After years of unpredictability, the Canadian housing market may find some sense of normalcy in 2024. And with it, higher prices.

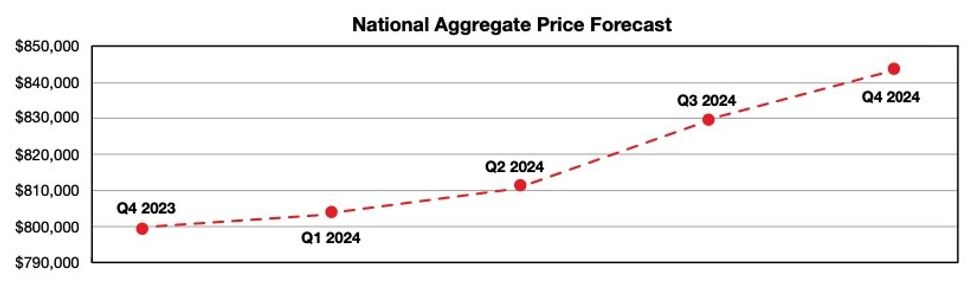

According to Royal LePage’s Market Survey Forecast, the aggregate price of a home in Canada will reach $843,684 in Q4 2024, a 5.5% annual increase. At the same time, the median price of a single-family home will rise 6% year over year to $879,164, while the median price of a condo will jump 5% to $616,140.

The forecast brings home prices back in line with the pandemic peak seen in Q1 2022. However, as the increase will have taken place gradually over nearly three years, it won’t deliver the same affordability shock as 2021’s price run up did.

The majority of the price appreciation will be seen in the second half of 2024 — modest quarterly increases of less than 1% are expected in Q1 and Q2. Meanwhile, quarterly increases of 2.3% and 1.7% are forecast for Q3 and Q4, respectively.

The prediction is based on the assumption that the Bank of Canada has finished raising interest rates, and will hold the key lending rate at its current 5% through the first half of next year. Royal Lepage expects “modest cuts” will begin in the late summer or fall, pushing home prices up.

While part of the market that will materialize in 2024 can be chalked up the the resumption of seasonal ebbs and flows — a winter hibernation, a springtime rush — there will also be what Phil Soper, the President and CEO of Royal LePage, calls the "great adjustment."

"In 2024, Canadians will adjust to the fact that we’re not going to see really low interest rates again anytime soon. Those 2% five-year mortgages [won’t return] maybe in most current people’s home buying lifetime,” Soper told STOREYS. “We don't believe that a large cut to interest rates is necessary to get the market going again, because we believe that the biggest impediment to sales transactions right now is psychological, not structural. It's not that people can't transact, it's that they believe that the home they're buying will be cheaper tomorrow."

"But we believe that once there is even a small, call it a 25-basis-point reduction, in interest rates, that even the most conservative of buyers will realize that the rising rate environment is truly over, that it won't sneak up on them again and depress home prices, and that home prices are likely to rise again."

With that acceptance, buyer’s pent-up demand will be unleashed. Amidst Canada’s worsening housing crisis, that demand will outweigh supply, putting upward pressure on prices.

On a local level, Calgary is expected to see the greatest price appreciation of any major Canadian market for the second year running. The aggregate price of a home will increase 8% annually in Q4, to $711,612.

The Greater Toronto Area is forecast to follow with a 6% annual increase, bringing the aggregate home price to $1,198,012 in Q4.

Although Greater Vancouver will only see a 3% annual increase, the city’s aggregate home price of $1,281,732 will help it maintain its position as Canada’s most expensive market.

Halifax, Regina, and Winnipeg are also expected to see prices rise 3% year over year in Q4, while Edmonton, Ottawa, and the Greater Montreal Area will experience annual price jumps of 4% to 5%.

“It’s definitely a risk that a cut to interest rates will unleash an uncomfortably large amount of pent up demand,” Soper said. “But that’s why I believe the bank will be very modest and methodical in its cuts.

“That should hopefully allow for a more gradual increase to normal transaction levels, and a return to mid-single-digit home price appreciation, which is a healthy long-term affordability level."