Inflation may be down but shelter costs are surging, and that might have something to do with provincial rent control rules, one economist says.

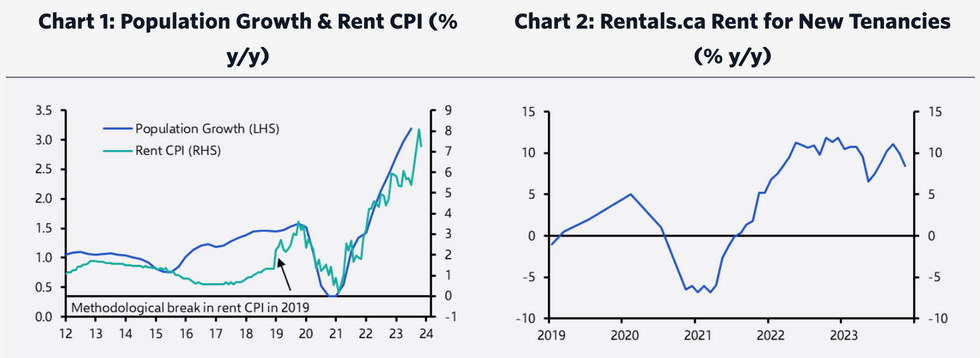

Statistics Canada’s Consumer Price Index saw just a 3.1% year-over-year increase in November, and that figure would have been lower if not for mortgage interest costs (up 29.8%) and rent costs (7.4%). On the mortgage front, the dramatic rate of growth makes sense, as mortgages are particularly sensitive to interest rates. However, when it comes to rent inflation, the matter is nuanced.

“It is no secret that strong immigration is pushing up rents but, as rent growth for new tenancieswas little changed last year, this does not fully explain the surge in CPI rent inflation,” says Stephen Brown, Deputy Chief for Capital Economics’ North America office.

In a report from Wednesday, Brown explains that sticky rent inflation is the product of “unusually large rent increases on rent-controlled units when they are re-leased.”

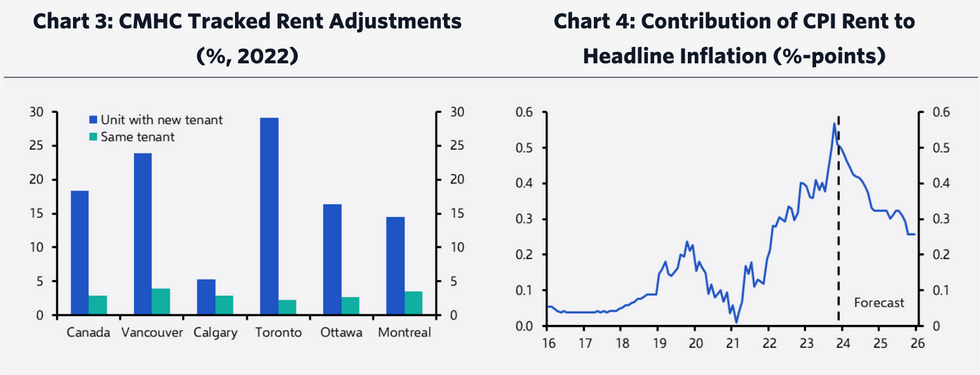

Though rent hikes are capped at 2.5% in Ontario, Quebec, and British Columbia — the three most populated provinces in the country, in that order — that cap only applies to buildings occupied before 2018 in Ontario. In Alberta, which is the fourth most populated Canadian province, there are no rent control rules to speak of. Still, Brown notes that around 85% of Canadian tenants are covered by some degree of rent control.

“If we assume existing tenants without rent control see increases in line with the growth rate for new tenancies, then the average rent increase for tenants that remained in their units in 2023 should have been only a little more than 3%, far less than CPI rent inflation,” writes Brown.

“The missing element is the size of the rent increases for units in which a tenant moves out and is replaced by a new one. For these units, especially those subject to rent control when occupied, landlords will often raise the rent considerably to catch up with the market when they are re-leased.”

Brown points to past data from Rentals.ca and Urbanation, which put the average rent for a two-bedroom rent-controlled unit in Toronto at $1,700 per month in late 2020. Two years later, at an annual rate of growth of 2%, that same tenant would be would be paying $1,770. However, if that tenant were to move out, the landlord would be able to charge current market rent for that same unit (and bear in mind, two bedrooms in Toronto are currently renting at close to $3,500 per month).

Brown also refers to a report from the Canada Mortgage and Housing Corporation, which says that landlords raised rents on average by 18% for new tenants in 2022, compared to just 3% for sitting tenants.“Based on the reported turnover rate of 14%, those figures are consistent with the 2022 rate of CPI rent inflation of 4.7%. The pick-up in CPI rent inflation in 2023 implies that rent hikes on ‘turnover units’ were even larger, as much as 25%, or that there was a rise in the turnover rate,” Brown writes.

“This shows that the outlook for CPI rent inflation depends not only on rent growth for new tenancies, but also on the share of turnover units that are subject to these high rent increases. While the rent gap between a rent-controlled unit and the market rent will generally grow over time, we suspect the magnitude of the recent rent hikes for turnover units is because many of the properties that change hands often, such as those occupied by students, were previously leased in 2020 or 2021 when rents dropped.”

Brown concludes by saying that loosening labour market conditions could help to temper rent growth over the next few years. If immigration pulls back from its current pace, that could help placate prices as well.

These sorts of factors could “help to offset the planned increase in the rent control limit in BC to 3.5% this year and a likely increase in Quebec,” Brown adds.

“Overall, we forecast that CPI rent inflation will fall from 7.4% in November to an average of 5.7% in 2024 and 4.3% in 2025. That means CPI rent inflation will remain well above its 2017 to 2019 average of 1.5% and so, even by 2025, rent inflation will be contributing 0.2%-points more to headline inflation than was the norm in the years before the pandemic. That is not a huge difference but, at the margin at least, it is one reason to expect the Bank of Canada to keep interest rates higher than in the past.”