We all know that housing affordability is an issue in Toronto, but when it comes to buying your first home, you can't just be thinking about home prices and borrowing costs but also land transfer and property taxes.

All provinces have a land transfer tax, with the exception of Alberta and Saskatchewan, which instead, impose a much smaller transfer fee. But those looking to buy in Toronto also incur an additional municipal land transfer tax — further adding to the already sky-high cost of a new home.

To help offset the unwelcome cost, both Ontario and the City of Toronto offer land transfer tax rebates for first-time homebuyers; however, many don't believe it's enough.

READ: COVID-19 Could Have Big Impact on First-Time Homebuyers

Back in January, Toronto Councillor Mark Grimes, with a second from Councillor Brad Bradford, requested a report on providing first-time homebuyers with greater relief from the Municipal Land Transfer Tax (MLTT), including increasing the maximum eligibility threshold of $400,000 to reflect increased home prices in Toronto.

The report was initially set to be presented in April, but given unexpected delays brought on by the pandemic, the report is just now set to be presented to council next week.

Currently, first-time homebuyers in Toronto are eligible for a rebate that tops out at an amount equivalent to the tax paid on a home valued at $400,000. When the MLTT was first introduced back in 2009, $400K was nearly equivalent to the average home price in the city. But as City columnist Matt Elliott pointed out in his latest newsletter, this initial rebate amount wasn't indexed to inflation or the growth of the real estate market.

And considering the average price of a house in Toronto reached $955,273 in May, up 2% y-o-y, it may be time for the City to reevaluate the amount of the rebate.

According to the report, if council decides to amend the Municipal Land Transfer Tax rebate, or even signal its intent to make specific changes in the future, in-year real estate market reaction (e.g. real estate sales) and Municipal Land Transfer Tax revenue changes could result. As such, the report says changes to the MLTT rebate structure should be considered as part of the City's annual budget process.

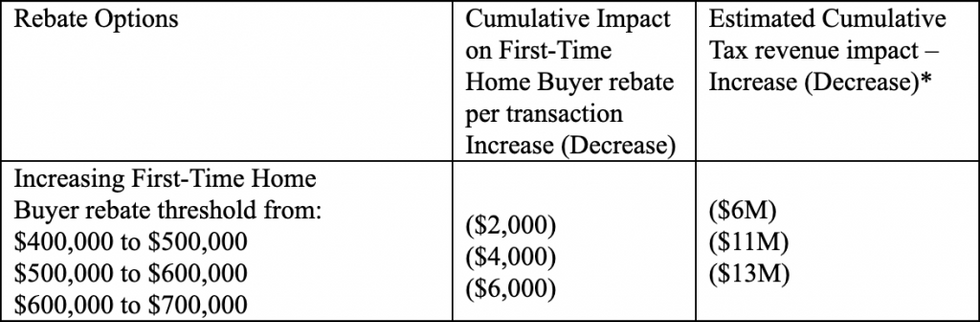

In the report, staff put together a few rebate option scenarios, which you can see in the table below. Based on the 2019 net Municipal Land Transfer Tax revenue of $791.2 million, potential amendments to the maximum price eligibility threshold would result in revenue reduction ranging from $6 million to $13 million.

The report also looked at applying a cap to the Value of Consideration, which would achieve annual savings ranging from $7 million to $35 million.

And while the report doesn't actually make any recommendations, as Matt Elliott pointed out, the report does provide councillors with some information that could potentially lead to a new policy.

The report is slated to be presented to Mayor John Tory's Executive Committee next Monday, June 22.