Despite elevated mortgage interest costs and relentless rents, Canada's annual rate of inflation was unchanged in November,

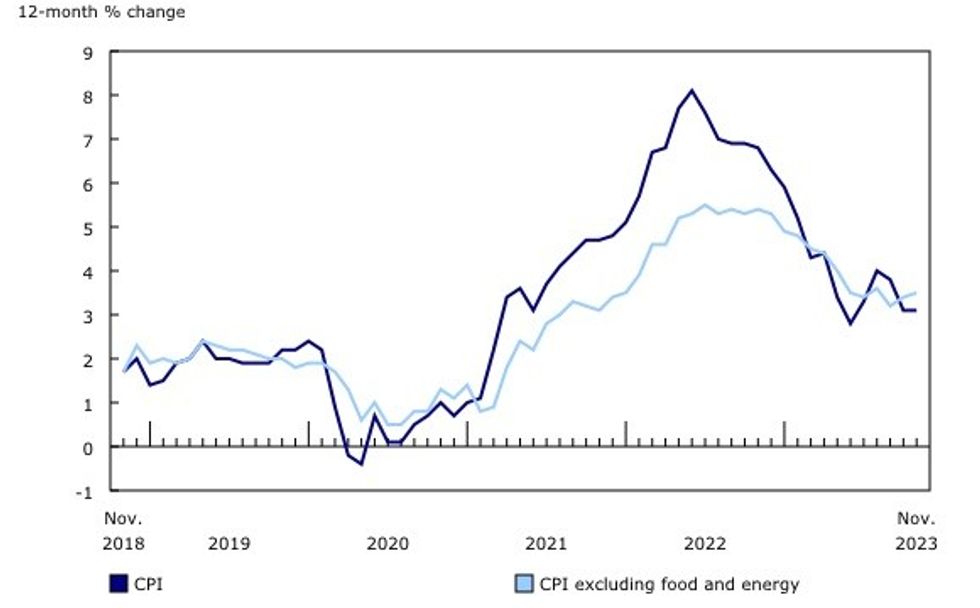

According to Statistics Canada’s latest Consumer Price Index (CPI), inflation rose 3.1% year over year in November, matching the increase seen in October. On a monthly basis, the CPI edged up 0.1%.

The largest contributors to the annual increase continued to be mortgage interest costs, which rose 29.8%, and rent, which jumped 7.4%. Although they remain highly elevated, the former eased slightly on an annual basis, while the latter experienced its first decline since July. Higher prices for travel tours, up 26.1% annually, also spurred the acceleration of headline CPI in November.

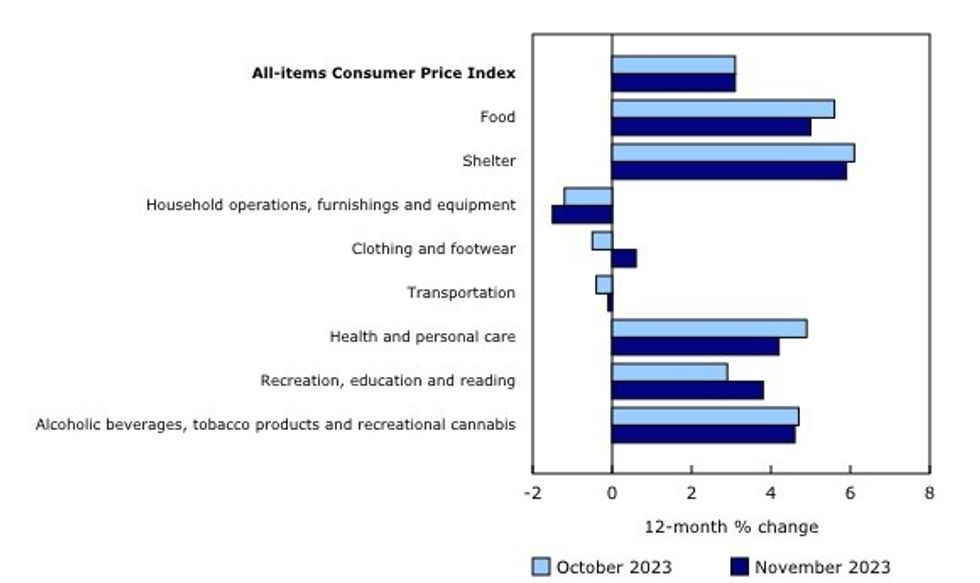

Offsetting the upward pressure was the slowing of food inflation, which rose 5% annually, down from 5.6% in October. Shelter prices cooled slightly too, increasing 5.9% compared to October’s 6.1%.

Energy prices also experienced a greater decline in November, falling 5.7% annually due to lower prices for fuel oil, which declined 23.6% thanks in part to the temporary suspension of the federal carbon levy. Meanwhile, electricity prices rose 8.2%, largely due to increased time-of-use rates in Ontario.

Grocery prices increased 4.7%, marking the fifth consecutive month that the pace of annual price growth has slowed.

Inflation remains above the Bank of Canada’s (BoC) 2% target, and the bank’s preferred measures of core inflation — CPI trim and CPI median — remained unchanged at 3.5% and 3.4%, respectively.

However, on a three-month annualized basis, CPI trim slowed to 2.6%, and CPI median fell to 2.3%, the slowest pace since early 2021. To Leslie Preston, Managing Director at TD Economics, this suggests that the annual pace of inflation should head lower in the coming months.

However, the prediction was not shared by Douglas Porter, Chief Economist and Managing Director of Economics at BMO, who called November’s inflation print “moderately disappointing.”

"Base effects suggest that inflation is almost certain to take at least a one-month detour higher in next month's release," Porter said. "Despite the recent mirth over potential rate cuts in 2024, we clearly can't assume that the inflation fight is finished—as Governor Macklem has so often warned one and all."

Despite their divergence on the short-term path of the CPI, Preston and Porter agreed that with underlying inflation trending lower and Canada’s economy cooling, the BoC will begin cutting interest rates in mid-2024, pending further softening of inflation.