It’s safe to say that the pandemic-inspired, now widely adopted, hybrid work model is here to stay -- at least for most businesses.

A just-released report from Colliers Real Estate Management examines the rise of the hybrid work model -- something it calls “the great experiment” -- and what it means for real estate needs. The report is based on Colliers’ latest office tenant survey and highlights the adoption of hybrid work's impact on office vacancy, sq. ft allocation per employee, and the demand for flex space.

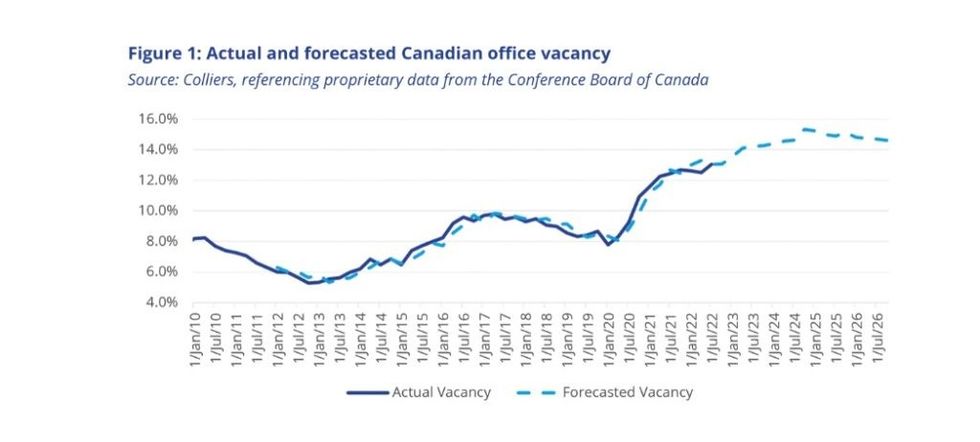

According to Colliers, national office vacancy is set to peak at approximately 15% by the end of 2024 before it begins to decline, with economic growth predicted to reduce the upward pressure caused by the rise in hybrid work. This prediction is based on multiple factors that impact office vacancy, including economic growth, employment levels, office construction rates, and -- of course -- hybrid work.

Not surprisingly, the report highlights how the effects of hybrid work are expected to be more pronounced in primary markets compared to secondary markets, thanks to a higher concentration of small businesses in secondary markets. In Colliers’ our Q4 2021 report, small businesses were significantly less likely than international businesses to indicate their future workforce would be hybrid (52% vs. 91%). Small businesses were also more likely to say that wanted to keep their same office space (62% vs. 43%).

"The higher reliance on office space and shorter commute times for employees at small businesses are contributing factors to the difference in the effect of hybrid work between primary and secondary markets," the Colliers report reads.

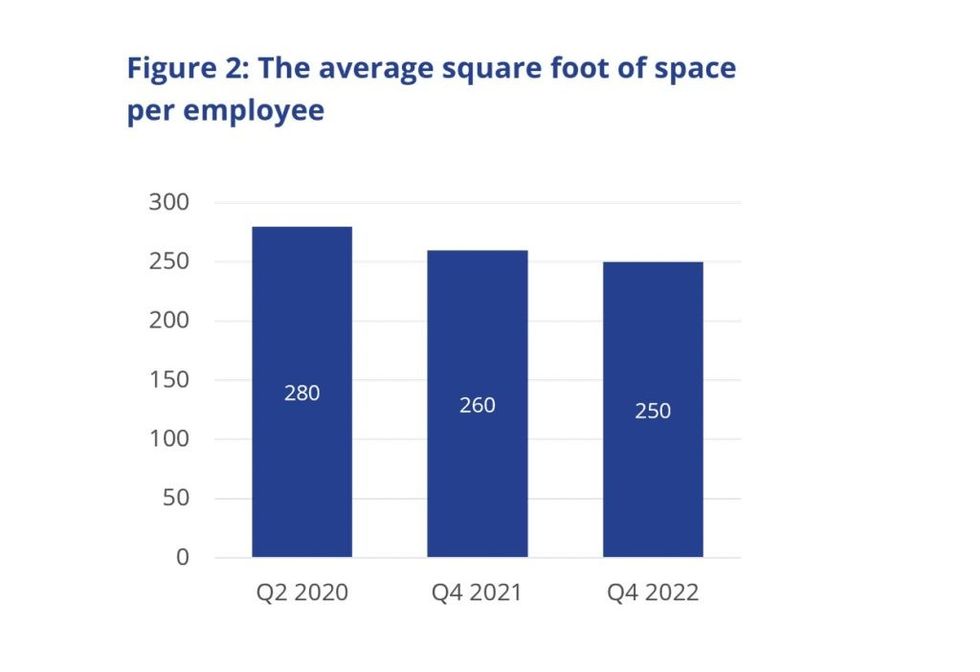

Colliers goes on to note that the average sq. ft space per employee has declined 10% since the onset of the pandemic, due to both the onset of hybrid work and the concept of “hoteling” when it comes to the office. According to the report, 44% of companies say they will not be providing a dedicated office or workspace for all employees. In turn, the average square footage per employee has dropped from 280 sq. ft at the start of the pandemic to 250 sq. ft – a 10% reduction.

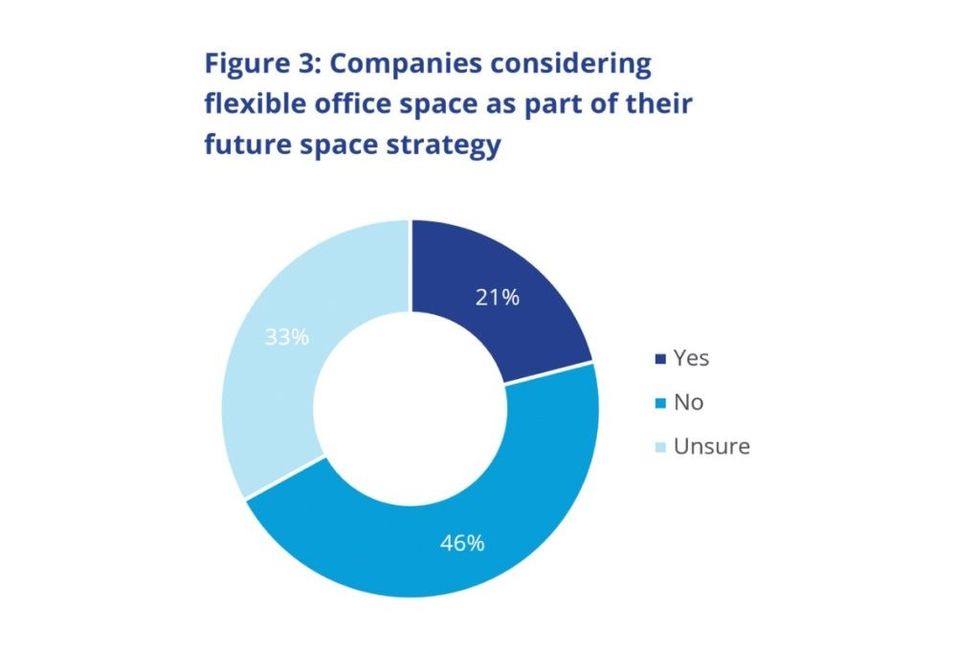

According to the report, the growing demand for flexible office space (flexible space outside of a business' core lease) suggests it will encompass 8% of total office inventory in the market. This figure is up from the 6% Colliers predicted in its Q4 2021 report. As the report highlights, "flex space can refer to designated space in an office building that is shared by all the tenants in the building, such as bookable boardrooms or co-working spaces. It might also refer to short-term leases of turnkey space."

“The rising flexibility in work means that people are interacting with their spaces differently and the physical infrastructure needs to respond,” John Duda, President, Real Estate Management Services, Colliers tells STOREYS.

“The office needs to be designed -- and operate -- in a way that enhances productivity and builds culture. Programming and amenities must facilitate meaningful human connection and collaboration. When office real estate is dynamic, responsive to changing expectations, and tailored to the unique needs of tenants, it can be conduit to elevate business performance. There are also opportunities to reimagine tenant engagement and advance ESG and PropTech priorities -- each of which can set these new workplace models up for success.”

While hybrid work culture is here to stay, companies seem up in the air about how it will be implemented. “Only 49% of the companies surveyed have finalized their plan for how they will approach the balance between in-office and remote work, suggesting that the great hybrid work experiment is still on,” reads the report. In fact, 27% of companies are currently evaluating the plan they put in place and 24% have not yet developed a plan.

A finding that may not be too surprising to most: managers were found to be twice as likely as employees to prefer a fully in-office work environment. "While hybrid work is definitively perceived as the preferred method of work between managers and employees, a larger gap exists between those who would prefer fully in-office (39% managers vs. 22% employees) and fully remote (4% managers vs. 13% employees)," the report says.

According to Colliers, the work plans that have been developed thus far suggest that "management was willing to compromise on a fully in-office model in favour of hybrid, but were unwilling to compromise on a fully remote option."

The reality is that most companies are requiring their employees work from the office two or three days per week. When asked their hiring preference, Colliers’ weighted average analysis indicated that "between fully in-office, fully remote, and hybrid, companies are showing a strong preference for hybrid and in-person work. This is consistent across all roles, from operations to technical support."

But to get a clearer picture of the future, tenants' feelings towards future office space need continue to stabilize. "Tenant sentiment around keeping more office space has been improving since the onset of the pandemic, yet the full impact of the anticipated changes have yet to be seen," says Colliers. Of the companies surveyed, 52% said they intend to keep the same amount of office space, 27% said they need less space, and just 6% said they need more space.

“There are early signs of stabilizing trends, including the desire for tenants to increase/decrease/maintain their current level of office space, along with their desire to explore flex space as part of their future space strategy," Duda says. "That said, as we reported, half of the companies surveyed have yet to finalize their plan surrounding in-office and remote work. We will continue to engage with our tenants and clients on what these finalized plans mean for their real estate needs going forward.”