The Canada Mortgage and Housing Corporation shared their 2025 Housing Market Outlook Wednesday, laying out key trends they see shaping housing in 2025. And from the looks of things, the year ahead should be pretty tame — save for geopolitical conflict, trade wars, and shifts in immigration, that is.

According to CMHC, economic activity will be modest, housing starts will slow, and rents will decline, while home sales should pick up in a number of regions. But these projections are in line with a modest prediction that balances two political and economic scenarios: a low-growth scenario and a high-growth scenario. (More on those later...)

Economy

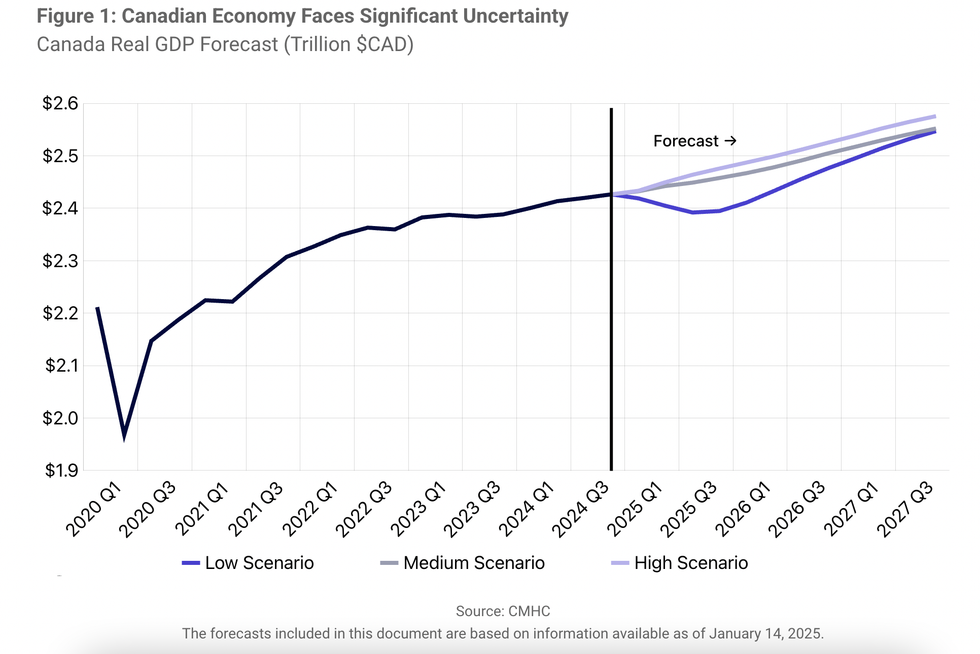

CMHC is forecasting "modest" economic activity in 2025 that should pick up as we head into 2026 and 2027. This projection reflects what the agency sees playing out if the US enacts 25% tariffs on 10% of Canadian goods and the negative economic impacts are "softened by stronger US government spending and higher US demand for imports as a result." Or, the 'medium scenario.'

In this world, Canada also sees reduced immigration targets between 2025 and 2027, lowering economic activity as a result. At the same time, consumer spending is expected to grow due to lower borrowing costs, though this growth may be undermined by loss of purchasing power from past inflation, increasing unemployment rates, and higher interest rates on mortgage renewals.

As for how these factors will impact housing, CMHC says outcomes are mixed. "Slower population growth and economic challenges will limit housing activity. On the other hand, some households will see improved buying power, boosting housing activity in the short term."

Housing

Overview

Economic and political forces aside, housing markets should improve in 2025, predicts the report.

"The combination of lower mortgage rates and changes to mortgage rules introduced in 2024 should unlock pent-up demand from homebuyers previously priced out of the market," says CMHC. "However, some of these homebuyers may face longer loan terms, higher interest costs over the duration of the loan, and larger down payments as prices continue to rise."

Getting into the nitty gritty, resale homes are likely to drive sales over new homes as they are generally more affordable and are available upfront, allowing them to meet pent-up demand head on. Those driving demand will continue to be the Millennial cohort, whom CMHC sees bolstering sales in urban centres as remote work declines, as well as repeat buyers who are looking to upgrade, take advantage of lower mortgage rates, or who bought during the pandemic and are facing mortgage renewals.

The report also emphasizes that market activity will skew depending on unit type as well, with condo sales and prices expected to lag in regions that depend on investor activity, while "ground-oriented homes" should draw much of the market activity in 2025, before slowing in 2026-2027.

"By 2027, we expect much of the pent-up demand to be met," says CMHC. "Although mortgage payments and prices will rise, improved job markets and income growth will make housing more attainable than during the 2022-2024 period. This will support further recovery in sales."

Affordable Regions To Lead Price And Sales Recovery

While sales in Alberta and Quebec are expected to hit historic highs during the forecast period, sales in more unaffordable markets, such as those in BC and Ontario, will remain below their 10-year averages and their prices will grow at a slower rate.

This disparity is largely due to Ontario and BC's "ongoing affordability challenges and the more notable impact of new immigration targets," explains the report.

Housing Starts To Slow

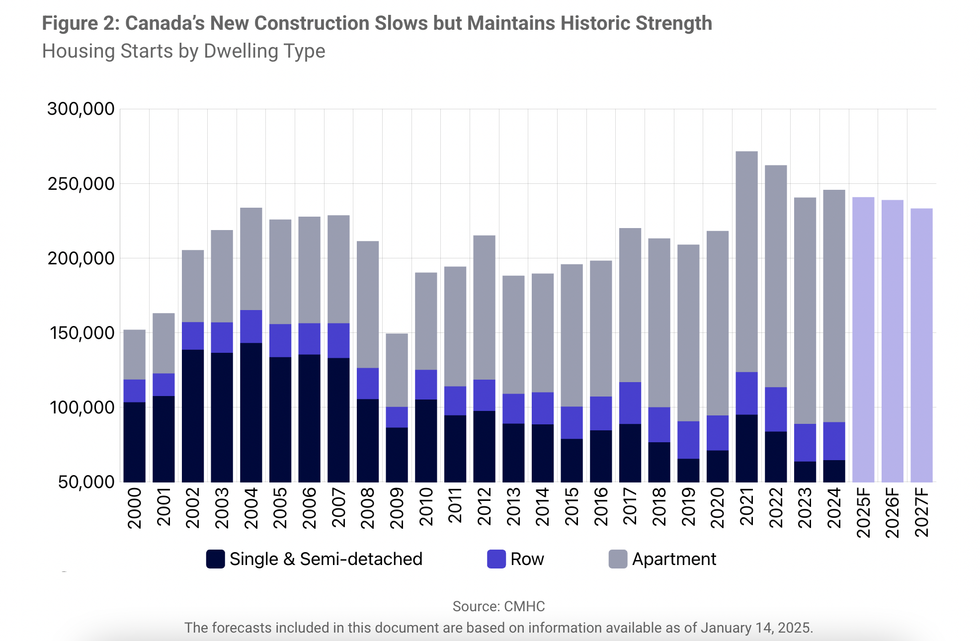

CMHC predicted housing starts will "slow down" while remaining above the 10-year average, citing the lack of condominium apartments being built. With that said, they see progress varying by region, with places like Ontario and BC, where investors drive demand, seeing a notable decrease and Alberta experiencing minimal impacts as more Albertan buyers are actual residents as opposed to investors.

On the rental front, we should continue to see increased construction through 2025-2026, though this trend could wane as rental market conditions "soften," impacting rental starts by 2027. There will also be "a small recovery" for ground-oriented home construction, as developers compete with the resale market to attract presale buyers.

Rental Markets Continue To Rebalance

Though rents remain largely unaffordable, 2025 should see rental supply continue to grow while demand falls, leading to higher vacancies and slower rent increases, predicts the report.

However, CHMC cautions that we are still a ways away from achieving meaningful rental affordability. "Some vacated units will adjust to market rents and renters' incomes will catch up to previous market rent increases," explains the report, adding that, "as financially able tenants move to higher-priced new units, more affordable options will gradually open up for other tenants."

Alternative Scenarios

Returning to those low- and high-growth scenarios, CMHC has laid out how the above predictions could evolve depending on two different global, political, and economic scenarios.

In the low-growth scenario, tariffs are implemented and a recession ensues, US immigration policy sends more migrants up to Canada increasing our population, and the BoC lowers the policy rate to support the economy. In turn, the housing market recovery is delayed, fewer homes are built, and rental markets remain tight, but by late 2026, the economy rebounds and a growing population boosts home sales.

In the high-growth scenario, tariffs are fewer and shorter-lasting, US spending boost Canadian exports, Canadian immigration meets its targets, and incomes and consumer spending increase as borrowing costs come down. In slightly peachier world, more homes are built, homeownership becomes more attainable, but home prices increase more quickly.