A new Municipal Benchmarking Study from the Canadian Home Builders' Association (CHBA) reiterates a tune that the development industry and (some) policymakers have been singing for a while now: in order to achieve housing affordability, development charges and application timelines need to be reduced. The study came out on the same day the US put a 25% tariff on Canadian imports into effect, and at a press conference ahead of the release, CHBA CEO Kevin Lee expressed that municipalities can “offset” at least some of the impact of tariffs on homebuilding by addressing pain-points surrounding development charges and approval timelines.

The study looks at 23 municipalities across Canada to compare how much municipal fees are charged on a new residential development, timelines for development application processes, and what features are in place to help applicants navigate the development application process. In turn, the study examines how these factors shape housing affordability and availability for young families in those communities.

“Development charges, delays, and inefficient processes at the municipal level directly impact the price of homes and how many are built," said CHBA CEO Kevin Lee. "The purpose of this study is to facilitate dialogue with all levels of government, but particularly with municipal governments, on the effects of longer timelines, higher fees, and the level of efficiency of processes on housing affordability and outcomes."

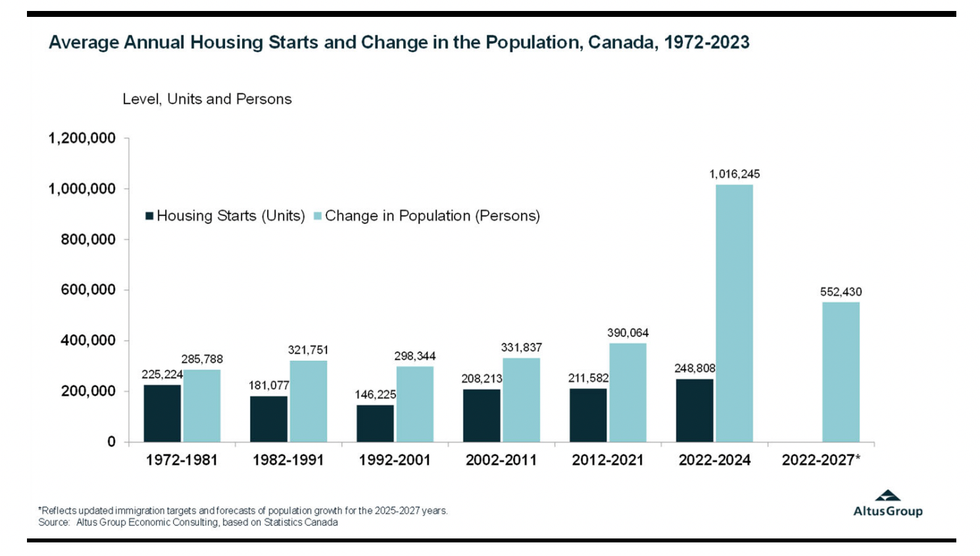

To set the scene, housing affordability for both the rental and ownership market has worsened across all 23 municipalities since the last editions of this study in 2020 and 2022, the average rent-to-income ratio is the highest it’s been since 2001, and Canada is building fewer homes to accommodate population growth than ever before.

At the same time, while 13 municipalities saw improved application timelines between 2022 and 2024, the study points out that this was likely due to challenging economic conditions and costly application processes leading to less applications overall. As well, another nine municipalities either had no improvement or saw timelines worsen, and development charges in most municipalities increased by $27,000 per unit for low-rise developments and $3,000 per unit for high-rises over that same period.

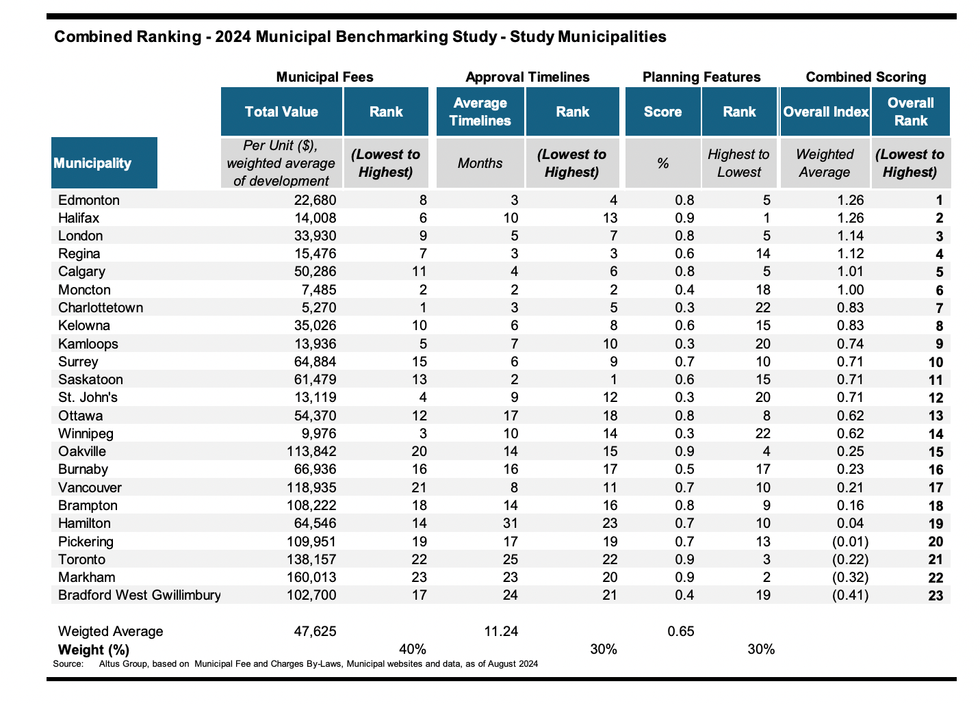

As of the time of the study, average development charges on a low-rise home sit at $82,600, but range all the way from $8,700 to $195,000. For high-rise units, average development charges clock in at $35,000, but range from $1,600 to $134,400. Across both home types, the municipalities with the five highest fees were found in Ontario (Toronto, Markham, Oakville, Brampton, and Pickering), with the cheapest in the Atlantic provinces (Moncton, Charlottetown, and St. John's).

In terms of application timelines, Ontario had the longest waits, with applications taking an average of 31 months to gain approvals in Hamilton, up from 22.9 months in 2022. Hamilton was followed by Toronto at 25 months (an improvement from 32 two years ago) and Bradford West Gwillimbury at 23.5 months. On the other end of the spectrum are cities like Saskatoon, Moncton, and Regina where timelines average 2, 2.4, and 3.2 months, respectively.

Metrics like development charges and application timelines, combined with availability of planning features like zoning by-laws in an interactive map and status indicators for applications, were analysed and ranked to formulate a benchmark ranking for each municipality. The study found that the top five ranked municipalities were Edmonton, followed by Halifax, London, Regina, and Calgary. At the bottom: Bradford West Gwillimbury, followed by Markham, Toronto, Pickering, and Hamilton.

To compare, Edmonton has a three-month average approval time and relatively robust planning features, and only $22,680 of a final unit cost in that city can be traced back to municipal fees like development charges. On the other hand, Bradford West Gwillimbury has municipal fees that amount to $102,700 of a units' final cost, minimal planning features, and 24-month application timelines.

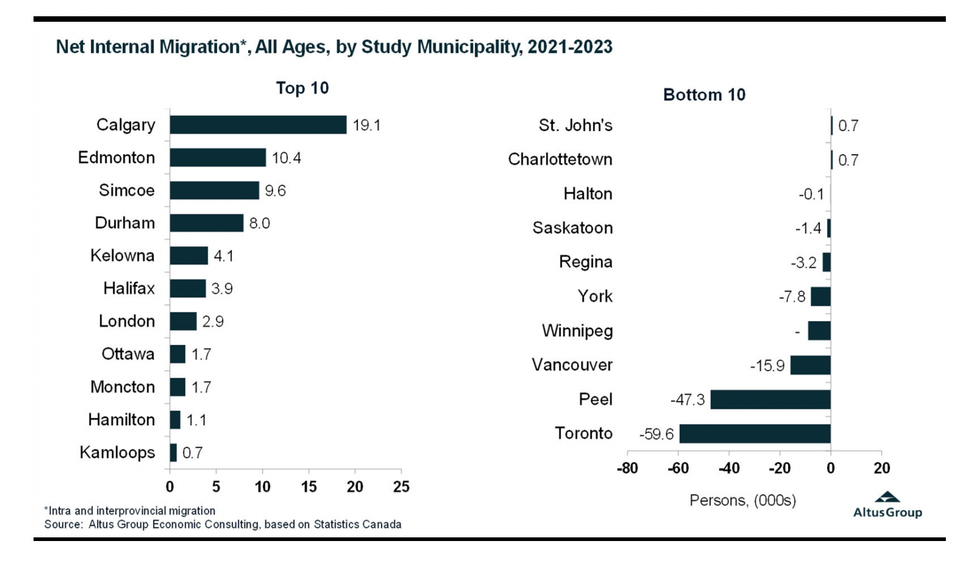

The study's key finding is that in most of the cities with low benchmark rankings, homes are less affordable, homeownership rates decline alongside rental vacancy rates, and outmigration rises. It's no surprise, then, that Toronto saw the largest outmigration, alongside Peel and Vancouver, on record since 2001. Meanwhile, young people aged 25 to 44 are increasingly leaving these same cities to move to the more affordable locales of Calgary, Durham, and Edmonton.

The takeaway: when cities discourage development and settlement through policies that knock hosing supply and drive up prices, the city as a whole, suffers.

"This report [...] offers insight into best practices that municipalities can adopt to help improve their housing affordability and supply. It also points to ways that the provincial and federal governments can continue to drive and support change at the municipal level,” said Lee. “More needs to be done to address the housing crisis in Canada."