At last week’s Toronto City Council session, members voted 18 to 2 in favour of freezing development charges at their current rates, effective May 1. This came a week before DCs were set to rise by 4%, and offers some semblance of reprieve for new housing development in the city, which has been trampled by the excessive cost of doing business.

As outlined in a motion that went to Council on April 23 and 24, the City’s Chief Financial Officer is authorized, as of Thursday, to use Section 27 agreements on all new housing developments to suspend DC increases until a “comprehensive review” has been completed and a new bylaw adopted. However, the freeze is only in the event that the Province fails to respond to Toronto’s ongoing pleas to waive the requirement to index its DCs every year.

DCs in Toronto have skyrocketed over the past 15 years, and last year, Toronto saw not one but two sets of increases — one on May 1, 2024, and then a second on June 6, 2024 as a result of Bill 185.

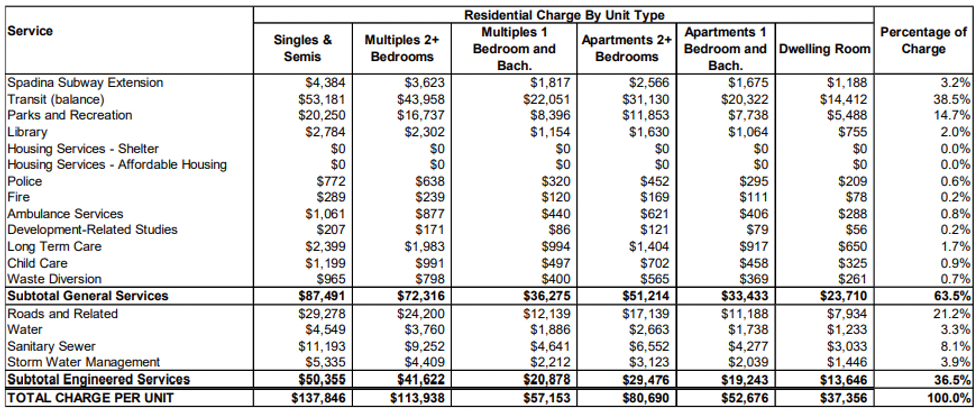

As of June 6, 2024, DCs for a non-rental one-bedroom apartment or condo have increased to $52,676. For a unit with two or more bedrooms, they’re up to $80,690. Those same figures back in May 2009 were $4,985 and $8,021, respectively. But even if you didn’t want to go as far back as that, DCs were $37,081 for a one-bedroom unit and $56,804 for unit with two or more bedrooms as of August 2023, marking year-over-year rises of around 42% for both between 2023 and 2024.

“Freezing development charges is better than increasing them, but let’s not confuse the issue: development charges are already far too high,” says President and CEO of Republic Developments Matthew Young. “They are a direct contributor to the housing affordability crisis in Toronto. Nobody deserves a pat on the back for simply not making a bad situation even worse.”

“I think raising development charges in this environment would have been extremely tone deaf and would warrant great criticism. Halting increases was politically necessary,” Young adds. “If [the City was] listening, they would have made motions to reduce or remove development charges, or worked more proactively with other levels of government to find ways to offset those costs in a more sustainable way that doesn’t burden homebuyers who are already stretched to their limits.”

Young is also Chair of the Coalition Against New-Home Taxes (CANT), and getting government to reduce taxes like DCs is what the initiative is all about. This latest move from the City falls short of spurring the “dollar for dollar” relief CANT would offer homeowners if the City lowered DCs in any way. As an example, when Conservative leader Pierre Poilievre announced at the end of March that his party would axe the goods and services tax on new homes sold under $1.3 million, Young told STOREYS that the 30 or so builders associated with CANT would revise the price of a $1.25 million home by $62,500 to $1,187,500.

“When the City of Toronto meets the moment and cuts development charges, we will be the first to applaud those efforts,” he says.

However, the City says it would need more funding for infrastructure from other levels of government to make that happen. According to last week’s motion, Toronto is facing “challenges” delivering infrastructure — something that DCs help to fund. The City’s $59 billion 10-Year Capital Plan includes $6.5 billion from DCs, with $1.2 billion allocated to water, wastewater, and sewer infrastructure, $950 million to road and intersection upgrades, $1 billion to parks and community centres, and $950 million to transit system capacity.

“Development charges will help build the infrastructure to serve tens of thousands of new homes in new communities at Quayside (4,700 homes), the Downsview airport lands (63,000 homes), Golden Mile (33,000 homes) and East Harbour (4,300 homes),” the motion says. “They will also fund Toronto’s one-third portion of the Eglinton East light-rail transit and Waterfront East light-rail transit, which are currently being designed.”

As for the development charge bylaw the City says it intends to update, Young has some notes. If the City can't remove or reduce DCs, he suggests deferring payments until new housing projects are complete. “That deferral will mean projects don’t need to finance those costs which improves the project economics meaningfully and will help projects moving forward again,” he says.

We’ve recently seen the City defer development charges on certain purpose-built rental and condo projects with at least 10% affordable housing — but of course, those incentives are being rolled out at a much smaller scale.

- "It Defies Logic”: Is Toronto's Approach To Development Charges Broken? ›

- STOREYS’ Policy Of The Year: Development Charges ›

- The City Of Toronto Could Soon Freeze Development Charges ›

- Op-Ed: York Region Must Cut Development Charges Now ›

- Toronto City Council Waives Development Charges On Sixplexes ›

- Hamilton Temporarily Lowers Development Charges By 20% ›