Toronto-based Dream Office REIT (TSX: D.UN) will soon embark on an office conversion project in Calgary, after securing both a grant from the City and financing for the project.

The subject property is the 16-storey office tower known as 606 - Fourth, located at 606 4th Street SW between Courthouse Park and the First Canadian Centre in the downtown core. Dream Office REIT owns a 100% interest in the property, which also includes the adjacent three-level Barclay Parkade and is one of three properties the REIT owns in Calgary.

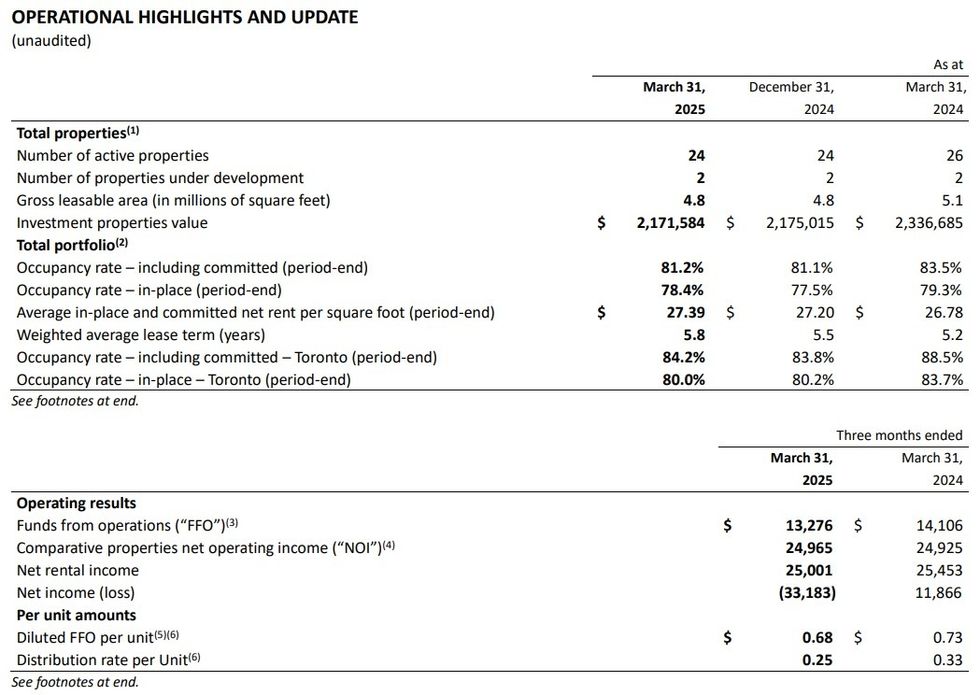

The building was originally constructed in 1969 and was renovated in 2017. According to Dream Office REIT, the building houses approximately 126,000 sq. ft of space and has an in-place and committed occupancy rate of 83.2% as of March 31, comprised of 11 tenants with an average remaining lease term of 2.0 years. The building's anchor tenant is Canadian Western Bank.

In its Q4 2024 report published in February, the REIT said that it intended to convert the building into a 166-unit rental building and called the conversion a strategy that "derisks the portfolio while unlocking value." Dream also said that it was in the process of relocating tenants to 444 7th Avenue SW, the office building directly to the south that is also owned by the REIT.

"This strategy will allow the Trust to improve the occupancy of 444-7th while creating a new residential rental building in downtown Calgary, thereby reducing the operational and financial risk of both buildings," said the REIT.

The REIT also said that it was "in advanced stages of negotiation" for a grant of up to $11 million from the City of Calgary via its Downtown Development Strategy Incentive Program, a multi-pronged program that includes its highly-successful office conversion program. Additionally, the REIT said it was also in the process of securing government financing for a 10-year loan at an interest rate lower than that of conventional development and mortgage loans.

In its Q1 2025 report published last week, the REIT said that both had been secured. The agreement with the City is for a grant of up to $11 million and the financing is a non-revolving development facility of up to $64.3 million at an interest rate that does not exceed the 10-year Government of Canada bond rate + 0.40%. The credit facility was secured on March 7 and the interest rate will be set at the first drawdown.

Furthermore, Dream Office REIT said that it is in the process of finalizing a construction management contract after a market bid process and is also in discussions to potentially bring on a joint venture partner for the project "to further reduce construction and balance sheet risk."

In terms of its balance sheet, the 606 4th Street SW property has now been reclassified to Properties Under Development, which had a minor negative impact on its overall in-place occupancy rate.

During Q1, Dream Office REIT also completed the sale of the 20-storey office building at 438 University Avenue in Toronto for $105.6 million in a sale that was brokered by TD Cornerstone and CBRE. The price translated to approximately $327 per sq. ft, before adjustments and transaction costs, and was completed on February 24. The REIT then used the proceeds to repay the $68.9 million property mortgage that was outstanding and the remainder towards a corporate credit facility.

Subsequent to the quarter, the REIT also sold a vendor take-back mortgage receivable that originated from a 2018 property sale for $15 million, the proceeds from which were also used to repay the corporate credit facility. Additionally, the REIT also refinanced its last remaining 2025 debt maturity, a $30 million mortgage secured against a property in Toronto that now totals $28 million and matures on April 1, 2028.