On Tuesday, real estate services firm CBRE Canada published its annual real estate lenders report, providing some insight into the thinking of lenders for this upcoming year.

The report is the product of a survey CBRE conducted between December 10 2024 and January 20 2025; participants included 37 domestic and foreign lenders of various forms — banks, credit unions, private capital, pension funds, insurance companies — with over $200 billion in real estate loans combined under management.

Here are some of the report's big takeaways.

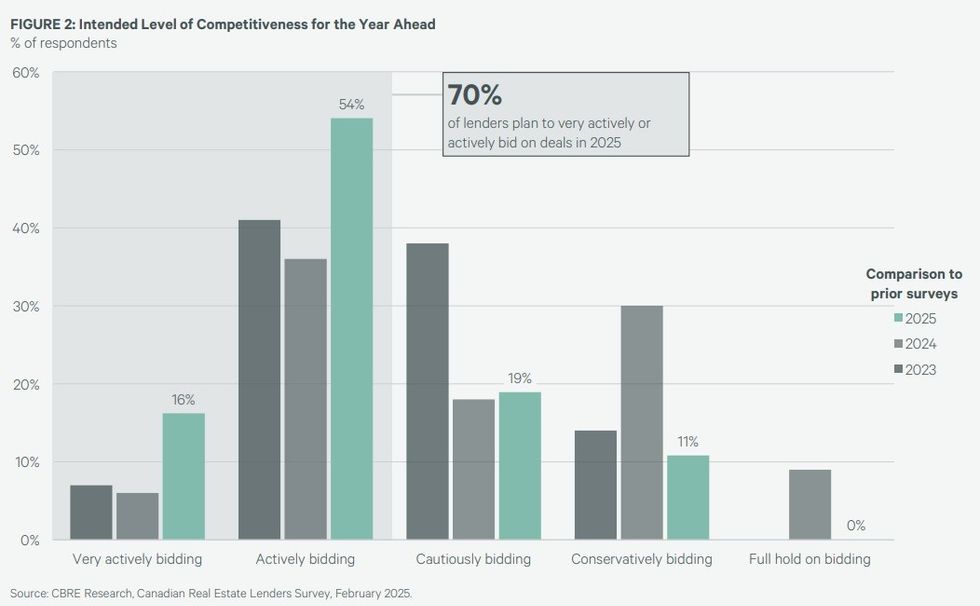

Expect A Lot Of Competition

Over the past three years, an average of 45% of lenders indicated that they would "actively" or "very actively" bid on deals. This year, that number has shot up to 70%.

On the other end of the spectrum, the proportion of lenders who indicated that they would be "cautiously" bidding has stayed relatively flat from last year to this year — at around 19% — and those who indicated that they would be "conservatively" bidding has dropped substantially — from 30% last year to 11% this year.

Attention On Purpose-Built Rental Is Increasing

"Purpose-built rental loans, and particularly for CMHC-insured product, continues to be the top targeted asset class for lenders," said CBRE. "Debt availability for purpose-built rentals is set to grow the most in 2025 as an average 73% of lenders look to increase their respective budgets for this sector."

Of the lenders that participated in the survey, 75% indicated that they have intentions to increase their budget for CMHC-insured purpose-built rental term loans, while 86% gave the same indication for CMHC-insured purpose-built rental construction loans. For products that are not CMHC-insured, lenders still indicated intentions for a sizeable increase, although the numbers drop to 57% and 74%, respectively.

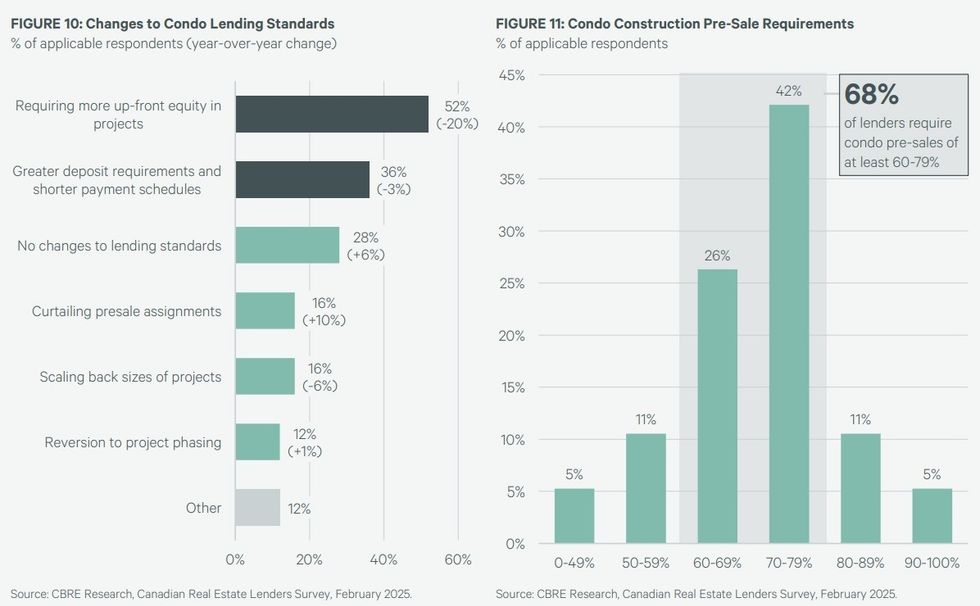

Condo Development Loans Remain Tight

Although the number has dropped some, the proportion of lenders requiring more up-front equity from developers in condo projects remains the top change lenders are making in 2025 — at 52%, after decreasing from 72%. The other big change lenders continue to make is greater deposit requirements and shorter payment schedules, coming in at 36%, a 3% decrease.

"As well, 68% of lenders currently require 60-79% pre-sale commitments for condo construction financing," said CBRE. "However, given the weaker condo sales market, this will likely be a more significant financing hurdle than compared to past years."

Development Land Is Still A Risky Bet

In terms of risk, development land has the highest risk expectation among lenders, with 25% (up from 17%) believing the risk to be "significantly elevated" and 43% (down from 50%) believing the risk to be "elevated." The only other asset class to come close is, as one would expect, office, where "significantly elevated" came in at 11% (down from 45%) and "elevated" came in at 60% (up from 48%). All other asset classes saw no "significantly elevated" risk concerns from lenders.

Although unmentioned in CBRE's report, development land has been the most common asset class to fall into distress over the past year or two. A report published by JLL last week found that distressed asset sales in Canada totalled $1.7 billion in 2024, with 70% of that volume being land assets.

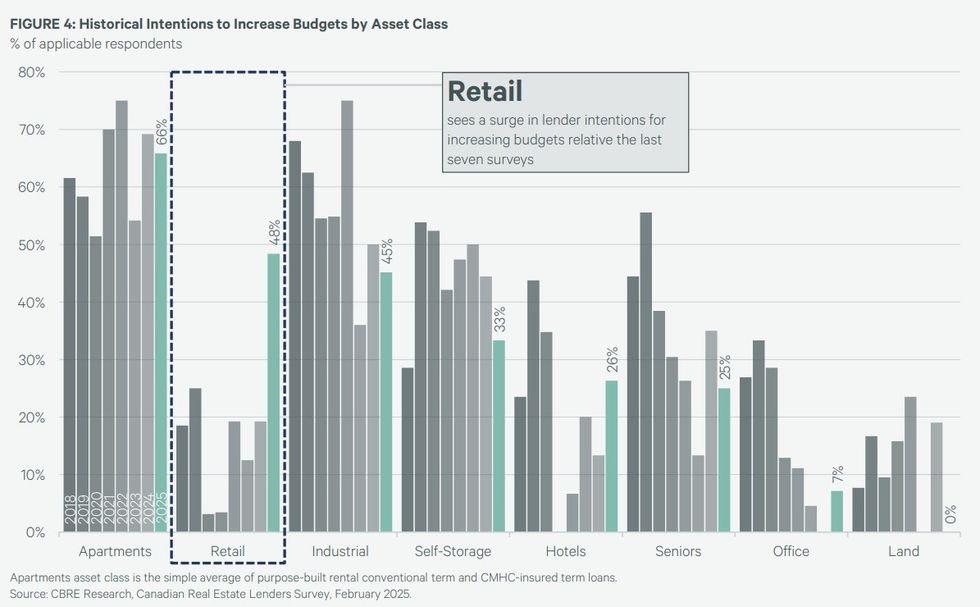

Interest In Retail Is Surging

Interest in purpose-built rental has always been relatively high, but the asset class that is seeing the largest increase in interest is retail. In recent years, 20% or less of lenders indicated interest in increasing their budget for retail assets; that number has more than doubled and is at 48% for this year. Hotels also saw a significant jump, from about 14% last year to 26% this year.

On the other end of the spectrum, industrial has dropped from 50% to 45%, self-storage dropped from 45% to 33%, and seniors housing dropped from 36% to 25%. After coming in at 0% last year, office has now increased to 7%, although 32% said they intend to decrease their budget for office, which was the highest of all asset classes.

Alberta Is Calling

Toronto, Vancouver, Montreal, and Ottawa remain the top markets of choice for lenders, with interest remaining flat year over year. By ranked-choice voting, Calgary jumped two spots and is now the fifth most popular market, overtaking Hamilton.

Furthermore, Edmonton has jumped four spots — the most of any city in this year's survey — to seventh place, overtaking Waterloo, Victoria, and Halifax.

"Overall, a minimum 73% of lenders are active participants with some level of interest in every market across Canada," said CBRE.

The CBRE 2025 Canadian Real Estate Lenders report can be viewed in full here.