Home sales surged across Canada in April as new listings remained persistently low, leading to the tightest market conditions in over a year.

According to the latest data from the Canadian Real Estate Association (CREA), there were 38,164 homes sold nationally in April, an 11.3% increase from March. The sizeable jump was foreshadowed by smaller back-to-back gains in February and March.

Although the actual number of sales came in 19.5% below April 2022 levels, the decline was "markedly smaller" than those seen over the past year.

"Over the last few months, there have been signs that housing markets were going to heat back up this year, so it wasn’t a surprise to see things take off after the Easter weekend, which often serves as the opener to the spring market," said CREA Chair Larry Cerqua.

"The issue going forward is not new: demand is once again returning at a scale that is outpacing supply."

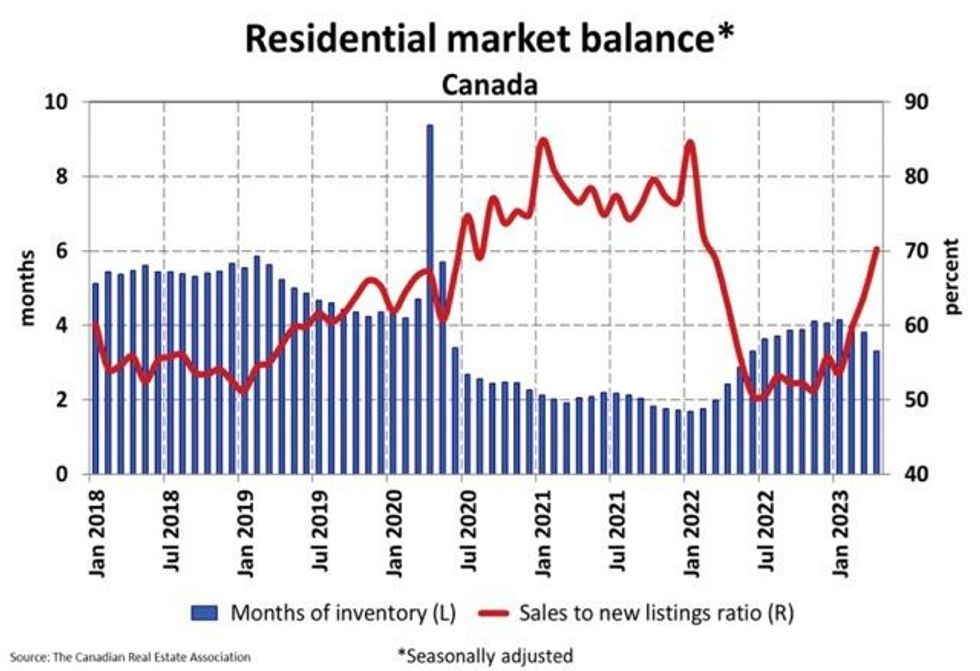

The number of newly listed homes increased 1.6% on a monthly basis in April, but supply remains at a 20-year low. With sales overshadowing new listings, the sales-to-new-listings ratio jumped to 70.2%, the tightest market since February 2022, and well above the long-term average of 55.1%.

Nationally, there were 3.3 months of inventory at the end of April, down from 3.8 months in March and nearly two months below the long-term average of five months.

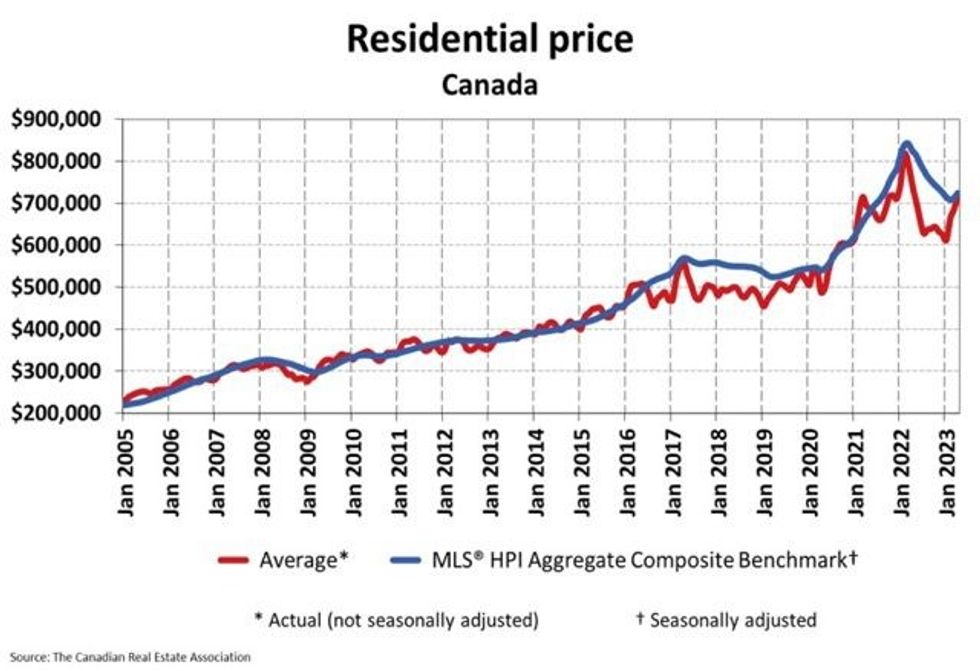

High demand and dwindling supply helped push the Aggregate Composite MLS® Home Price Index (HPI) up 1.6% month over month in April, which CREA noted was a large increase for a single month.

The actual national average home price stood at $716K in April, a 3.9% annual decline, but an increase of $103,500 from January 2023. The gain was due to "outsized" sales rebounds in the Greater Toronto Area and BC's Lower Mainland -- excluding the GTA and Greater Vancouver from the calculation cuts more than $144K from the national average price.

"With interest rates at a top, and home prices at a bottom, it wasn’t all that surprising to see buyers jumping off the sidelines and back into the market in April," said Shaun Cathcart, CREA’s Senior Economist. "Supply, on the other hand, has been sluggish, hence the price gains from March to April seen all over the country."

"Looking ahead, the first week of May did see a bit of a burst of new supply, suggesting some of those April buyers were existing owners now looking to sell their current homes. That could make for the kind of virtuous circle that might ultimately get more first-time buyers into the ownership space this year."