Fixed Rate Mortgage

Learn how fixed rate mortgages work in Canadian real estate, their pros and cons, and why they offer payment stability for homebuyers.

May 22, 2025

What is a Fixed Rate Mortgage?

A fixed rate mortgage is a home loan with an interest rate that remains unchanged for the entire term of the mortgage agreement.

Why Fixed Rate Mortgages Matter in Real Estate

Fixed rate mortgages offer stability and predictability in monthly payments, which makes them a popular choice for homebuyers in Canada. Because the interest rate doesn’t change during the term—commonly 1, 3, or 5 years—borrowers are shielded from fluctuations in the market.

This predictability can be especially valuable in rising interest rate environments, allowing homeowners to budget with confidence. However, fixed rate mortgages often come with slightly higher initial rates compared to variable options, and borrowers may pay more in interest if rates decline.

At the end of the fixed term, the borrower must renew their mortgage at current market rates, potentially under new terms. Early termination of a fixed rate mortgage can also result in higher prepayment penalties, usually based on an interest rate differential (IRD).

Understanding how fixed rate mortgages work helps buyers choose the right product for their financial goals, risk tolerance, and future plans.

Example of a Fixed Rate Mortgage in Action

A buyer secures a 5-year fixed rate mortgage at 4.5%. Their monthly mortgage payment remains constant over the 5-year term, regardless of changes in the prime rate or market conditions.

Key Takeaways

- Interest rate stays the same throughout the mortgage term.

- Provides stable and predictable monthly payments.

- Ideal for buyers who value certainty and risk protection.

- May have higher prepayment penalties than variable mortgages.

- Requires renewal at the end of each term.

Related Terms

- Variable Rate Mortgage

- Mortgage Term

- Mortgage Pre-Approval

- Interest Rate

- Prepayment Penalty

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

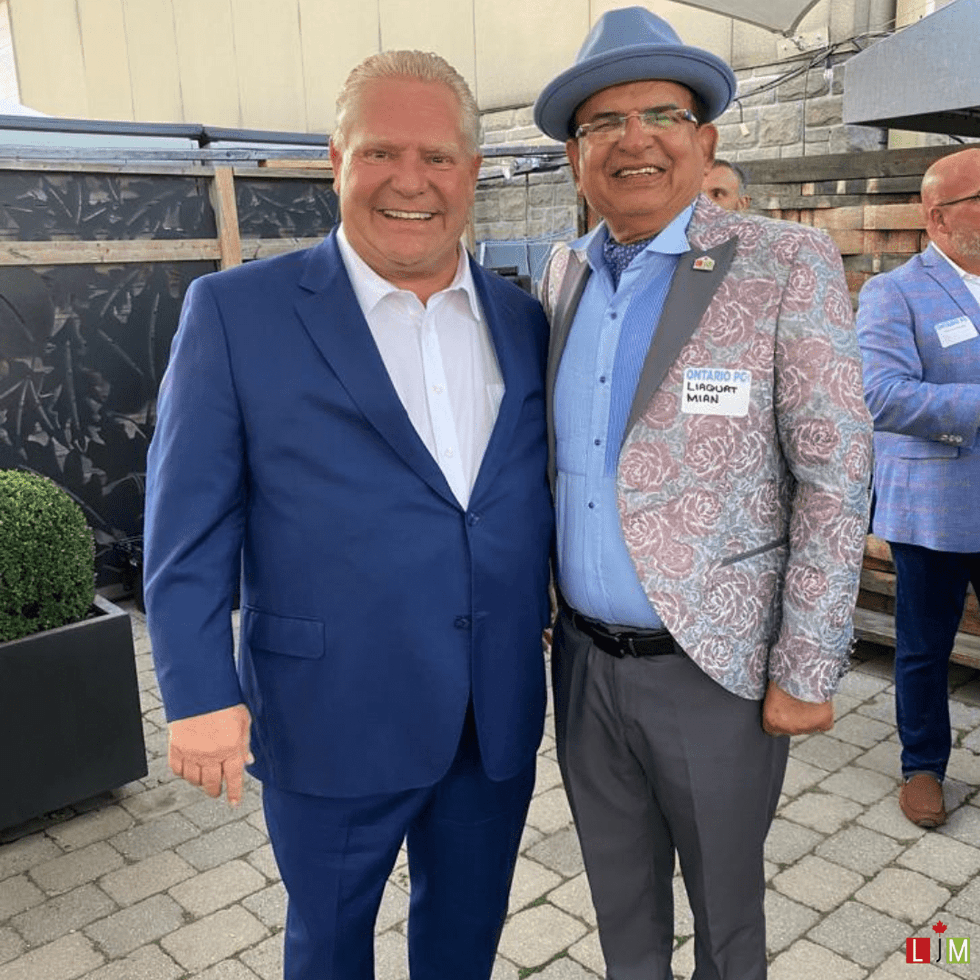

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)