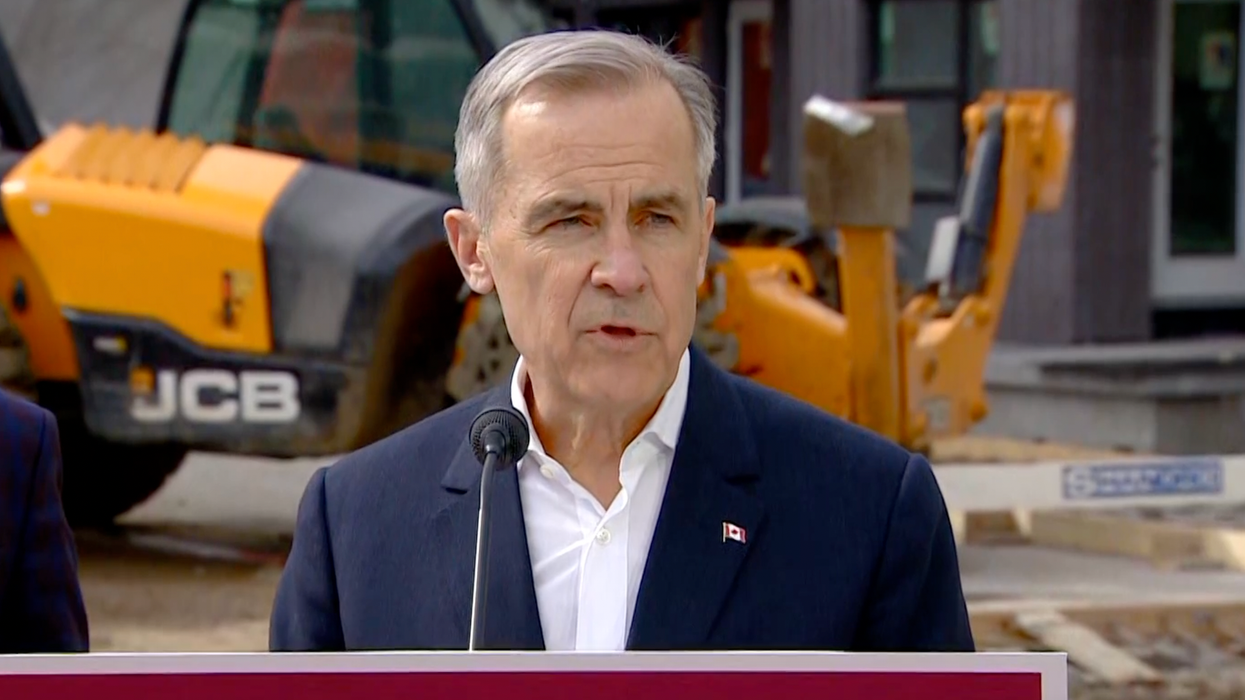

“Stable housing, access to housing, is the foundation for success. Without housing its hard to focus on your future, without housing its hard to start a family, and without housing we cant build the strongest economy in the G7," recently sworn-in Prime Minister Mark Carney said during a speech in Edmonton on Thursday, during which he discussed his administrations' plan for tackling the nations' housing crisis.

The purpose of his remarks, however, was to announce the PM's intent to eliminate GST on all new and substantially-renovated homes priced under $1 million for first-time homebuyers — a move intended to improve housing attainability for young people in Canada and spur new home development.

“This is a big deal because first-time homebuyers are the major purchasers of new and substantially-renovated homes," Carney said. "[...] It means that all first-time homebuyers will need to save less for a deposit, and they’ll be able to move in sooner, and it will allow more first-time homebuyers to realize their dream of homeownership, whether you’re a nurse here in Edmonton, a teacher in Red Deer, or an equipment operator on the oil patch.”

While Carney said he would eliminate GST for first-time homebuyers on his housing platform leading up to the Liberal leadership election, today's announcement reaffirms Carney's stance on the pledge as Prime Minister and provides more details, such as the inclusion of "substantially-renovated" homes in the tax exemption.

As well, he shared that the tax cut will save Canadians up to $50,000 when purchasing a home, "allowing more young people and families to enter the housing market and realize the dream of homeownership."

The idea, while bold and widely welcomed, has been a popular pledge made by other politicians.

While running against Carney in the Liberal leadership race, former Finance Minister Chrystia Freeland promised to eliminate GST for first-time homebuyers on purchases up to $1.5 million, one-upping Carney by adjusting the price to reflect increasingly unaffordable home prices, especially in city centres.

But the idea was first proposed by Conservative Party leader Pierre Poilievre, who said in the fall that he would eliminate the tax on new homes for all Canadians. NDP leader Jagmeet Singh has also said that his party would be willing to look into eliminating or lowering GST for first-time homebuyers, but cautioned that allowing everyone to buy a home under $1 million with no GST, as Poilievre has proposed, would only incentivize rich developers and investors to buy up homes.

In response to Carney's announcement, the Canadian Home Builders' Association (CHBA), which has been advocating for the lowering of GST thresholds since their introduction in 1991, are sharing their support.

“We are pleased that two major federal parties have made substantial promises regarding GST on new homes. In light of the tariff war with the United States, it is doubly important that all avenues to improve housing affordability for Canadians are explored," said CHBA CEO Kevin Lee in a press release. "Addressing the GST on new housing is certainly a step in the right direction in ensuring Canada has a comprehensive plan to support better housing affordability and supply in the face of increasing construction costs, and is long overdue."

In the release, the CHBA also highlights the failure of the federal government to adjust GST thresholds to home prices, as promised. When first introduced in 1991, the CHBA laments, the feds committed to adjusting GST New Housing Rebate thresholds every two years to correspond with home prices, but since their inception, thresholds have never been adjusted despite substantial increases in home prices, particularly in the last five years.

- After A Top-Down Approach On Housing, BC Is Starting To Listen. Is That Enough? ›

- Canada Is Building Fewer Homes To Accommodate Population Growth Than Ever Before ›

- How Mark Carney and Chrystia Freeland Plan To Tackle Canada's Housing Crisis ›

- Carney Pledges To Get Feds Back Into "Business of Homebuilding" ›

- Experts Analyse Poilievre and Carney's New Home GST Rebates ›

- GTA New Home Sales Hit Historic Low, Surpass 1990 Downturn ›

- The Feds' GST Rebate For First-Time Homebuyers: What To Know ›

- "Room To Be More Bold": Expanding The FTBH GST Rebate ›