A rare sense of calm is the name of the game as we move into Canada’s spring selling season. While the season is typically a busy one – perhaps even described as chaotic in the not-too-distant past (i.e. pandemic times) – the Canadian real estate industry appears to be in a place of rest.

But – as Douglas Porter, Chief Economist and Managing Director of Economics at BMO Economics, highlights in a new report – the “calm” is not necessarily a bad thing. This is especially true for first-time homebuyers who, in a climate of sky-high interest rates, are looking for some relief on the price front.

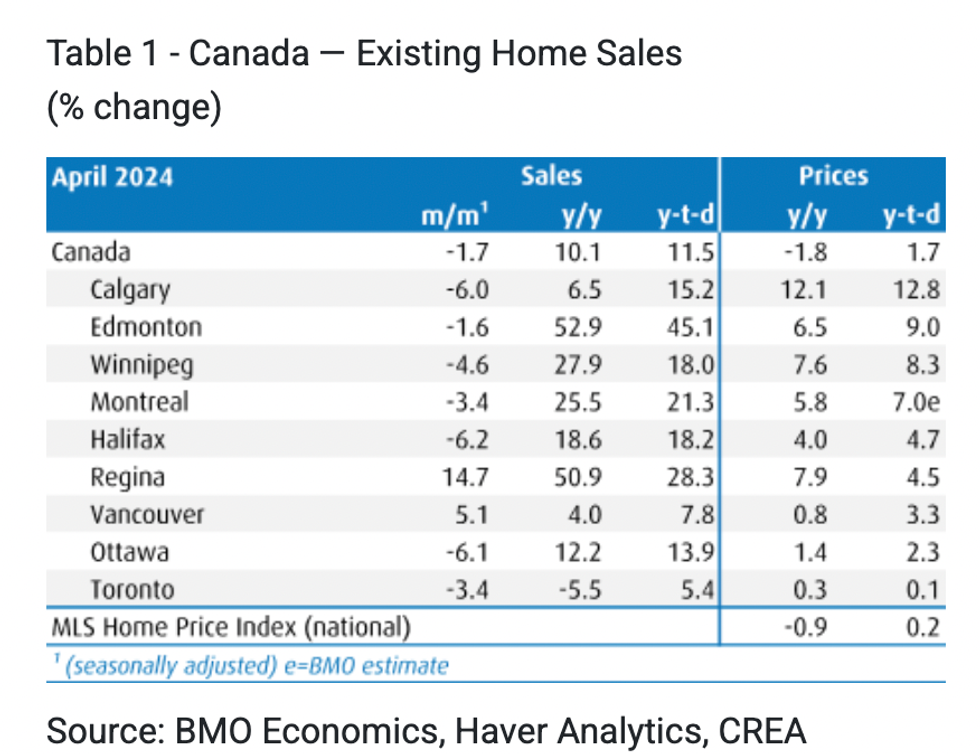

Yesterday, the latest statistics from the Canadian Real Estate Association (CREA) revealed that Canadian home sales actually dipped between March and April 2024, with the number of sales recorded through MLS decreasing by 1.7%. Though sales were up 10.1% on an annual basis. CREA’s Home Price Index was unchanged for April and was down 0.9% annually, while the national average selling price was down 1.8% on the year. As Porter highlights, the dip in home sales occurred despite new listings rising a “sturdy” 2.8%.

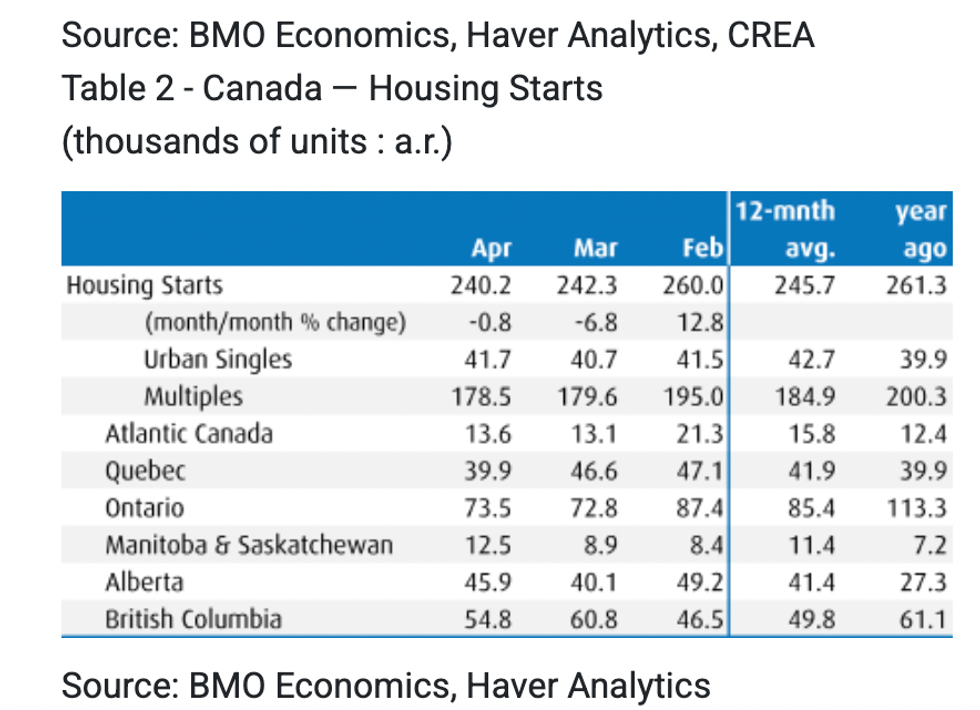

“This combination of solid new supplies and lukewarm demand helped keep prices down slightly from year-ago levels,” writes Porter. “At the same time, housing starts slipped slightly last month to an unassuming 240,200 units, just a tad below the past year's average, but right in line with our (mild) expectation for the year.”

Still, buyers have options – and plenty of them. Porter calls Canada’s monthly 6.5% rise in existing listings – the second largest monthly increase on record – “perhaps the most noteworthy data point.” As he highlights, this left the supply of real estate the highest since pre-pandemic days.

“Put another way, there was the equivalent of 4.2 months of inventory last month, also the highest since early 2020,” writes Porter. “As CREA notes, most measures suggest the market remains largely balanced, perhaps more so than at any time since prior to the wildness of the pandemic years.”

With this said, Porter calls the 10% year-over-year rise in sales activity “one small surprise,” especially given the relative calm in typically bustling markets like Toronto and Vancouver. “But large bounces in many medium-sized cities, aided by the timing of Easter this year, helped bump up the headline tally,” writes Porter. “The changing city mix—soft activity in the priciest cities—helps explain why average transactions prices fell 1.8% y/y. “

A BMO Economics-generated table illustrates that none of Canada’s nine largest cities reported a price drop in April. Furthermore, only five of the country’s 26 largest cities reported price drops in April. As Porter highlights, four of those were in Southern Ontario. “However, the MLS Home Price Index, which adjusts for quality mix, was flat in April from the prior month and still sits 0.9% below year-ago levels,” writes Porter. “It remains down 14% from the all-time peak reached in early 2022 on a national basis.”

Echoing earlier CMHC reports, the country’s housing starts are waning – something fuelled by perpetually high interest rates, This comes despite countless cries from all levels of government to “get shovels in the ground” and build much-needed new homes.

“After hitting the highest level of starts on record for a two-year period in 2021/22 (at nearly a 270,000 pace), starts simmered down to just over 240,000 last year, and will struggle to hit that mark in 2024,” writes Porter. “To put these figures in perspective, the building goals set out in this year's federal budget implied an annual pace of construction of roughly double that rate—not going to happen.”

Porter also illuminates the reality that multiples are the most dominate form of Canadian housing starts in Canada, comprising three-quarters of new building in the past year. While they undoubtedly open up the country’s housing supply once completed, it’s a long road to completion compared to other housing forms. So, the country won’t see enough supply to aid Canada’s affordability crisis in the near future, says Porter.

But there is some good news; Porter ends the report on a positive note. The slow sales activity keeps prices at bay as Canada continues to battle its relentless affordability crisis. Furthermore, they could indicate that a long-anticipated interest rate hike could be on the horizon as the summer sun rolls around – something that economists echoed at the release of the country’s latest GDP figures.

“For the Bank of Canada, a calmer housing market will provide a bit more comfort that some small rate trims won't spark a major flare-up in prices,” writes Porter. “At the margin, cooler home prices and more ample listings slightly increase the chances of rate relief in coming months. When it comes to Canadian housing, calm is good.”