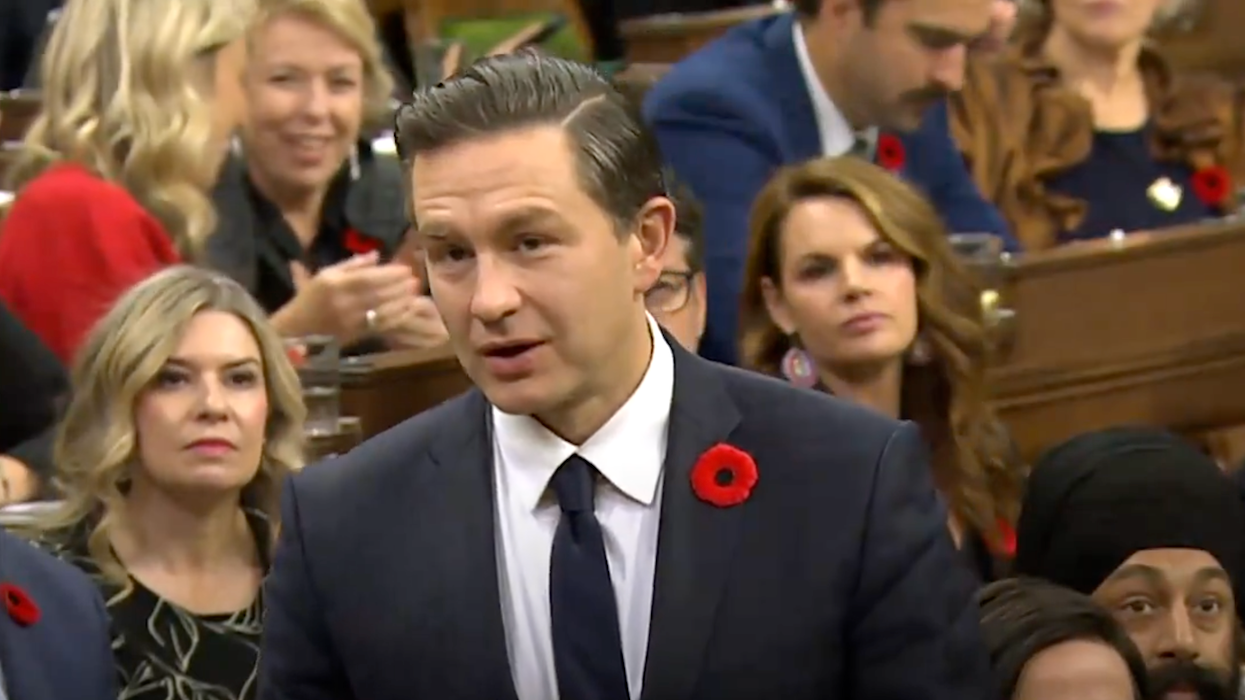

Conservative Party Pierre Poilievre continues to make a big splash as he makes his way through the race to be Canada’s next Prime Minister. Last week, he made headlines when he pledged to “axe” the goods and services tax on new homes sold for less than $1 million.

Now, he’s doubling down. In a letter penned to premiers across the country, Poilievre asked for leaders to “match my common sense sales tax cut with one of your own by axing the provincial sales tax (where applicable) on new homes under $1 million.”

“If we are to restore Canada's promise, we must take urgent action,” he said, in a letter, which was posted to social media.

READ: Poilievre Pledges To “Axe” GST From New Homes Under $1M

“Since 2015, housing costs have risen faster than any other G7 country. Rent costs have doubled. Mortgage costs have doubled. Needed down payments have doubled. Nine years ago, it used to only take 39% of the median pre-tax household income to cover home ownership costs. Now, it takes nearly 60%,” Poilievre wrote. “Young Canadians should be able to afford homes in the communities they grew up in. But that dream has been destroyed. Now, 80% of Canadians tell pollsters that homeownership is only for the very rich. Across the country, taxes and government fees add unnecessary costs to homebuyers.”

Poilievre also underlined that, in Ontario in BC, government charges translate to around 30% of the cost of a new home.

“The federal government takes the biggest share. In Ontario, about 39% of the total taxes on a new home go to politicians and bureaucrats in Ottawa. But, across the country, provincial sales taxes also significantly increase the cost of homes,” he said. “My common sense tax cut will generate more income for construction workers and businesses, and $2.1 billion of revenue for government. Not only will this make housing more affordable for homebuyers, but it will also spark 30,000 extra homes built every year.”

The letter from Poilievre comes just days after he told press in Ottawa that he would “axe the sales tax” on homes sold under $1 million if his party is elected. He reiterated it via a YouTube video posted to his channel and over a slew of posts on social media urging Canadians to support the Conservatives’ “common sense plan.”

The Conservatives said last Monday that dropping the federal sales tax on those new homes would bring down the cost of an $800,000 home by $40,000.

When asked by one reporter if he could confirm that scrapping the GST on new homes over $1 million will save the feds some $8 billion, Poilievre did so, without hesitation, and pointed to the fact that the Conservatives would, concurrently, get rid of the Housing Accelerator Fund as well as the Housing Infrastructure Fund, calling them ineffective and purely bureaucratic.

“So that [saves] a total of $8 billion over several years,” he said. “Then we expect that we will collect about $2 billion more as a result of the 30,000 additional homes that will be built year after year because of this highly stimulative tax cut — it's going to spark more home building, which means more workers and businesses will be making money building homes, and therefore, at the existing rates, they'll be paying more into the system.”

The announcement was then applauded by organizations like the Building Industry and Land Development Association (BILD) and the Residential Construction Council of Ontario (RESCON).

In particular, RESCON’s Present Richard Lyall said in a statement released last Monday afternoon that he commends the Conservatives for putting forth such a plan, and that he urges provinces to do the same. “The tax burden is preventing many people from buying a new home and many are leaving our cities,” said Lyall. “The plan put forward by the Conservatives is forward-thinking and should help restore balance to the market.”

The Coalition Against New Home Taxes also released a statement last Monday, saying that while they are “encouraged” by the Conservatives' pledge, they will continue to advocate for more action when it comes to tax relief, including a GST waiver “on all new homes for sale at all price points, including those above $1 million, to encourage the development of more family sized units and enable move-up buyers to sell their more affordable housing stock.”