2.

"Canada is still undersupplied on the industrial side," Wong said. "There is just not enough supply to keep up with demand."

While investors remained relatively confident in the industrial sector, faith in the residential component faltered. Investment transactions in the sector fell to $563M in Q2, an annual decline of 44%.

The report notes that a gradual decline in transaction volume began in Q3 2022, as as interest rates and construction costs rose alongside a worsening shortage in the skilled trades.

The most significant pullback in activity occurred in the office component, though, with investment transactions falling from $1.07B in Q2 2022 to $414M in Q2 2023 — a 61% decline.

The return to office has stalled across Canada, leading the national office availability rate to climb to 18% in Q2; in the GTA, it stood at 18.5%. Sublet space represented 24.9% of the total available office space in Q2, a 4% annual increase.

"AA office space is doing well. It’s the B and C Class space that’s struggling, because there’s more demand for better class buildings," Wong said.

"Some of those [B and C class] buildings could be at the end of their lifecycle and could be ready for conversion, perhaps to a data centre or life science centre. We’re going to see office space and how we use it evolve over time."

Wong expects the slowdown in activity seen throughout the first half of 2023 will persist for the remainder of the year, as investors grapple with high interest rates, a growing bid-ask price gap, and the threat of a recession.

"Activity will definitely be down this year compared to last year,” Wong said. “But 2021 and 2022 were very strong years. So, we may just be going back into a level of normalcy for investment activity in the GTA."