[Editor's Note: Thind is now facing two more receiverships, for its Highline and Minoru Square projects, owing KingSett Capital a further $220M.]

The District Northwest project in Surrey by Burnaby-based Thind Properties has been placed under receivership, according to filings in the Supreme Court of British Columbia, in what is one of the more severe insolvencies Metro Vancouver this year.

The site of the project is 13438 105A Avenue in Surrey, a two-acre site bound by 105A Avenue on the north, 134A Street on the east, 105 Avenue on the south, and University Drive on the west.

The property is located directly south of the BC Lions Football facility and is diagonally bisected by the Expo Line SkyTrain guideway, about midway between Gateway Station and Surrey Central Station.

BC Assessment values the property at $65,885,000 and Thind Properties owns the property under 105 University View Homes Ltd., which is controlled by District Northwest Limited Partnership, both of which are the subject of the receivership proceedings.

The Receivership

The application to appoint a Receiver of the property was initiated in October by Toronto-based KingSett Mortgage Corporation, also known as KingSett Capital, who holds both the first-ranking and second-ranking mortgage registered against the property.

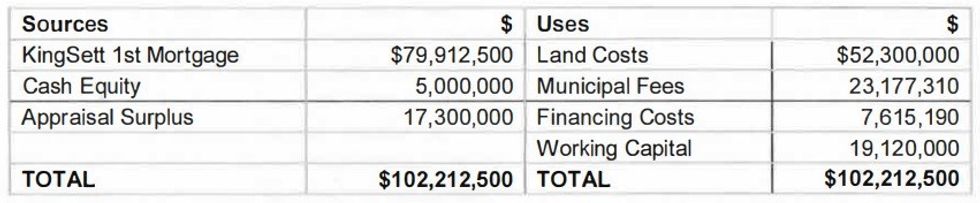

For the first-ranking mortgage, the two sides entered into a loan agreement in February 2022 for the principal amount of $55,750,000, with interest accruing at the RBC Prime Rate + 4.55% per annum, with a floor rate of 7.00%. This loan agreement was then amended in October 2023 to increase the principal amount to $79,912,500, with the interest rate also increasing to RBC Prime Rate + 7.04% per annum, with a floor rate of 9.49%.

The second-ranking mortgage was then registered in November 2023 and was for the principal amount of $99,890,625.

According to KingSett Capital, Thind failed to make its monthly interest payment on May 1, 2024, defaulting on the loan agreement. The two sides then spent some time trying to remedy the situation, before KingSett ultimately issued notices to enforce security on August 30.

Thind was unable to remedy the situation and KingSett now says they are owed $85,695,102.47 as of October 1, pursuant to the first mortgage, with interest accuring at a rate of $31,661.89 per day.

District Northwest

Unlike many of the large real estate insolvencies that have occurred in Metro Vancouver, such as that of 1045 Haro Street or AimForce Development, District Northwest had already launched presales and had actually sold a majority of the units.

In an affidavit dated November 7, Thind Properties' Owner, Founder, and CEO Daljit Thind said they commenced presales around December 21, 2021 and have sold approximately 90% of the 1,023 units, with approximately $78,777,703.65 in deposits now held in trust. The project was being marketed by Rennie.

Thind added that on March 3, he was informed by Justin Walton, KingSett Capital's Managing Director of Mortgage Investments, that KingSett was not going to provide construction financing for District Northwest, citing KingSett's "overall exposure to my company, Thind Properties Ltd."

"The petitioner's failure to follow through on its commitment has forced the respondents to search for alternative joint venture partners resulting in the accrual of significant interest charges and the partial erosion of the respondents' equity in the Project," added Thind, opposing the receivership order. "The intrinsic value of the Project is well in excess of the debt owed to the petitioner. At this critical juncture, the respondents need additional time to secure new joint venture partners."

According to Thind, they are currently in discussions with a potential joint venture partner that will either result in KingSett being paid out by mid-January or not proceed at all, adding that KingSett is aware of this and has indicated that it would provide construction financing if an agreement with the new joint venture partner is reached.

Thind went on to ask for more time, saying he would not oppose a receivership order if an agreement with the new partner is not in place by January 22, 2025. Nonethless, the Supreme Court granted the receivership order on Friday, November 8.

Thind Properties

As first reported by STOREYS last month, Thind Properties made the decision to sell its Minoru Square project in Richmond, a year after cancelling the project.

According to Thind, the developer has also undertaken sales related to its interest in two other projects, both in Burnaby, that were also financed by KingSett. Those include Highline in the Metrotown neighbourhood and Eclipse Tower C in the Brentwood neighbourhood.

"The latter project, Eclipse (Tower C), is approximately 95% complete, with an occupancy permit expected in Q1 of 2025," said Thind in his affidavit. "The proceeds of sale from the units sold at Eclipse totaling approximately $144 million (net) will be paid to [KingSett] and reduce its loan exposure."

The other project, Highline, completed construction in Fall 2023, but there have also been signs of trouble there pertaining to the strata corporation.

"Unfortunately, on the balance sheet, the Strata corporation is not doing as well," said the property management firm, Tribe Management, in a notice to owners dated August 2024 previously provided to STOREYS. "The Strata is currently hampered by unpaid Accounts Receivable, primarily from the Developer, and is unable to pay its monthly bills."

According to the notice, Thind Properties had a bit over $800,000 in various unpaid fees, and the building's concierge and building manager services were suspended by the service providers as a result of non-payment. Thind is also in the process of converting the 10 floors of office space in the building into a hotel.

STOREYS has reached out to Thind Properties, but has not received a response as of publication.

For District Northwest, under normal circumstances, the receivership proceedings would now proceed towards a sales process. However, with a potential deal on the horizon, it may not come to that. Stay tuned.

If you are a pre-sale purchaser of District Northwest who would like to share your experience, email howard@storeys.com or find HowardChai.24 on Signal.

- Waterstock Properties' Surrey Southend Village Master Plan Under Foreclosure ›

- AimForce Development Hit By 3 Foreclosures, Including 67-Storey Surrey Project ›

- Northwest Development Selling 50 And 42-Storey Project In Surrey ›

- Thind Facing Foreclosure On Burnaby Property Acquired Earlier This Year ›

- Presale Buyers Back Out Of Thind's District Northwest Under Receivership ›