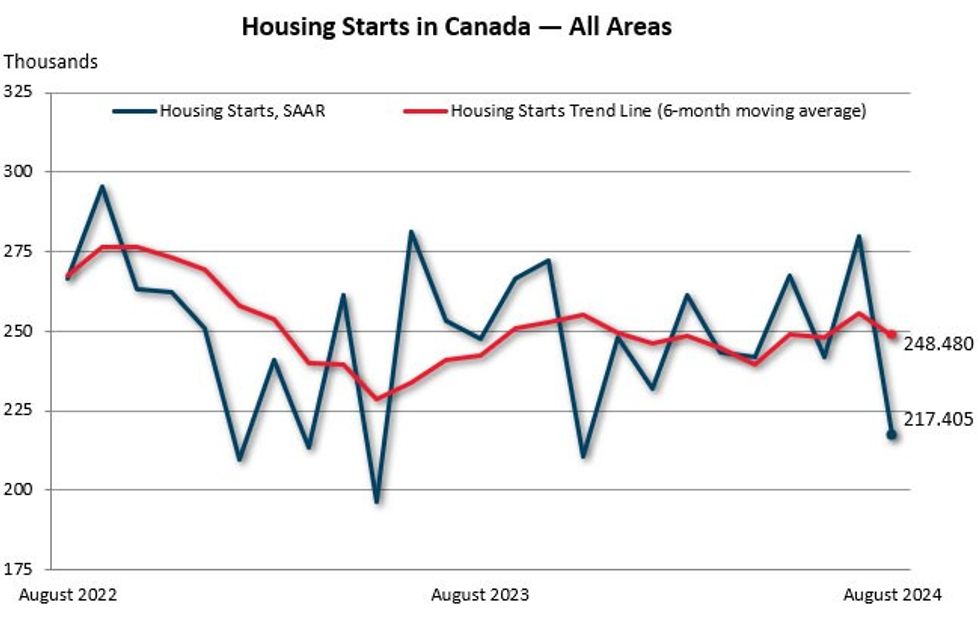

After July posted an unexpected 16% jump in housing starts, month-over-month figures for August undid that growth (and then some) with a 22% decline, according to Canada Mortgage and Housing Corporation — a number that grew to 24% in urban centres.

The decline brings the seasonally adjusted total housing starts from July's 279,804 units down to 217,405, representing a 2.9% decrease in the six-month trend. Still, CMHC said, there have been 149,922 actual housing starts year-to-date — a 5% year-over-year increase compared to the same time last year.

So, short-term bad, long-term... okay?

In July, the 16% increase was largely driven by starts observed in multi-unit construction, which rose 17% annually during that month, hitting 261,134 units. But in August, we saw another reversal in that respect, with multi-unit starts decreasing 29% to 154,290 units, while single-detached urban starts increased 3% to 45,188 units.

But that's at the national level. Among the provinces, we're seeing some leaders and laggers. “Growth in actual year-to-date housing starts has been driven by both higher multi-unit and single-detached units in Alberta, Quebec, and the Atlantic provinces," says Bob Dugan, CMHC’s Chief Economist. "By contrast, year-to-date starts in Ontario and British Columbia have decreased across all housing types."

In Toronto and Vancouver, for example, actual year-to-date housing starts are down 14% and 20%, respectively, though it should be noted that 2023 was a historically high year for home starts in both cities. In contrast, Montreal was up by an impressive 39% in year-to-date housing starts, up from the historically low new home construction the city saw in 2023.

Overall, the turn out is still lower than ideal for the country to reach its housing goals, Dugan emphasizes. "As the housing shortage continues, higher levels of construction are needed to restore affordability in Canada’s urban centres.”

- Canadian Housing Market Stuck In "Holding Pattern": CREA ›

- New Edmonton Auto-Review System To Bring Same-Day Approval For Development Permits ›

- "From Bad To Worse": Construction Productivity In Canada At 30-Year Low ›

- Canadian Housing Starts Surprise In July With 16% Jump ›

- August New Home Sales See Another "Historically Low" Month In The GTA ›

- Canada Housing Starts Still 'Well Below Required Amount' ›

- Housing Starts Rise 8% In October, Affordability Far Off ›