After hitting a nearly 25-year high in May, active listings in the Greater Toronto Area (GTA) only grew over the course of June, according to the Toronto Regional Real Estate Board's (TRREB), as tariff-related economic uncertainty continued to win out over improved affordability.

With many still wary about jumping off the sidelines, the region posted a mere 6,243 sales last month, essentially unchanged from May and 2.4% below June 2024's sales, according to TRREB's June Market Watch report. On a seasonally-adjusted basis, however, sales did edge up month over month, following two months of consecutive increases in April and May.

Recent data points towards signs of life in a market that has been effectively paralyzed by economic uncertainty since February — a condition TRREB Chief Information Officer Jason Mercer hopes to see remedied by things like a US-Canada trade agreement and improved borrowing costs.

“A firm trade deal with the United States accompanied by an end to cross-border sabre rattling would go a long way to alleviating a weakened economy and improving consumer confidence," he said. "On top of this, two additional interest rate cuts would make monthly mortgage payments more comfortable for average GTA households. This could strengthen the momentum experienced over the last few months and provide some support for selling prices."

While sales stalled in June, active listings had hit 31,603 by the end of the month, up from 30,964 in May. This represents a 30.8% year-over-year increase from the 24,169 listings recorded in June 2024 and puts active listings at the highest the metric has been since at least August 2002, which is when TRREB changed its reports to reflect new and active listing counts as of the end of each month.

After steadily rising from 12,066 in February to 21,819 in May, new listings added in June ticked back down to 19,839, which, coupled with an increase in seasonally-adjusted sales, reflects the "tightening trend experienced during the spring," reads the report.

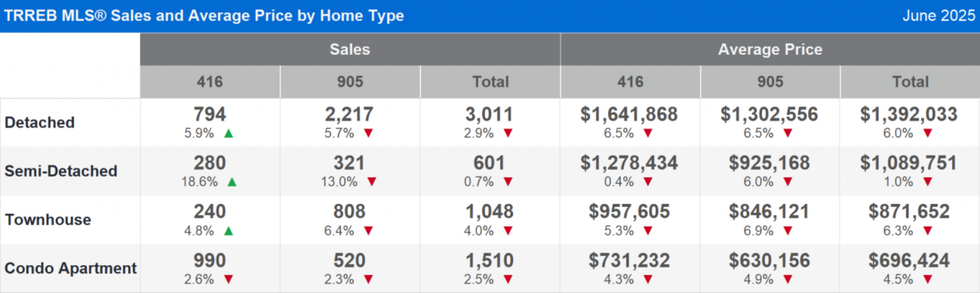

Despite the slight uptick in sales, GTA home prices continued to slide in June as buyers enjoyed increased leverage due to high inventory. Compared to last year, the MLS Home Price Index Composite benchmark was down by 5.5% and the average selling price was down 5.4% at $1,101,691. The latter metric also fell month over month from $1,120,879 in May — by close to $20,000.

“The GTA housing market continued to show signs of recovery in June. With more listings available, buyers are taking advantage of increased choice and negotiating discounts off asking prices," said TTREB President Elechia Barry-Sproule. "Combined with lower borrowing costs compared to a year ago, homeownership is becoming a more attainable goal for many households in 2025."

A recent report from RBC found that owning a home in Canada is the most affordable it's been in three years, with some of the largest price decreases seen in Toronto over Q1-2025. Still, homes in the city and in other uber-expensive cities like Vancouver remain well out of reach for many buyers.

"Pressure is coming off ownership costs, but progress — while material — has been insufficient to make a real difference," says the report.

- Cause For Concern: Toronto Condo Units Already Represent 60% Of Total Inventory ›

- GTA Active Listings Hit 31K In May – Highest In Nearly 25 Years ›

- Toronto Realtors Report Most July Home Sales Since 2021 ›

- Canadian Home Sales Mark 4th Consecutive Monthly Increase ›

- TRREB Calls For More Rate Cuts As GTA Housing Market Shows Fragile Recovery ›