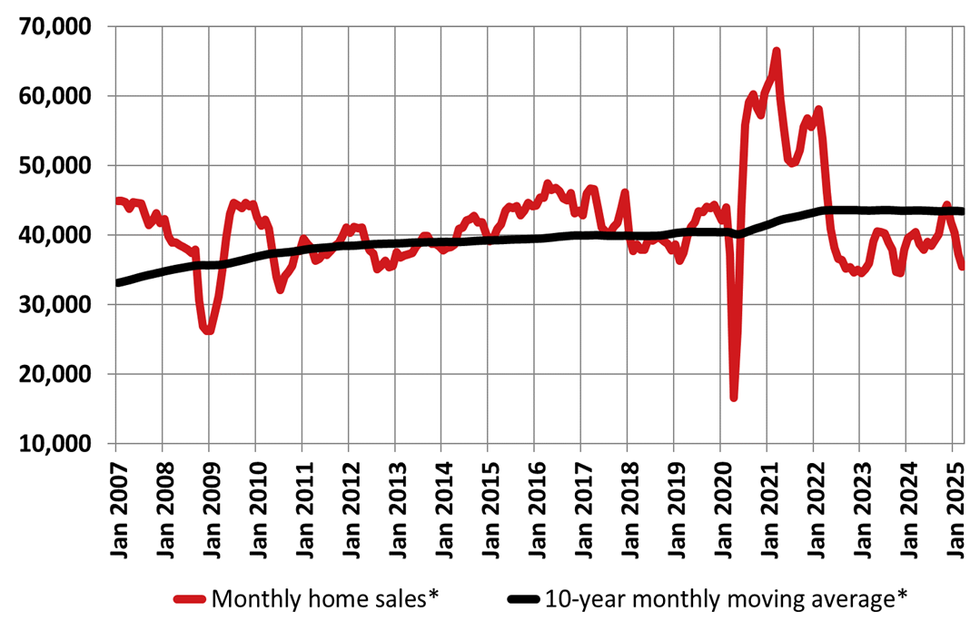

We may be seven (soon to be eight?) Bank of Canada interest rate cuts in, but “tariff turmoil” has kept buyers on the sidelines and put Canadian home sales on a months-long downtrend. The Canadian Real Estate Association (CREA) reported on Tuesday that sales fell 4.8% month over month in March, and have slipped 20% from their “recent high” in November.

Without adjusting for seasonal effects, national sales also fell 9.3% year over year and had the slowest March on record since 2009.

“Up until this point, declining home sales have mostly been about tariff uncertainty. Going forward, the Canadian housing space will also have to contend with the actual economic fallout,” said CREA’s Senior Economist Shaun Cathcart in a press release. “In short order we’ve gone from a slam dunk rebound year to treading water at best.”

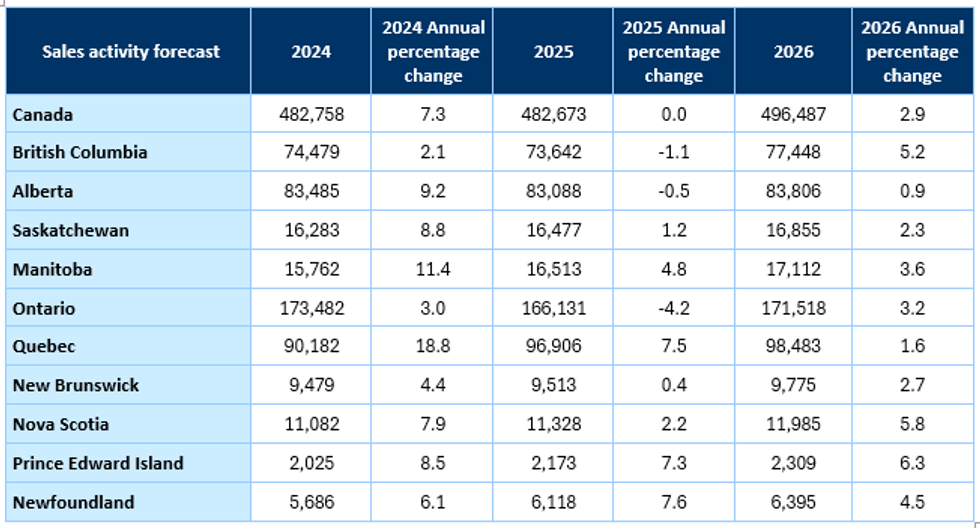

This is reflected in CREA’s latest quarterly forecast, released Tuesday as well. The national association is now calling for 482,673 residential properties to trade hands over 2025, which marks an 8.6% downward revision compared to their forecast from January 15. It also represents a scant 0.02% decline over 2024’s level.

In 2026, national home sales are forecasted to edge up 2.9% to 496,487. “Sales would fail to crack the half million mark for the fourth straight year,” CREA said. “Historically, since 2007, national home sales have surpassed 500,000 units seven times.”

Coming back to the March stats, CREA reports that “sales are down over the last few months in all but a handful of small markets across the country” — although the largest declines have been observed in Ontario and BC.

On a national basis, new supply increased 3% month over month in March, putting the sales-to-new listings ratio at 45.9% (compared to 49.7% in February). The ratio is the lowest it’s been since February 2009, CREA notes. “The long-term average for the national sales-to-new listings ratio is 54.9%, with readings between 45% and 65% generally consistent with balanced housing market conditions.”

A ratio below 45% points to buyers’ territory, mind you, which suggests that Canada is right on the cusp of a buyers’ market.

In total, there were 165,800 properties listed for sale in March, and that figure is up 18.3% from its year-ago level. However, it remains below the long-term average for this time of the year of around 174,000 listings. There was also 5.1 months of inventory recorded by the end of the month — “the highest level since the early months of the pandemic,” according to CREA.

“The long-term average for this measure is five months of inventory. Based on one standard deviation above and below that long-term average, a sellers’ market would be below 3.6 months and a buyers’ market would be above 6.4 months,” the association said.

Meanwhile, the national composite HPI dipped 1% between February and March 2025, and softer prices were “most notable” in BC and Ontario’s Greater Golden Horseshoe. Conversely, prices across much of the Prairies, Quebec, and the East Coast have “continued to push higher.”

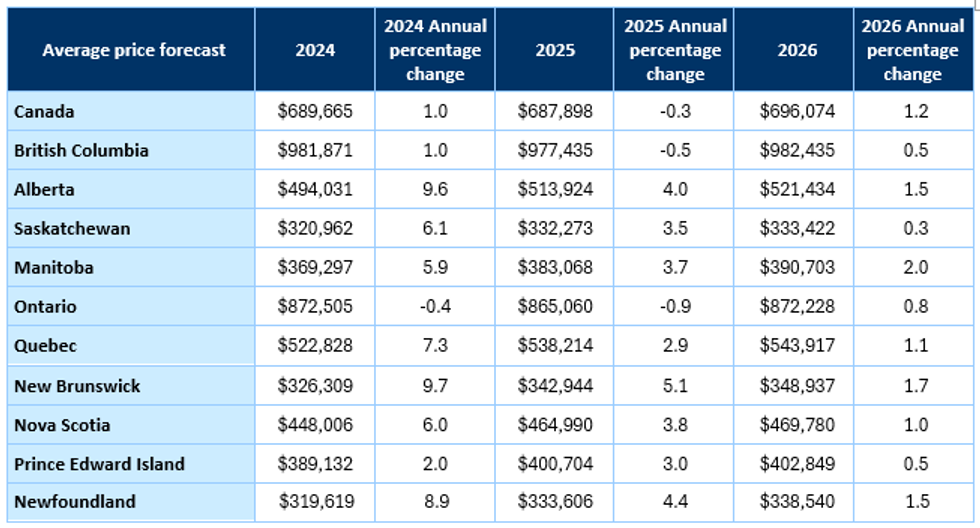

Without adjusting for seasonal effects, the national composite HPI fell 2.1% year over year. In addition the non-seasonally adjusted national average home price came in at $678,331 last month, down 3.7% year over year.

According to CREA’s latest forecast, the national average home price is expected to see a slight 0.3% decrease (year over year) $687,898 in 2025, which is around $30,000 below what was forecasted in January.

“British Columbia and Ontario are expected to see small declines in average home prices, while in other provinces, expected increases in average home prices have been scaled back to the 3% to 5% range for 2025,” CREA said.

In 2026, the national average home price is forecast to rise by 1.2% to $696,074.