Overall real estate market activity dipped considerably between March and April in the Greater Toronto Area as homebuyers grappled with a newly-minted higher cost of borrowing.

However, it's sales and price growth in the outlying 905 parts of the GTA that are seeing the most precipitous declines according to the latest statistics from the Toronto Regional Real Estate Board (TRREB).

READ: The 905 Region Real Estate Market Dials Back the Price Drama

Detached homes sales in the 905 declined by 47.2% year over year in April, while transactions for the same segment decreased by 34% in the 416. Semi-detached home sales in the 905 fell by 39.6% during the same period, compared to a 35.7% drop in Toronto proper. Townhouse sales in the 905 fell by 44.1% year-over-year in April and by 41.6% in the 416.

Only in the condominium segment of the market were sales lower in the 416 (-34.5%) than in the 905 (-32.2%).

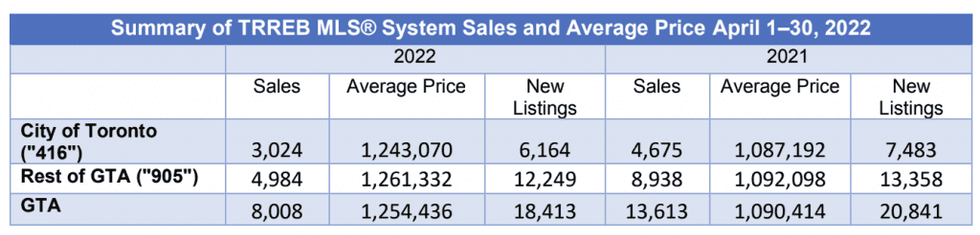

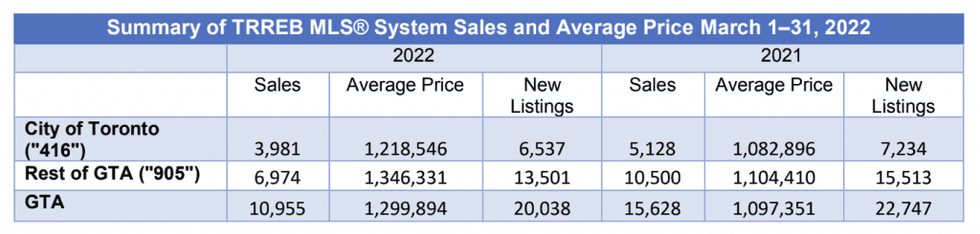

According the latest TRREB statistics, the average home price in the overall GTA declined by 3.5% in April to $1,254,436 from $1,300,082 a month prior. Falling prices were disproportionately found in the 905 markets, however: at an average of $1,261,332 in April, that's down 6.3% from the $1,346,331 average price recorded in March. In contrast, the average price in the City of Toronto rose 2% month over month, to $1,243,070.

An independent analysis conducted by John Pasalis of Realosophy Realty comparing low-rise price trends between the first three weeks of February and April also revealed price declines between 6 - 21% throughout the GTA.

Rising Interest Rates Eating into Affordability

The most obvious explanation is that interest rates have increased by 75 basis points since March 2 and they’re slated to keep rising. The 905 is where the lion’s share of the GTA’s population lives and, therefore, where most transactions occur, so a dip in sales and prices might not be reflective of the whole story. Still, it is telling that the 416 rental market is on fire, suggesting that people who left the city at the onset of the COVID-19 pandemic are returning. In addition to rising interest rates, inflation is taking sizeable chunks out of people’s incomes.

As TRREB Chief Market Analyst Jason Mercer stated in the board's April report, fundamentals are still tight enough to support price growth from a year-over-year perspective -- but at a less searing pace than observed during the pandemic.

“Despite slower sales, market conditions remained tight enough to support higher selling prices compared to last year. However, in line with TRREB’s forecast, there is evidence of buyers responding to increased choice in the marketplace, with the average and benchmark prices dipping month-over-month. It is anticipated that there will be enough competition between buyers to support continued price growth relative to 2021, but the annual pace of growth will moderate in the coming months,” he stated.

905 "Definitely More Vulnerable"

The 905 is also where the fastest price increases have occurred during the last two years, and that consequently means it’s the most susceptible to major price corrections, says Nasma Ali, Broker and Founder of One Group Real Estate.

“I think with prices going down recently, a correction is occurring in the city, but in the 905, while it’s too early to say, it is definitely more vulnerable,” Ali said. “In some of those markets, prices went up 40-100%, sometimes even 140%, since 2020. So if you have a 30% setback, that’s a crash in a regular market but here 30% just brings us back to 2021.”

She added that activity in Toronto’s suburbs was comparatively docile before the pandemic.

“COVID revived the suburbs,” Ali said. “The city is resilient, though.”