Grab a scotch, a G&T, or a martini and sit back. You are either celebrating or commiserating, but either way, with dry January over, the time is right to break open the bottle. The good news is construction costs have dropped off a cliff the past few years. But the bad news: not many people can build anything due to horrific housing economics we have in the Greater Toronto Area.

So, is this a glass half full or a glass half empty sort of situation? Does it really matter? It is what it is, and you can only run with it and hope for the best.

If you can make the math work to build it’s amazing; if you can’t, it’s a horrible time and perhaps the worst in recent memory. That said, 2025 will be great for some and beyond awful for others, but next year and the year after, it's going to get a lot better. Why? We can thank the government for utterly dropping the ball on the housing crisis — the housing shortage is real, and its teeth will show in 2027 and 2028. Math rarely lies, unlike political types.

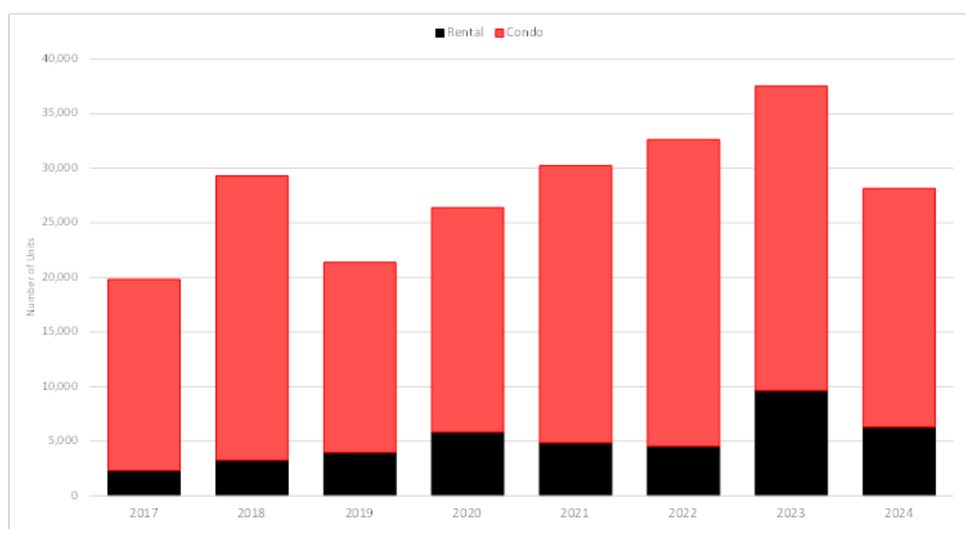

The condo market in Toronto was utterly brutal in 2024 with less than 5,000 sales, and purpose-built rental dropped off a cliff at the same time. As we move into 2025, housing starts are plummeting and the outlook looks bleak.

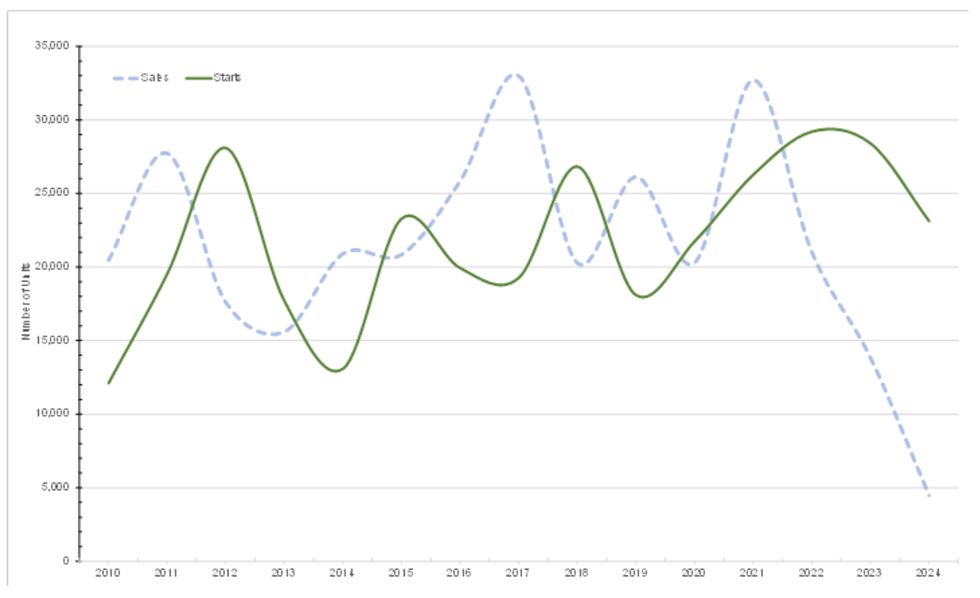

That is fantastic news if all you care about is construction costs. CHMC starts in Toronto 2024 dived 25% from the year before, including by 22% in condo and 35% in rental, and it will get much worse in 2025 on the condo side. The lag between sales and starts and how CHMC measures it all means this year will be terrible for construction. Here are a couple of charts that demonstrate the issue.

CHMC Starts Toronto:

Sales Vs. Starts For Condo Only:

The starts still have the 'cliff' to fall off compared to sales, but record completions combined with no sales means no homes, eventually. Wait a couple years, the gates of hell on housing will open nice and wide — if something is not done soon.

When it comes to construction costs, the one constant positive is that hard costs continue to fall in the private realm. The public sector — well, they never found a huge pile of taxpayer’s money they could not burn with zero discipline and a lack of talent controlling the purse string (think: a barrel with no lid or base and we are pouring water into it... Public Budgets 101). Instead, let's focus on the adult side of the discussion, and where construction costs are going in the private real estate sector.

Well, costs have plummeted over the last couple of years, and projects are down anywhere between 15% to 25%. It’s been a fairly consistent drop of costs as the housing picture gets much worse; from a high-octane action movie in 2022 to a musical in 2023. And now, we are in black-and-white silent territory, but it's a 'thinking person's' style movie, with a person and a stuffed cat talking for 2 hours. Slow and tedious, and we are desperately waiting for it to end.

This year, potential exists for costs to continue the drop, but the pace has slowed, and there is only so much blood you can get from a stone. If you break the stone, it might take you down with it, so buyer beware, trades in receivership is not where you want to be. And for the trades, sometimes the deal is not worth taking — layoffs beat receivership, so know who you are working with and make sure you get paid.

So how do costs come down? Labour is a constant, materials are the market price, and it’s quite a lot of margins, and when the market is amazing, margins go up: Capitalism 101. When the market is bad, and you want to keep the lights on, margin is somewhat mute and cashflow is king.

Labour being constant, union agreements are up this year, that is beyond fantastic. Wait, but no — we are usually panicking at this point and questioning how will that impact projects? But in reality, this is quite frankly the least of the worries the industry faces, which means we are most certainly in unusual times.

If people want to go on strike…. let them, because the market can’t get any worse and there are no bargaining chips. We know the next two, maybe three years are set to be horrible, and there could be an argument for labour rates to be reduced — something that would have been regarded as insanity a couple years ago. Cost of living is up, but if there is a massive drop in demand , a 5% increase on zero hours worked is zero.

The real threats to costs are the exchange rate and potential tariffs. And we also have two elections, including Ford doing a lap-of-honour style election against an inept Provincial Liberal Party, which capitulated with its choice of leader, and then the Federal clown-show with the current government trying to pretend they had nothing to do with the past nine years.

On that topic... carbon tax? What carbon tax? That should help — well, removing it anyway. Plus, if you listen to Freeland, that guy with the pretty hair had nothing to do with her.

We can't control these outside factors, or the apparent lunatics associated with them, but we can try and plan around them. Still, it's tricky with interconnected economies. Perhaps, if we get adults running this country again, common sense will prevail. Or early purchasing and alternate sourcing of materials, etc.

Back to devil in the detail: construction costs.

- Costs for the early works bottomed out last year are lean and mean. Rates for excavation and shoring are very aggressive and the timelines for work very reasonable. There is also some competition in the space with some new old players and a few real good quality trades.

- Structure. Formwork, which is the largest budget on high rise, has a little wiggle room, but it’s getting tight(ish) to carry on dropping at the same pace. With 80 crane operators looking for work, which is almost unheard of in Canada in over a decade, times have changed. Formwork is down over 30% on a lot of projects over the past few years, and perhaps there is another dollar or two — but don’t bet on it. Concrete supply levelled off and is under budget after the insane increases. If anything, our blends are down $10-20/m3. And rebar is fairly reasonable. Steel, not too bad either we just don’t use a lot on residential.

- Envelope... brick? On the high-rise side, the recent tenders have been beyond aggressive on rates. Window wall, prices sub $70/sf are becoming common again. Now, it’s not the sub $40 we had 14 years ago, but it’s a hell of a lot better than over $80. So, it’s relative. Pre-cast prices are aggressive, so it's all about the design: keep it simple, and envelope costs can be very attractive.

- Interiors. Drywall, there is a little in denial in the trade community, but off a cliff is where the low tenders have been heading with swings of 25% to 30% versus last year. There is not a whole lot of a high-rise project budget in finishes compared to other elements, but there are good prices for discerning owners and the number of projects is dropping rapidly.

- The last person to the party….mechanical. Well now they are calling looking for work maybe the gravy train is ending? Prices have flat-lined, and if anything you could argue future projections are down in that they are not still going up minute by minute. Tariffs and exchange rates have an impact, but let's wait and see. Watch the spec, consider direct purchase and so forth and you can save money.

Should you tender right now: 100% yes, yes, and a side of hell yeah. This is the best opportunity for tendering I remember in 14 years. We have access to great quality companies with extremely competitive prices, all bringing their 'A' crews to your project. Meanwhile, negotiation is back. Don’t like the bid? There are five companies lined up behind all happy to do the work.

But the soft-cost side of the budget? Still stupid. Land tanked, and if you own it that is bad not good. With respect to taxes and fees, Vaughan lowered DCs, and that's a display of great leadership from the Mayor, and Mississauga is next on deck. After that, all we need is the self-absorbed megalomaniac dictators in Toronto to wake up and smell the roses.

Socialism is great until you run out of everyone else’s money (the $11B Ontario DC war chest, spend it!). Interest rates continue to fall (hopefully) but with no sales and proformas not penciling on rental, its not really moving the needle in Toronto. Listless might be the market, headwinds and tailwinds offset and we are going nowhere. 'Becalmed' did not seem like a good choice of words as not sure anyone is calm these days (see: intro on cracking the bottle open).

This year, escalation will likely be 0% on residential high rise, maybe single digit down (-1% to -3%). But I’ve said it before, 2027 or 2028 will likely have 10%+ escalation, so time is of the essence. '

In summary: Build baby, build.