Much has been made about the Bank of Canada’s need to take an aggressive approach on interest rates in order to tame decades-high inflation -- but nearly half of Canadians would prefer it take a breather before hiking rates yet again.

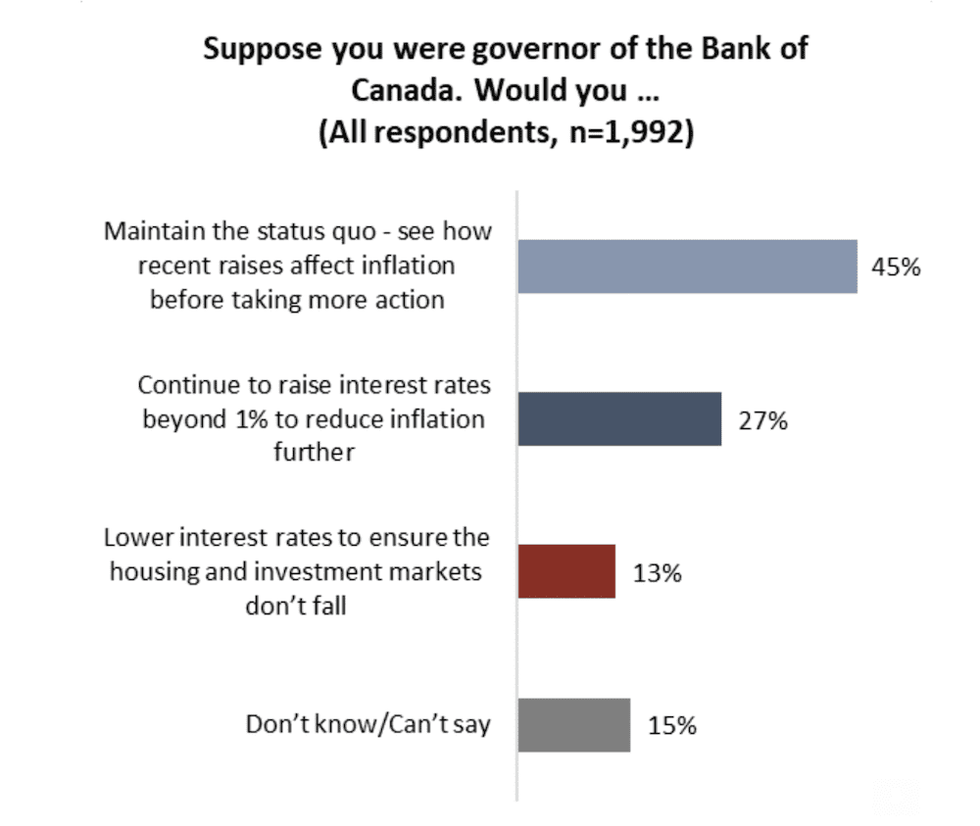

A new study from the Angus Reid Institute found that 45% of respondents says they’d like the BoC to stick to status quo at 1% for its trend-setting Overnight Lending Rate and observe how a tougher cost of borrowing filters down through the economy, before taking further action.

The BoC has increased borrowing rates twice so far this year, with a 0.25% increase in March and an unusually large 0.5% increase in April. As inflation hit another 31-year high last month at 6.8%, it is all but assured another half-point hike is coming on June 1, when the Bank makes its next policy rate announcement.

READ: Mortgage Renewals, Refinances Up “Across the Board” Amid Rate Hikes

According to the survey, only a quarter (27%) of respondents want to see the BoC hike rates further in order to scale back inflation.

Another 13% expressed concern about the impact of rising interest rates on the housing and investment market, saying they’d keep rates low as a result. Recent analysis from BMO Chief Economist Robert Kavcic finds that a housing market correction isn't a question of "when but if" as result of rising rates, as tougher borrowing costs cut the froth from the market.

One-quarter (27%) would continue to increase the rate in a more aggressive attempt to mitigate rising prices, while half that number (13%) say that they would keep rates low as they worry about the impact any changes may have on the housing and investment markets.

Stress Rising Along with Bills

Canadians have seen their purchasing power dwindle in recent months, as a combination of surging energy prices and post-pandemic supply chain snarls have driven up the cost of everything from gas to groceries. While interest rate hikes are widely viewed as the most effective treatment to runaway inflation, that’s compounding financial stress for cash-strapped consumers, finds the survey: 22% reported having major debt concerns currently, with 42% indicating that this is a minor issue, but still a marked source of stress.

Of the one in five with heightened debt concerns, most are dealing with it by watching their spending such as “going out” costs, driving less, cutting phone and streaming services, and even changing up their diet for a lower grocery bill.

Overall, that’s led to some of the most negative financial expectations seen in the past decade with 28% reporting they expect they’ll be worse off financially by this time next year, a seven-point increase compared to when this question was posed in 2021, and the highest recorded in 13 years of tracking the sentiment, Angus Reid points out.

Additional key findings from the poll include:

- The percentage of Canadians who say they are worse off now than they were 12 months ago is also at its highest mark since 2010 at 36% (34% in 2021, 32% in 2020).

- The Angus Reid Institute’s Economic Stress Index finds 22% of Canadians are “struggling”, 25% are “uncomfortable” 26% are “comfortable” and 27% are reportedly “thriving”.

- One-third (32%) of Canadians express difficulty in paying for their housing costs, whether renting or paying a mortgage. This includes 9% of those who are categorized as “struggling”.

- Men of all ages are considerably more likely than women to say that the Bank of Canada should increase interest rates further (37% to 17% overall).