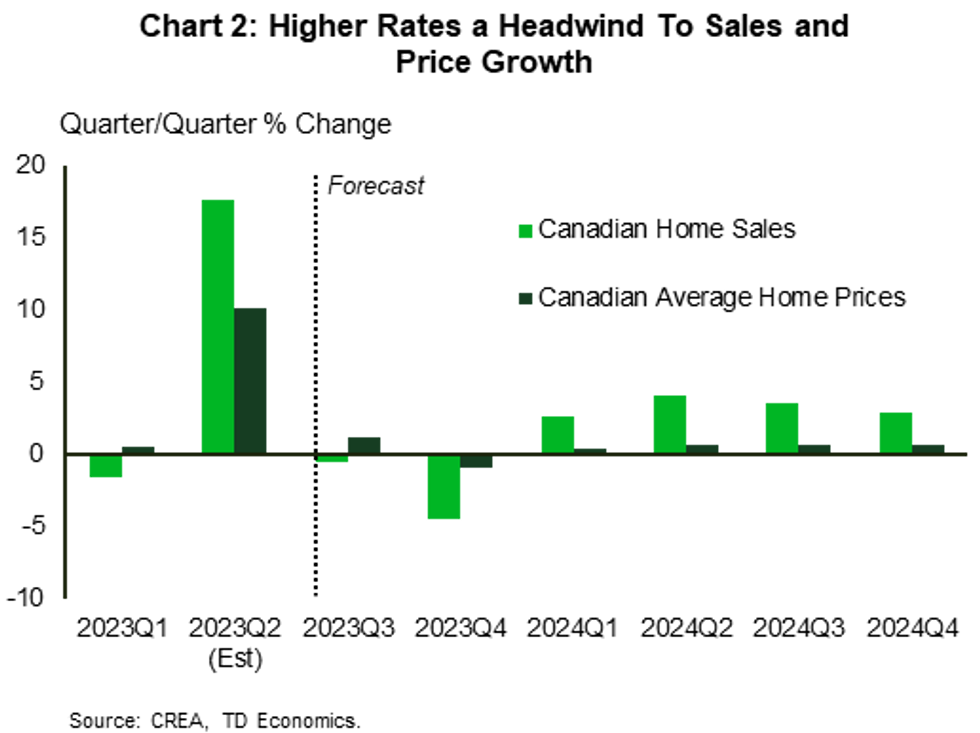

With just a few days left in the second quarter of the year, a new report from TD Economics looks ahead to the anticipated trajectory of the Canadian housing market, saying that “headwinds” brought on by the Bank of Canada’s (BoC) continued hike cycle will cause sales activity to dip in the second half of the year.

“Furthermore, we anticipate purchases growing at a slower quarter-on-quarter pace than previously envisioned in 2024,” writes TD Economist Rishi Sondhi in Tuesday’s report.

Despite some support from tight supply-demand conditions, which should keep average price growth positive in the third quarter, a fourth-quarter slide is expected for prices as well, continues Sondhi. “Like sales, we’ve marked down our quarterly growth profile next year.”

The quarter-on-quarter cool-off will also be pronounced at a provincial level in Ontario and BC, says the report, as those markets “move towards more ‘normal’ sales levels after they cratered last year.” This owes to “heightened sensitivity to the higher rate backdrop.”

TD’s report comes on the heels of Statistic Canada’s latest inflation measure, released Tuesday morning, which showed that the Consumer Price Index has slowed to 3.4%, putting it at its lowest level in almost two years.

Inflation edging down, coupled with an expected loss of stream in the housing market, makes a strong case that the BoC’s aggressive hike cycle is doing what it’s meant to. Interest rates can take as long as 18 months to work through the economy, experts say, so a slowdown in consumer spending is right on track.

Still, with the next rate decision just weeks away, economists are speculating another increase from the BoC that would bring the rate to 5% -- the highest level since 2001. BoC Governor Tiff Macklem himself has also indicated a 25-basis-points increase at the next meeting, scheduled for July 12, 2023.

Tuesday’s TD Economics report predicts that the Bank will opt to cut rates in the second quarter of 2024. In the meantime, the impending implications to housing remain largely unknown; there are far too many variables to consider.

“The potential for tighter mortgage lending rules has been raised by regulators and remains an important downside risk to the outlook. However, we don’t have clear enough line of sight to build this into our forecast,” writes Sondhi. “Sales could also be weaker-than-anticipated in the near term if hawkish central bank signalling drastically upends buyer psychology. Weaker-than-expected economic growth could also weigh on prices, both through softer demand and the potential for a higher degree of forced selling by strained homeowners.

“On the other side, compositional forces pushing average prices up in Ontario and B.C. could persist longer than anticipated. Housing shortages stemming from very strong population growth could also pressure prices higher than we anticipate.”