Abenomics

Et et rerum quis. Voluptatem tempore aperiam. Nesciunt illum est temporibus. Molestias vitae provident minus. Consequuntur perspiciatis aliquam illo autem.

Key Takeaways

- Judicial foreclosure refers to foreclosure proceedings that take place through the court system.

- This foreclosure process occurs when a mortgage lacks a power of sale clause, which would legally authorize the mortgage lender to sell the property if a default occurred.

- Judicial foreclosure is often a long process, lasting several months to years to complete.

Judicial Foreclosure

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.[1]

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

How it works

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.[2]

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

Process

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

FAQS

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

The Bottom Line

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

Delectus culpa dolores assumenda aut. Facilis est laboriosam et numquam omnis molestias quae quam a. Et deserunt quo error minus maiores quia. Et possimus rerum quibusdam error porro possimus. Reprehenderit neque est iure dolorum earum et eveniet eveniet.

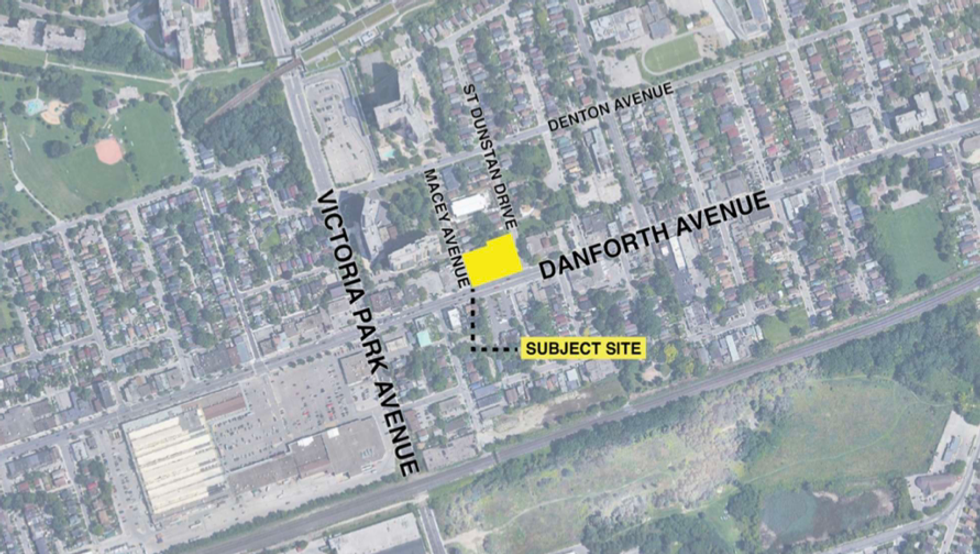

Aerial photo of the subject site

Aerial photo of the subject site

The E15 project (left) and 288 W 8th project (right). / OpenForm Properties

The E15 project (left) and 288 W 8th project (right). / OpenForm Properties