The Greater Vancouver real estate market is currently hitting levels that we have not seen since the COVID-19 boom — at least by one metric.

According to statistics published on Thursday by Greater Vancouver Realtors (GVR), formerly the Real Estate Board of Greater Vancouver, active listings for single-family homes, townhouses, and condominiums in the region hit 11,957 in April, an amount not reached since Summer 2020.

This came after a total of 7,092 new listings came online last month, a significant increase from the 5,002 that came online in March. Last month's total was also significantly higher than both the April 2023 total of 4,307 and the 10-year April average of 5,637.

Demand, on the other hand, was not able to match that supply, although it has been stronger than some perhaps expected.

In April, the Greater Vancouver region recorded a total of 2,810 home sales, which represents an improvement compared to both March 2024 (2,396) and April 2023 (2,721), although it is below the 10-year April average (3,223).

"It's a feat to see inventory finally climb above 12,000," said GVR Director of Economics and Data Analytics Andrew Lis. "Many were predicting higher inventory levels would materialize quickly when the Bank of Canada began its aggressive rate hikes, but we're only seeing a steady climb in inventory in the more recent data. The surprise for many market watchers has been the continued strength of demand along with the fact few homeowners have been forced to sell in the face of the highest borrowing costs experienced in over a decade."

Buyers or Sellers

With the above statistics, we can identify the sales-to-new-listings ratio and sales-to-active-listings ratio, which are two quantitative indicators that give us a sense of whether the market is leaning in any particular direction — towards buyers or sellers.

For the sales-to-new-listings ratio, a ratio of 40% or lower is considered a buyers' market, a ratio of 55% or higher is considered a sellers' market, and anything in between is considered a balanced market.

With 2,810 home sales and 7,092 new listings recorded in April, the sales-to-new-listings ratio is now at 39.6%, after being at 47.9% at the end of March, a significant shift towards buyers that aligns with the increase in inventory, which gives buyers an advantage over sellers due to the amount of options available on the market.

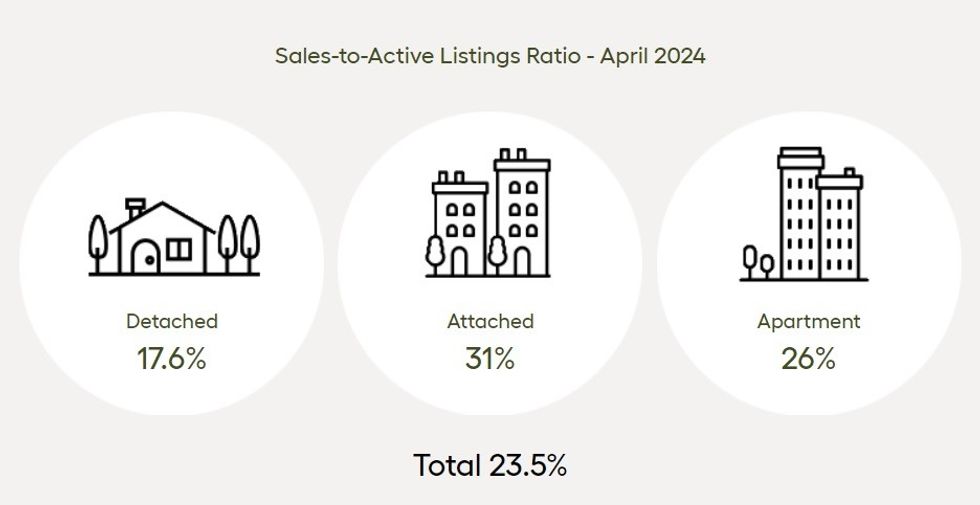

For the sales-to-active-listings ratio, a ratio of 12% or lower is viewed as favouring buyers, a ratio of 20% or higher is viewed as favouring sellers, and anything in between is viewed as a balanced market.

With 2,810 home sales and 11,957 total active listings in April, the sales-to-active-listings ratio is now 23.5%, after coming in at 23.8% in March — a similar shift, albeit much smaller.

The sales-to-active-listings ratio varies rather significantly when distinguishing between different property types, however, with the ratio at 17.6% for single-detached homes, 31% for attached homes, and 26% for apartments.

Prices and Outlook

"Another surprising story in the April data is the fact prices continue climbing across most segments with recent increases typically in the range of 1% to 2% month-over-month," added Lis. "The one segment that didn't see an uptick in prices in April were apartments, which saw a 0.1% decline month-over-month. This moderation is likely due to a confluence of factors impacting this more affordability sensitive segment of the market, particularly the impact of higher mortgage rates and the recent boost to inventory levels, tempering competition somewhat."

Acccording to GVR statistics, the composite residential benchmark price is now at $1,205,800. By property type, the benchmark price is $2,040,000 for single-detached homes, $1,127,200 for townhouses, and $776,500 for condominiums.

While the apartments segment saw a 0.1% decrease from March to April, single-detached homes saw an increase of 1.6% while townhouses saw an increase of 1.3%. All three, however, represent increases of between 3.2% and 6.3% when compared to April 2023.