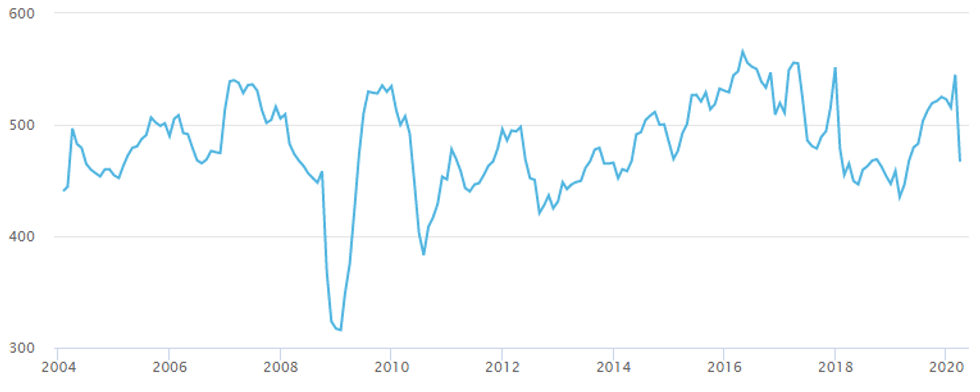

While the coronavirus pandemic has caused a seismic shift in daily life across Canada, with residents facing stay-at-home orders that may last for months, Canadians are still buying and selling real estate – though at a level that causes concern.

In the past month, Canada's housing market has been a rollercoaster of uncertainty. March home sales started strong — in part fuelled by the Bank of Canada cutting interest rates early in the month. However, they took a dramatic plunge in the latter half of the month as provincial governments rolled outer strict social distancing measures.

READ: RBC Says “Low Risk” of Housing Market Collapse: Report

And with the real estate industry considered an essential service in some provinces, activity continued, albeit at a different pace as social distancing guidelines disrupted how the industry operated.

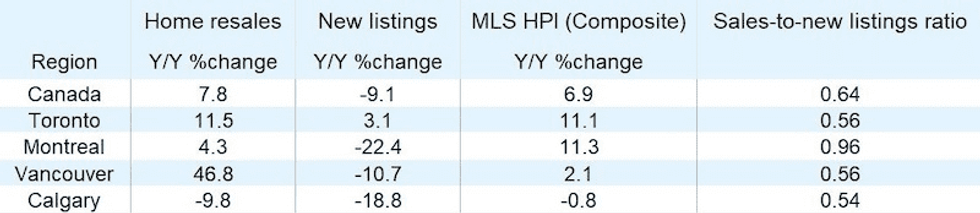

In turn, RBC bank analyst Robert Hogue says many buyers and sellers opted to shift to or stay on the sidelines, with both resales (14.3%) and new listings (-12.5%) plummeting in March from February levels.

But as Hogue said, this was just the beginning.

Turning to April, the Canadian Real Estate Association (CREA) has reported that home resales and new listings were running at "about half normal levels," as Hogue believes many of the transactions occurring already this month have been deals in the works for several weeks.

"We expect activity to quiet down even further as the deal pipeline dries up," says Hogue, using the Calgary housing market as an indicator of what could occur in the rest of the country.

According to the Calgary Real Estate Board, resales have fallen 63% year-over-year and new listings are down 62% month-to-date in April.

"This could give a rough indication of what’s in store for other markets across Canada," said Hogue.

READ: Home Sales in Canada Could Drop as Much as 30% This Year: RBC

However, Hogue believes stronger activity will resume once social distancing orders are relaxed, though when that may be remains unclear. At this time, RBC's baseline assumption is some time in June.

While "exceptionally" low interest rates will help stimulate the recovery, Hogue says the strength of the recovery will depend on the damage suffered by the labour market, to which RBC says it expects the unemployment rate to plunge into the double-digits in all provinces this month before gradually easing in the months to follow.

"The longer unemployment stays high, the slower the housing market recovery will be. Our current view is the recovery will stretch into 2021 in most markets," says Hogue.

There is a small light at the end of this dark tunnel though, with RBC saying it expects property values to "generally" hold up.

"We believe the initial position of strength—current tight demand-supply conditions in most major markets—will provide some cushion against a correction," says Hogue.

Additionally, Hogue says the bank expects the recent acceleration of home prices in Toronto, Vancouver, Ottawa, and Montreal to taper off in the period ahead.

However, this might not be the case in the prairies, where "softer market conditions and the plunge in crude oil prices are poised to further drive prices lower."