Following a historically slow spring season -- a time that is known for being bustling for real estate -- Canadian homebuyers returned to markets across the country to take advantage of low-interest rates during the post-lockdown period, even within the luxury home sector.

Subsequently, a number of major Canadian real estate markets saw unprecedented demand for homes priced over $1 million in 2020, a trend that's expected to continue through 2021, especially as consumer confidence returns thanks to the (slow) COVID-19 vaccine roll-out.

On Tuesday, international real estate firm Engel & Völkers Americas released its annual year-end Canadian Luxury Real Estate Market Report, which included 2021 forecasts for properties exceeding $1 million in Montréal, Ottawa, Toronto, and Vancouver, with Victoria featured as a Market to Watch.

On a national level, the real estate firm projects homes in Canada priced over $1 million will grow in value by 7.5% in 2021, which will be driven by low-interest rates, along with a growing number of expatriates returning to Canada amidst global uncertainty.

“From coast to coast, Canada experienced unprecedented levels of domestic home trading across the country. With borders closed, Canadian real estate proved it’s built on solid fundamentals,” said Anthony Hitt, president and CEO, Engel & Völkers Americas.

“As it relates to home value, there is no question both fiscally and in sentiment, it’s never been greater in the Canadian market.”

READ: Luxury Home Sales in Toronto Set An All-Time Record in 2020

Additionally, a new factor coming into play is an "unprecedented" level of interest from American buyers. Engel & Völkers says that while there is a temporary buying opportunity in Canada’s downtown condo markets, especially in Toronto and Vancouver, once the borders reopen, it’s expected that Canadian markets will return to pre-pandemic levels of supply and demand.

And now that most of the country is riding out the second wave of the pandemic, Canadians continue to re-evaluate their living situations and seek properties that are more suitable for their evolving needs.

Engel & Völkers says this demand coupled with growing expatriate interest and historically high immigration targets and the possible return of university students will result in Canada's luxury real estate market outpacing last year's growth.

What's more, as the vaccine continues to be distributed, Engel & Völkers believes Canada will return to some form of "domestic normalcy" with homebuyers regaining confidence, which will ultimately translate into a further wave of interest for Canadian real estate.

"Demand for Canadian real estate will surge as Canadians transition into the next normal," reads the report. "Pressure from domestic migration, expatriate demand, and the reopening of the Canadian border will see 2021 experience a post-pandemic boom."

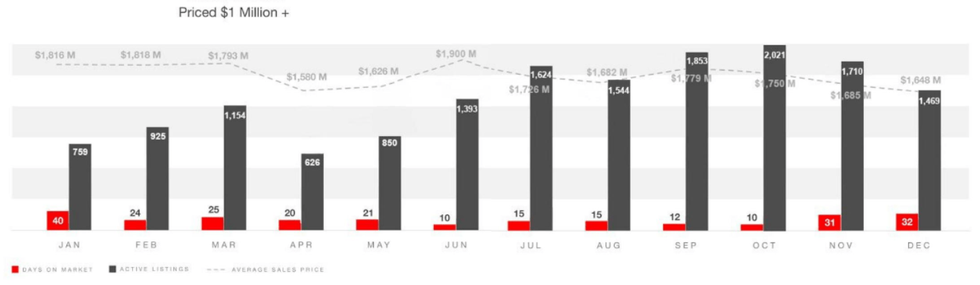

Here in Toronto, throughout 2020, Engel & Völkers says luxury inventory remained limited, which created a balanced market in both the $4 and $10 million-plus categories. On the other hand, the real estate firm said that the standard detached home priced between $1 to $4 million had a "heavyweight" year, particularly in some of the city's most sought-after neighbourhoods such as the Bridle Path, Rosedale, and Forest Hill.

While the condo market is always a hot segment, 2020 presented a "rare and temporary" buying opportunity for buyers, as the mass exodus from the city led to rising inventory and price drops in the tens of thousands, which Engel & Völkers thinks will continue until borders reopen.

What's more, upward pressure on the market has already returned: in December, condo sales transactions were up an impressive 75.9% year-over-year -- indicating savvy buyers are jumping on the market. Additionally, deals closed by Engel & Völkers Toronto saw a 12% increase in average sales price.

As for what's to come for Canada's largest city, Engel & Völkers is forecasting the condo market could pick up as soon as the spring, so locals sitting on the sidelines should consider buying now.

Currently, Toronto's high-end housing market remains balanced, it's standard market favours sellers, while its condo market is now favouring buyers -- though this is only expected to be temporary.

Looking ahead, Engel & Völkers is predicting that Toronto market prices will increase by 5% in 2021. However, the report does say that the recently introduced vacant homes tax could slow down local real estate growth, though only for a short period.

"As borders reopen, there will be a backlog of new immigrants waiting to come to Canada's biggest city. This, coupled with students returning to universities, will quickly infringe on supply," says Anita Springate-Renaud, Engel & Völkers Toronto Central.

"With the end of the pandemic in view, there will be a short window to capitalize on these temporary market conditions," added Springate-Renaud.