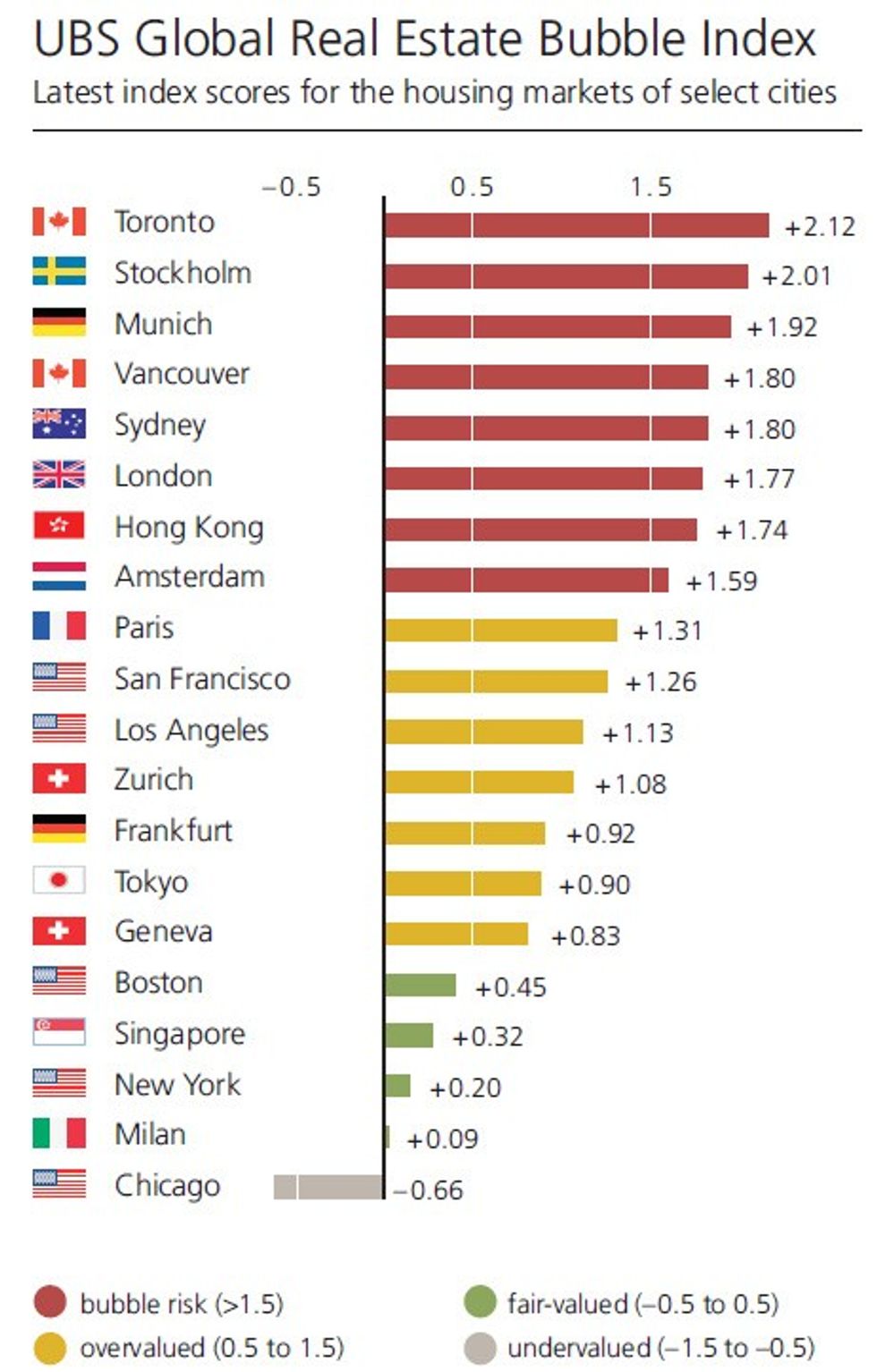

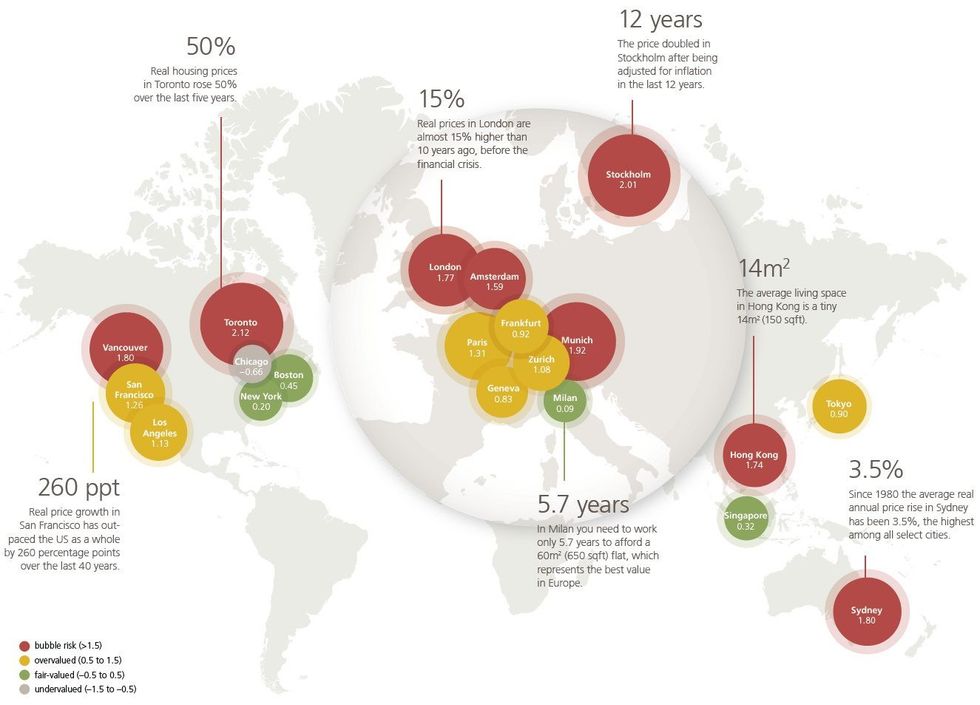

There are eight cities worldwide cited as risks for real estate bubbles. Toronto ranks first.

The data for these rankings is compiled by UBS for its Global Real Estate Bubble Index and presented in a new report by Visual Capitalist. It found Toronto's real estate market to be well beyond anything sustainable, with the highest housing prices compared to annual inflation rates.

Our most recent Toronto budget relied upon real estate and how it fuels our city. But in a city fuelled by real estate, what will that mean for your pocketbook, even if you're not in the market to buy or sell?

Toronto has been seen as a safe asset for so long, so everyone has been piling their money into the city's real estate. But if you keep pouring your most prized coffee into your favourite mug, it will eventually flow over.

While cities such as Hong Kong and Amsterdam have notoriously been among the world's most expensive for real estate, the bank highlights Toronto as an even greater potential bubble risk. It notes our prices have doubled over 13 years, while rents and income have only increased five and 10 per cent respectively.

In the last five years alone, real housing prices in Toronto rose 50 per cent.

So savings in this year's budget, may be due in part to a strong real estate market. While we hate to burst your (looming) bubble ... as Christopher Hume writes, sooner or later, we may have to pay the price.