Canadian real estate is “still squarely in correction mode,” says a new report from RBC Economics, authored by Assistant Chief Economist Robert Hogue.

The report cites the latest data from local real estate boards, calling generally downturned conditions “entirely expected considering the heavy toll soaring interest rates are taking on buyers from coast to coast.” It also forecasts depressed market conditions into the early part of 2023 -- although this certainly hinges on the Bank of Canada putting an end to its rate hike series.

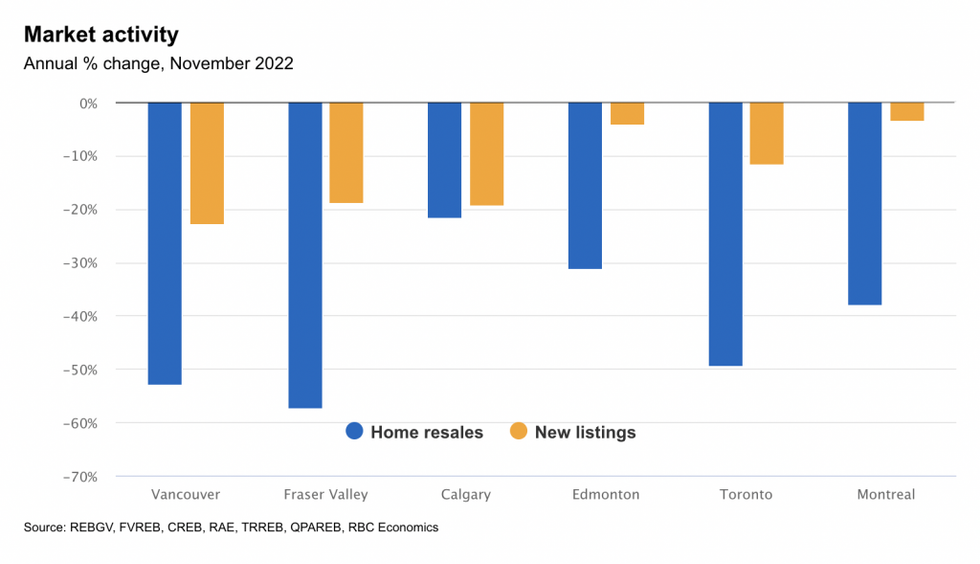

“For the most part, local market activity is downright soft, at levels far below where they were before the pandemic,” writes Hogue, pointing to the sharp corrections still underway in Vancouver, the Fraser Valley, Toronto, Hamilton, Ottawa, and Montreal. “We see those trends continuing until demand-supply conditions tighten from current levels. We expect the cyclical bottom for prices to be reached around spring next year -- though this is poised to vary market by market.”

READ: GTA Home Prices Slide 7% in November, New Listings Hit Historical Low

Toronto: “Correction May be Moderating but is Still Ongoing at This Stage”

Home resales in Toronto were down 3.8% month over month in November, while the composite MLS HPI dropped 0.8%, marking this metric’s eighth-straight month of decline.

“Clearly, sharply higher interest rates and the considerable loss of affordability continue to challenge buyers. And we think they will keep the market quiet for some time to come,” writes Hogue. “The surge in interest rates has materially changed the equation for buyers, many of whom may be sidelined for an extended period. It will take further price declines to draw them back in the market. With demand-supply conditions no longer favouring sellers, we believe that’s exactly what’s in the cards.”

He goes on to note that while prices are still expected to continue to slide, rate of monthly decline has slowed and “any further depreciation is likely to be more incremental.”

Vancouver: “Activity Remains Not Only Soft but Fell Again Last Month”

Vancouver’s proportion of home resales fell more than 12% on a seasonally-adjusted basis in November, and 51% since March. New listings were also down MoM.

In a similar manner to Toronto, Vancouver’s MLS HPI fell saw an eighth-straight month of decline in November, dipping 1.5% (unadjusted for seasonality), and 0.6% below its year-ago level for the first time in close to three years. The index has fallen 10% from its April peak.

“Demand-supply conditions eased only marginally-- remaining on the cusp of a full-blown buyer’s market. This kept property values on a moderate downward track,” notes Hogue, later adding that Vancouver’s “extremely poor affordability” will continue to dampen activity and prices in the near-term.

Montreal: “The Market Shifted to a Lower Gear in Recent Months”

Montreal saw home resales plunge around 8% MoM in November, putting this metric at its lowest level in almost 13 years. At the same time, the market saw an influx of property listings in November relative to October, which helped to ease demand-supply conditions.

As was the case in Toronto and Vancouver, MLS HPI fell in November, marking a sixth-straight month of decline. Price depreciation was most apparent for single-family detached homes on the Island of Montreal and in Laval where the median price has fallen 10% and 4% year over year, respectively.

“After sharply appreciating earlier in the pandemic, property values are now on the decline,” writes Hogue. “The correction is about to reverse the entire appreciation over the past year, leaving price levels below year-ago levels for the first time in more than eight years… We expect the price softening to continue in the near term as higher interest rates keep buyers on the defensive.”

Calgary: “The Market is Letting Some of the Steam Out of Prices”

Calgary continued to be an outlier in November, with home resales actually seeing an increase, rising an estimated 3% (seasonally adjusted) from October. That rise “might have been restrained” by a 14% drop in new listings MoM, leaving fewer options for buyers.

Nonetheless, home prices in the area continued to moderate, and the MLS HPI eased for the sixth consecutive month in November. Since a peak in May, index is down almost 5%. Calgary represents “one of the milder corrections among Canada’s largest markets,” says Hougue.

“While demand remains robust, soaring interest rates have materially eroded buyers’ budget, which is what we think is at play… We expect higher interest rates will continue to drive prices modestly lower in the near term.”

In general, areas of the Prairies -- also including Edmonton -- are continuing to see housing market activity above pre-pandemic levels. This is attributed to the strength of Alberta and BC’s economies and an uptick in demand from interprovincial migration.