Amidst rising interest rates and record-breaking levels of inflation, the Fraser Valley housing market is starting to show signs of a correction.

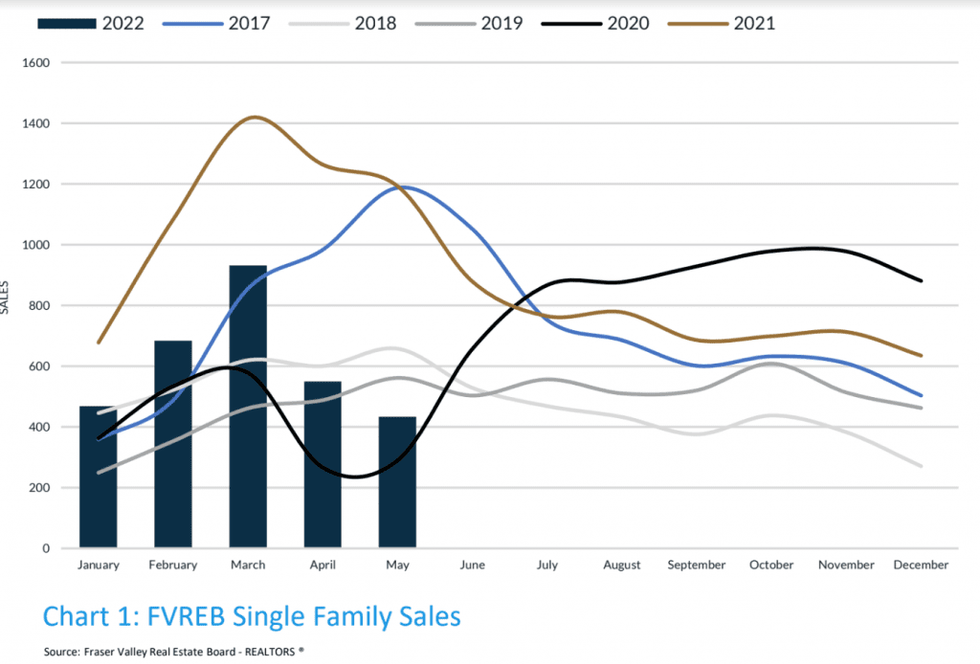

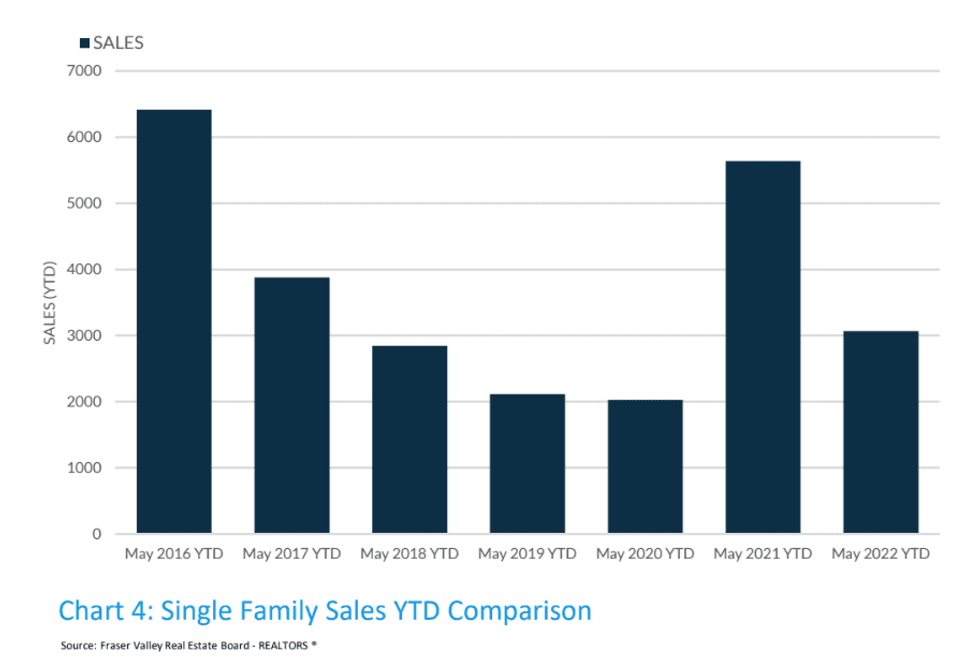

In May, sales activity across all property types was down 16.9% compared to April, with single-family homes experiencing the most drastic dip at 21% compared to the month prior.

While sales have slumped, active listings in the area have more than tripled since December 2021. At the end of May, there were 6,183 active listings across the Fraser Valley, a 14.8% increase compared to the previous month.

READ: Metro Vancouver Housing Market Set Records This Winter: Report

But is this market slowdown a cause for concern? According to Jamie Squires, real estate expert and President of Fifth Avenue Real Estate Marketing, homeowners don’t need to worry.

Squires has been monitoring and working in the Fraser Valley market for over 19 years. Based on what she’s observed, Squires believe these recent dips appear to be a market normalization rather than a full-on crash.

That’s because prior to this recent dip, sales activity and prices in the Fraser Valley were abnormally high.

“What we’ve seen last year and in the first couple of months of 2022 was unprecedented,” explains Squires. “So if you weren’t comparing figures to a record-breaking year, the pace of sales last month would look normal.”

When it comes to average prices, Squires believes they’re likely to level off soon rather than drop further—especially for new builds, since there’s not much room for construction costs to go down given the rate of inflation.

Sales activity may stay slow for a few months, especially throughout the summer, as people are increasingly busy (and frequently away on vacation).

But it’s important to remember that real estate is generally a long-term investment that will experience occasional dips and slow downs.

Amidst a cooling market, homeowners haven’t actually lost any money unless they’re actively selling their property.

“Market trends have shown us that as long as you aren’t moving in the next six months, you’ll probably be back to where you were,” says Squires. “If you’re moving in five years, you’ll probably be up by the time you go to sell.”

This article was produced in partnership with STOREYS Custom Studio.