In an attempt to cool the province's relentlessly hot real estate market, British Columbia (BC) just announced the introduction of a cooling off period come spring 2022 for home purchases in the notoriously pricey province.

Under the new law, homebuyers will be able to back out of purchases of both resale properties and newly built homes and face few consequences in the process.

If it sounds familiar, it's similar to the current seven-day cooling off period for pre-construction condo sales.

According to a government-issued press release, the BC Financial Services Authority (BCFSA) is being asked to consult with key stakeholders and experts and review other potential consumer protection measures. “This includes looking at the blind bidding system, as well as condition waiving in offers and other practices that may pose risks to consumers,” reads the release.

The move to introduce the cooling off period comes at a time when BC’s robust and increasingly unattainable real estate market shows few signs of dialling back the drama to a meaningful degree. It also comes at a time of increasing concern that buyers -- perhaps caught up in the frenzy of it all -- could be subsequently purchasing homes without everything they need to make fully informed decisions.

“People looking to buy a home need to know they are protected as they make one of the biggest financial decisions of their lives. Especially in periods of heightened activity in the housing market, it’s crucial that we have effective measures in place so that people have the peace of mind that they’ve made the right choices,” said Selina Robinson, Minister of Finance, in a statement. “With this step, we’re moving ahead to protect people and their interests in the real estate market by bringing in a cooling off period for homebuyers and looking at additional measures to ensure effective safeguards are in place.”

Cooling off periods will involve limited periods of time in which buyers can change their minds and cancel the purchase with no or diminished legal consequences. According to the release, BCFSA will consult with key industry stakeholders and experts to help determine the parameters of a cooling off period for resale properties and newly built homes and will present advice to government in early 2022.

Enabling legislation for cooling off periods will be drafted and targeted for introduction in spring 2022.

While this is undoubtedly an appreciated addition for the province's prospective homebuyers, how much of a difference will the move really make when it comes to cooling the actual market? According to some experts, not much.

In fact, it could make everything even worse, if not executed properly.

“It's nice to see that they are addressing a common concern from a buyer’s standpoint around blind bidding so to speak, and that they’ve heard some concern from the market," says Vancouver mortgage expert and partner at Thrive Mortgage Co., Alex McFadyen. "However, I think they’ve taken the wrong approach to do this and I think they released the information prematurely without listening to industry knowledge."

Indeed, the announcement was an unexpected one to many of the province's industry professionals.

"The announcement of the new cooling off period set to come to the market in the Spring of 2022 was a shock to the entire industry," says realtor Alex Dunbar, who sells homes in the Surrey, Langley, White Rock, and Vancouver regions. "After making the announcement, it is only now that the government has decided to consult with professionals in the real estate industry about the impact that this sort of action would likely have. While I believe they have the right intentions, I don't think implementing a cooling off period alone will produce the desired outcome. The primary goal behind this new legislation is to protect consumers. However, I believe that without further ruling and policies surrounding the 'cooling off' period, it will actually cause more harm than good."

As Dunbar highlights, removing the need to have subjects in a contract will put everyone on a level playing field, which may sound nice in theory, but isn't necessarily a good thing.

"Currently, an offer with no subjects is often taken over an offer with subjects, even at a lower price," explains Dunbar. "This is because of the fact that the seller could accept the offer without subjects on the spot and not have to worry about them backing out of the deal or trying to further negotiate later on. Removing this option would make all offers solely price driven which, surprise surprise, would lead to further upward pressure on home prices."

That's not all. "Additionally, it will give buyers the ability to write extremely high offers without having to commit to following through with the purchase, while also allowing them to tie up properties for a given period of time," says Dunbar.

The ability to do this without repercussions is problematic for a few reasons, he says. First, buyers could be offering on multiple properties at the same time with no intent to purchase all of those properties. Furthermore, if another property was to hit the market that they were more interested in, they may choose to back out of their current contract to pursue the new listing. Thirdly, individuals may try to flip the property during this period. Finally, says Dunbar, the seller may try to negotiate a lower price with the seller during this time.

So, while the cooling off period seems like a sweet deal for buyers, the sellers could get the short end of the stick without the proper safeguards in place.

"There is a concern among people in the industry that they haven’t really taken the sellers concerns into consideration -- or at least, not yet, they haven't," says McFadyen. "A cooling off period could be a scary proposition for sellers, who have to turn around and buy another home on their end. Does this put them in a negative situation? A cooling off period has proven effective in the new development space, but with resale, there are so many factors a seller needs to negotiate in terms of the timelines on their home."

Both McFadyen and Dunbar, however, point to ways in which a cooling off period could potentially work.

"The only real solution is that buyers need to have something on the line," says McFadyen. "Buyers should definitely have adequate time to prove they can get financing, but there should also be a mandatory minimum deposit required."

Dunbar says that buyers who back out of accepted offers without acceptable reasoning should be penalized. "Buyers should only be able to back out of deals due to major structural issues with the home determined by a licensed home inspection or failure to attain financing with proof from lender," he says.

Dunbar also suggests having insurance rider on the property in advance, mandatory Arms-Length building inspections prior to a house being listed for sale, and requiring properties to be listed for a minimum number of days and hours prior to accepting offers.

At the end of the day, however, the reality is that adding a cooling off period to the equation likely won't do anything to reduce the province's sky-high home prices or unwavering lack of supply. According to the latest figures from the British Columbia Real Estate Association (BCREA), the supply of homes listed for sale across BC is at a historic low.

“A cooling off period won’t stop prices from going up; I can’t imagine it impacting price point,” says McFadyen. “There are just as many people looking to get onto the market as there's ever been, and I don’t see that changing when this goes into effect. The big issue is supply and demand.” It could even backfire on the price front, says McFadyen, causing people to feel pressure to bid higher on homes.

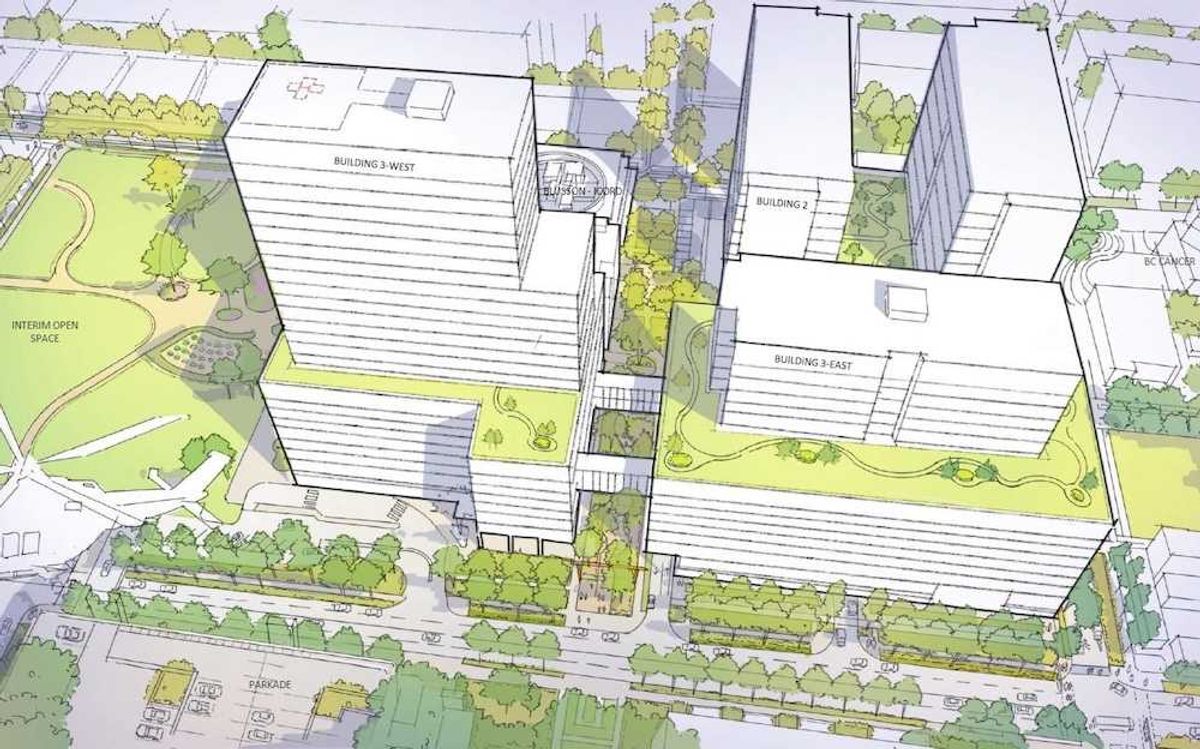

"The bigger issue is still housing affordability, which will likely only worsen," agrees Dunbar. "It would be in the government's best interest to focus on the root cause of the housing crisis which has been and continues to be the lack of supply. If they were to put their time, energy, and money into finding ways to improve and speed up the process of changing zoning and approving permits for builders, I believe this would have a far more substantial impact on the issues the BC real estate market is currently faced with."

What the province really needs are meaningful measures to help the first-time buyer get ahead, says McFadyen.

“I think the government should be looking at other considerations,” says McFadyen “People who are having trouble purchasing are generally first-time buyers without co-signers or large amounts equity or cash available. Why don’t they re-evaluate things like the CMCH amortization guidelines being 25-30 years? Why don’t they raise the floor from $1 million to $1.5 million because price points have changed so much [for mortgage minimums]? Why don’t they reduce the land transfer tax? These things will help buyers get into the market. I think the only positive to the cooling off period is to protect the buyer who isn’t well advised.”