Despite speculation that yesterday’s interest rate hike would be the last in the rate cycle, a new report from TD Economics predicts that we could see another hike by year-end.

As it is, a series of supersized rate hikes this summer have brought the Bank of Canada's Overnight Lending Rate to 3.25%. Economists are calling this “economically restrictive territory,” and are forecasting a long road ahead, without much relief from inflation any time soon.

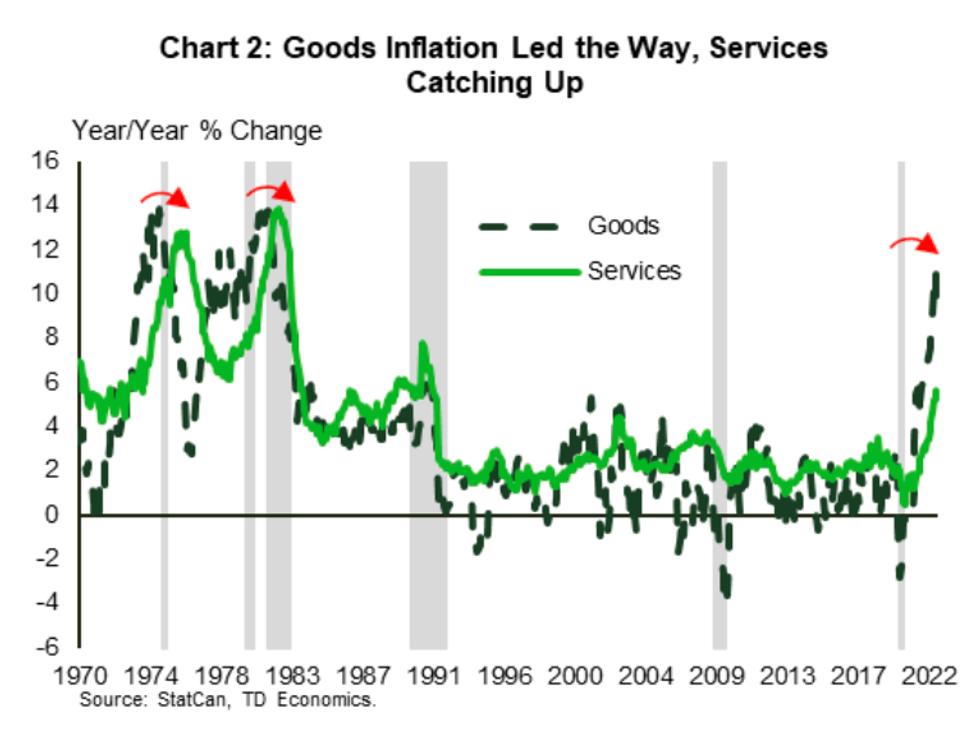

“There is little question that the economy will reflect the weight of one of the fastest rate hike cycles in history. However, bringing price pressures back to the 2% target will be no easy task,” the report reads. “There are signs that a peak in headline inflation has already arrived. That’s modest good news. The bad news is that the past surge in goods prices has bled into the service side of the economy, which is captured within core inflation metrics. Prices for services tend to be more sticky, raising the risk of an elongated period of high inflation. For the Bank of Canada, this complicates an eventual needed pivot in rhetoric away from the here-and-now data to the most likely trajectory, given the known lags in the transmission of interest rates onto the real economy.”

The report goes on to say that it’s not out of the question that the BoC will drop the rate deeper into restrictive territory.

"An overnight rate of 4.0% (or higher) cannot be ruled out. Once the policy rate peaks, we caution against expecting the BoC to be quick-fingered in lowering rates on any signs of a weak economy in 2023. Its priority will be to ensure that expectations remain anchored and that core inflation is on a clear path back to the target window.”

In July, Statistics Canada reported that the Consumer Price Index (CPI) was 7.6%, dropping from 8.1% in June. This decrease in headline inflation was thanks to slower year-over-year growth in gasoline prices and a positive indicator that inflation is indeed being curved.

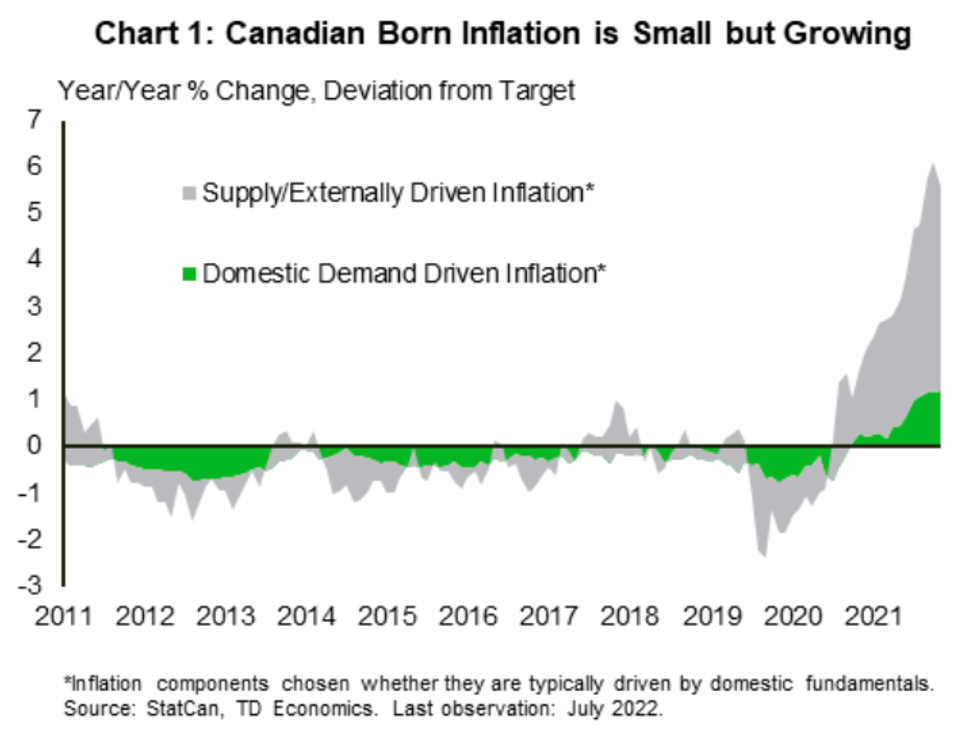

In the past months, external factors, including pressures to supply chains and commodity prices, have served to drive inflation up. But we are now seeing some of those pressures reversing. In the months to come, a slowdown in global demand will ease some of those external pressures and pull inflation down.

On the other hand, domestic-driven inflation is expected to hold firm due to higher costs for mortgage rates, rents, restaurant services, entertainment, and personal care in Canada. It is expected that all of the BoC’s core inflation metrics will grow by at least 5% year over year.

TD’s report notes that in the 1970s and early 1980s, domestically driven inflation had taken hold in a similar manner. Food and fuel prices increased, driving overall goods inflation into double digits. As a result, Canada faced three separate recessions from 1975 to 1982, coinciding with a pull-back in commodity prices and a peak in goods inflation. During that time, services inflation increased significantly, lingering even as the economy experienced downturn.

While there is always the risk that history may repeat itself, the report notes that the BoC’s attitude has shifted.

“The central bank is acting more preemptively this time around, it has evolved its monetary policy approach over decades and is committed to a stated and transparent inflation target. At the same time, the structure of the economy has evolved in those 40 years,” the report explains. “However, some things don’t change with time. High inflation has raised the cost of living and wages are responding. Since wages comprise a large component of service costs, it will take time for service inflation to cool. This tailwind is why we recently upgraded our inflation forecast over the remainder of 2022 and into early 2023.”

In order to maintain the public’s tolerance and allow the real economy to catch up with interest rates, economists suggest capping the policy rate at around 3.5%. But it’s likely that the BoC will take a “here-and-now” approach, as they have historically.

“The stopping point on the policy rate will come down to a communication exercise,” the report goes on to say. “The BoC has trained markets to prioritize data that is either lagged or represents the here-and-now, relative to the expected trajectory. Continuing to do so could lead to a higher end-point on the policy rate and a bigger hit to economic growth. A shift to guidance on “what to look for” within key metrics could help anchor inflation expectations and allow an earlier stopping point. Tackling inflation appears straightforward in theory, but not in execution. So buckle up, there’s a lot of ambiguity littering the road ahead.”