Following a year like no other, Canada's housing market is poised to have a record-setting 2021, with price momentum and demand forecast to continue, according to a new report from RBC.

On Wednesday, RBC Senior Economist Robert Hogue released a new report looking at the current state of the country's housing market, which Hogue believes is on pace to set more records amid the current unprecedented public health and economic challenges.

Hogue began the report by saying, "in the end, the rollercoaster that was 2020 left Canada’s housing market more or less where it started the year: full of bidding wars, escalating prices and exasperated buyers unable to find a home they can afford."

The economist says that the pandemic changed some buying behaviours by driving many buyers to the suburbs, exurbs, and beyond while grounding immigration to a halt, triggering a downturn in big cities’ rental markets, and causing households to build up their savings.

But one thing the pandemic didn't do is "dial down the market’s heat," which RBC expects will largely continue in 2021, with prices slated to reach "new heights" in the year ahead.

Hogue says the bank forecasts the national benchmark price to rise 8.4% to $669,000 and home resales to increase to the strongest level ever in Canada up 6.5% to 588,300 units with nearly all provinces showing gains.

READ: Canadians Believe More in the Housing Market Than the Overall Economy

However, Hogue also noted that RBC expects a cooling period to emerge, which won't come into full effect until 2022.

The key factor in play here will ultimately be a lack of supply combined with "waning pandemic-induced market churn," a modest increase in interest rates, and an erosion of affordability. Overall, Hogue describes 2022 as a "soft landing."

"Of course, we can’t exclude the possibility of a rougher landing -- either in 2022 or earlier -- so long as the pandemic remains a threat to our economy, though large-scale vaccination campaigns should mitigate that risk," added Hogue.

Below, we take a deeper look at Hogue's predictions for the year ahead and beyond.

Home Price Gains

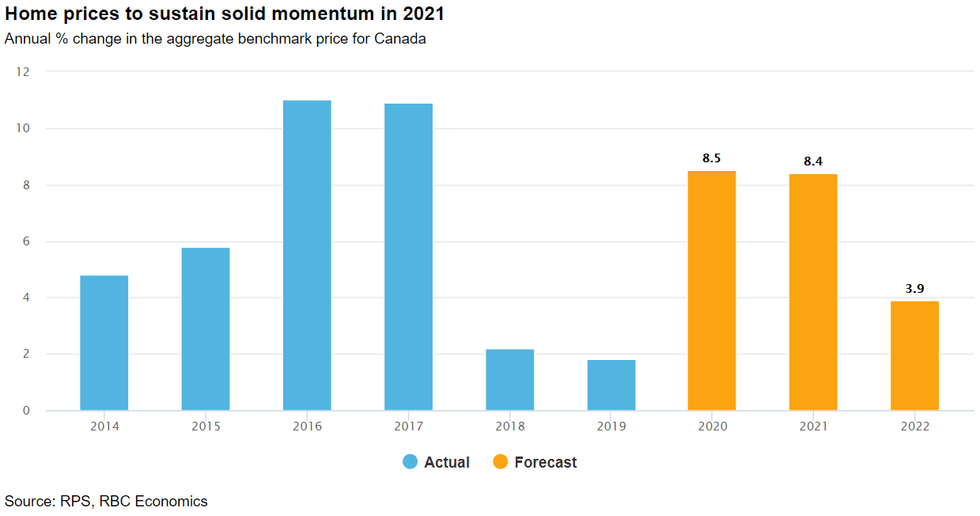

While home price increases stayed on track throughout the pandemic, the pace quickened, with the national aggregate benchmark price rising 8.5% in 2020 -- or almost five times the 2019 rate of 1.8%.

"We expect this solid momentum to be sustained in 2021 with a gain of 8.4%, underpinned by tight demand-supply conditions in most regions of the country," said Hogue, who added that prices will soften gradually over the course of the year, though, still setting the stage for a more modest 3.9% appreciation in 2022.

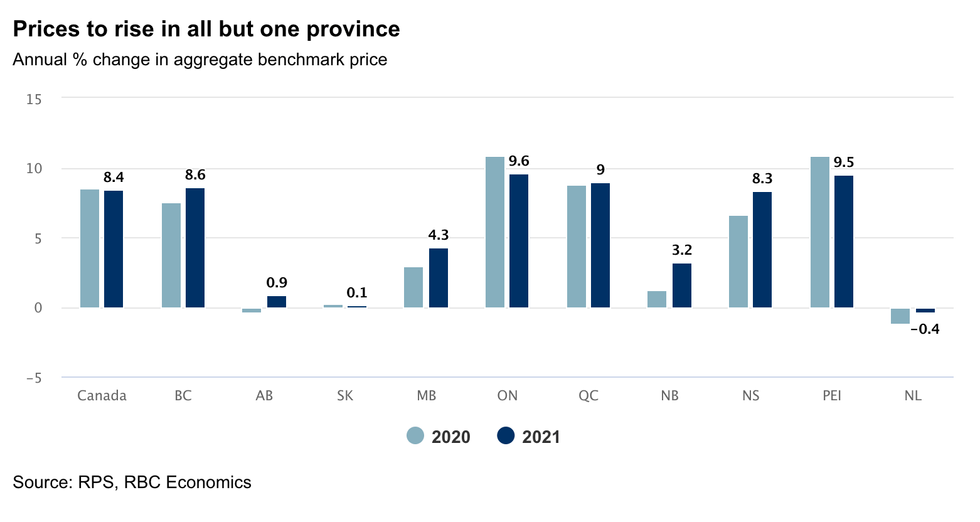

The price gains are expected to "stay firm" in most provinces in 2021, bringing property values up 9.6% in Ontario, 9.0% in Quebec, 8.6% in BC, 8.3% in Nova Scotia, and 9.5% in PEI -- further building on 2020’s solid gains.

However, the outlook for the Prairie Provinces remains comparatively weaker, with economic challenges facing the region continuing to weigh on prices, though RBC expects an increase in Alberta (0.9%) after nearly five years of decline.

Newfoundland and Labrador is the only province for which RBC forecast prices to drop in 2021 (-0.4%) -- for the sixth year in a row.

"It’s important to note the upswing in property values in BC, Ontario, and Quebec isn’t just a big-market story," said Hogue. "The pandemic has heated up prices in smaller markets too. In fact, we could see stronger gains in smaller markets than in core urban areas because downtown condo prices are likely to stay flat through much of 2021."

Bidding Wars

Hogue says a lack of supply will be the reason property values continue to rise, as the strong demand pre-pandemic and through summer has cleaned up inventories in many areas of the country.

"Relative to the 10-year average, active listings had plummeted between 50% and 61% in Ontario, Quebec, and most of Atlantic Canada, and 29% in BC by the late stages of 2020," says Hogue, noting that this is in spite of the surge in downtown condo listings in Canada’s largest cities since spring.

And with little options to choose from -- outside downtown condos -- buyers will continue to "compete fiercely."

RELATED: This Roncy Rowhouse Holding 80 Viewings in 6 Days Sums Up the Current Market

However, Hogue added that sellers entering the market in 2021 will have a strong advantage when setting prices in most of the country, which he expects will continue during most of 2021.

"We expect provincial sales-to-new listings ratios -- a reliable gauge of price pressure -- to generally stay above the threshold (0.60) where sellers have historically yielded more pricing power. In several cases (including BC, Ontario and Quebec), ratios are well above the threshold, providing plenty of buffer against demand-supply conditions flipping in favour of buyers."

Supercharged Demand

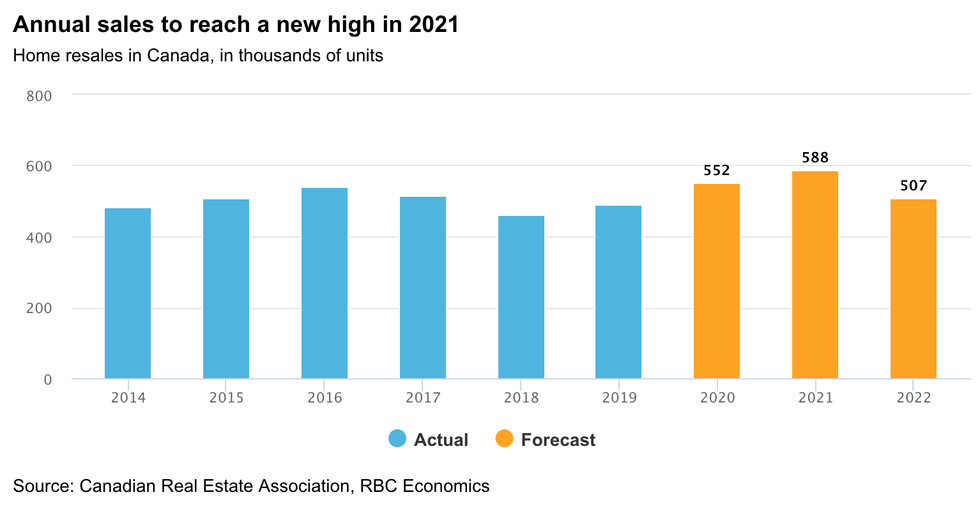

Hogue says following a record-setting 2020, where home resales rose nearly 13% to 552,300 units nationwide, he expects home resales to be even stronger overall in 2021, reaching 588,300 units. This will be driven by historically low-interest rates, changing housing needs, high household savings, and improved consumer confidence.

However, Hogue also expects 2021 to be followed by a gradual cooling period with some moderation setting in over the course of the year.

"We expect low supply to become a growing constraint, pandemic-induced market churn (resulting from changes in housing needs) to wane, and a slight rise in longer-term interest rates and material erosion of affordability to cool demand by a few degrees. Low immigration levels could also play a role," said the economist.

Hogue says these factors will rein in resales to something closer to 515,000 units by the end of 2022 -- "still solid but down from the stratosphere."

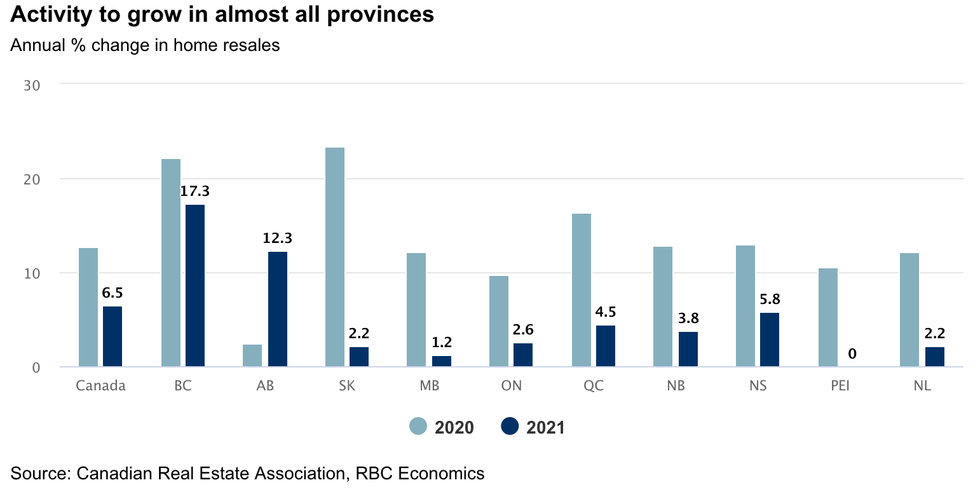

In 2020, home resales rose in all provincial markets -- the last time this happened was in 2004. Subsequently, Hogue expects a "near-repeat" performance in 2021 with only PEI opposing the trend.

"We project activity in BC and Alberta to grow the most, at 17% and 12%, respectively. In both cases, this will reflect further recovery of ground lost years earlier. These provincial markets had slumped prior to 2020," said. Hogue.

He added that forecasted gains will be more modest for most other provinces, ranging from 1.2% in Manitoba to 5.8% in Nova Scotia, with supply constraints serving as a particular issue to hold back the pace in Central Canada and most of the Atlantic Provinces.

Potential risks

Hogue says he also expects interest rates to stay low in 2021, though he sees long-term rates starting to creep slightly higher this year.

"It’s important to remember that when rates are at rock-bottom levels like they are today, it doesn’t take much of an increase to jack up debt service costs. So the slightest rate increase could compel many buyers to exit. Any sudden, larger increase would pose a risk to the market," said Hogue.

The economist also noted that there are several other risks to be wary of, including the pandemic and the drop in immigration, which could weaken housing demand if it continues.

"To date, the plunge in immigration has primarily affected the rental and, to a lesser extent, condo markets in Canada’s largest cities though the impact could spread to other housing categories and markets," said Hogue, adding that strong immigration has been a huge source of housing demand over the past decade.

"Should signs of market overheating emerge, this could prompt policymakers to intervene by tightening rules or imposing new restrictions in order to cool things down."

However, just like the pandemic, the Canadian housing market remains largely unpredictable, and only time will tell how 2021 and beyond will actually pan out.