While temperatures continue to drop as the country moves farther into its fall season, Canada's housing market remains hot, as robust demand and extremely tight demand-supply conditions continue to eat away at affordability.

And while the housing market may not be as heated as it was in the spring, it continues to operate at historically strong levels, pushing the dream of homeownership further out of reach for many Canadians.

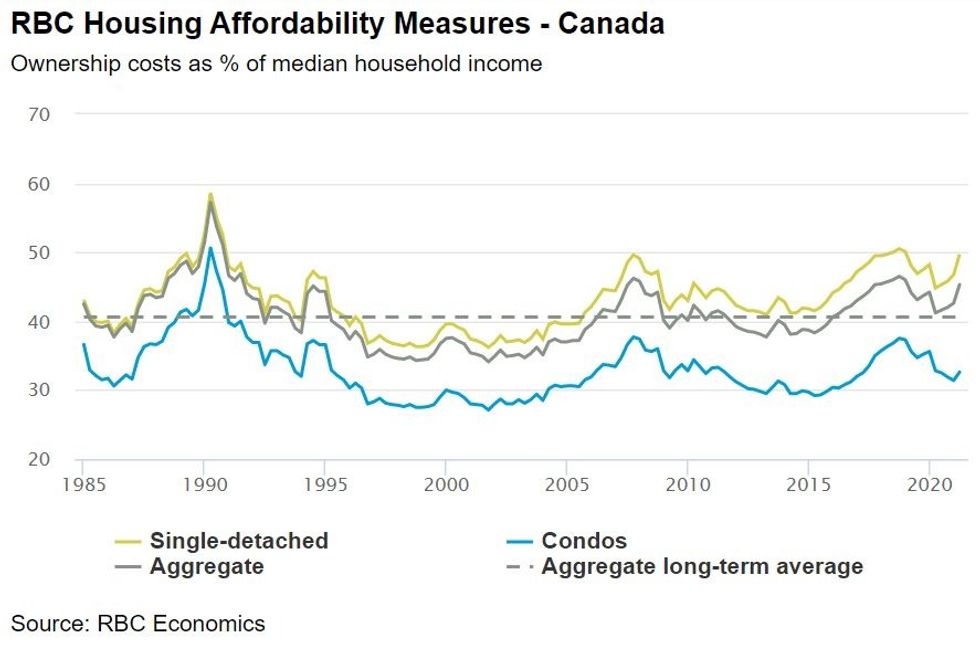

To this point, affordability in Q2-2021 has worsened the most over any quarter in more than 30 years, according to RBC's aggregate affordability measure -- which measures ownership costs as a percentage of median household income.

RBC economist Robert Hogue says that the 2.7% jump the country made in the second quarter (to reach 45.3% Canada-wide) was the fourth-straight increase, entirely rolling back the improvement that occurred at the start of the pandemic when the federal government's financial support programs boosted household income.

READ: 'Extreme' Demand-Supply Imbalance Will Push Luxury Real Estate Prices Higher

Based on the latest aggregate affordability measure, Hogue says the share of income required to comfortably cover the costs of owning a single-detached home in Canada is not only high, but it's rising rapidly.

Hogue believes the growing demand for properties with larger living spaces has been what's driving up single-family home prices during the pandemic. According to the Canadian Real Estate Association (CREA), the average cost for a home in Canada climbed 13.3% year-over-year to reach $663,500 in August.

However, Canadians may find some comfort knowing that buying a condo is a still a relatively achievable option. According to RBC, the bank's national condo measure was 32.6% in the second quarter.

As affordability continues to erode in all major markets, Hogue says it is still within buyers' reach in many parts of the country.

According to RBC's aggregate measure, Toronto (up 4.1 percentage points), Vancouver (up 3.2 percentage points), and Ottawa (up 3.1 percentage points) recorded the most significant increases last quarter -- though the deterioration was widespread, affecting every market tracked.

Overall, affordability is most strained in Vancouver, where ownership costs represent 63.5% of household income. Unsurprisingly, Toronto isn't far behind, with ownership costs representing 59.1%, followed by Victoria (48.0%). Ottawa (38.5%) and Montreal (38.4%) are two other markets where RBC's aggregate measures look historically high.

For those living in the Prairies and parts of Atlantic Canada, ownership costs aren't quite as problematic as in other areas. Despite most markets seeing recent increases, RBC's measures are still below their long-term average in Calgary, Edmonton, Regina, Saskatoon, Winnipeg, Saint John, Halifax, and St. John's.

Echoing other affordability predictions that see demand-supply imbalances pushing national home prices higher, Hogue believes housing prices will become even more strained this year, but some moderation is coming.

"We expect home prices to continue to rise in the near term, as demand-supply conditions generally remain exceptionally tight. This will further raise ownership costs across a wide spectrum of markets and housing categories," said Hogue.

"That said, the affordability deterioration is poised to moderate. The rate of price appreciation is now slowing in many places, and we project prices to flatten in 2022," added Hogue.