Between the pandemic, an uncertain economy, and rising interest rates, Ontario homebuyers and owners have spent the last two and a half years on a rollercoaster.

As a sense of normalcy returns and we slowly emerge from the pandemic, a new report from Teranet lends new insight into the trends and behaviours seen in Ontario's real estate market pre-(before March 2020), during, and post-(April to December 2022) COVID-19.

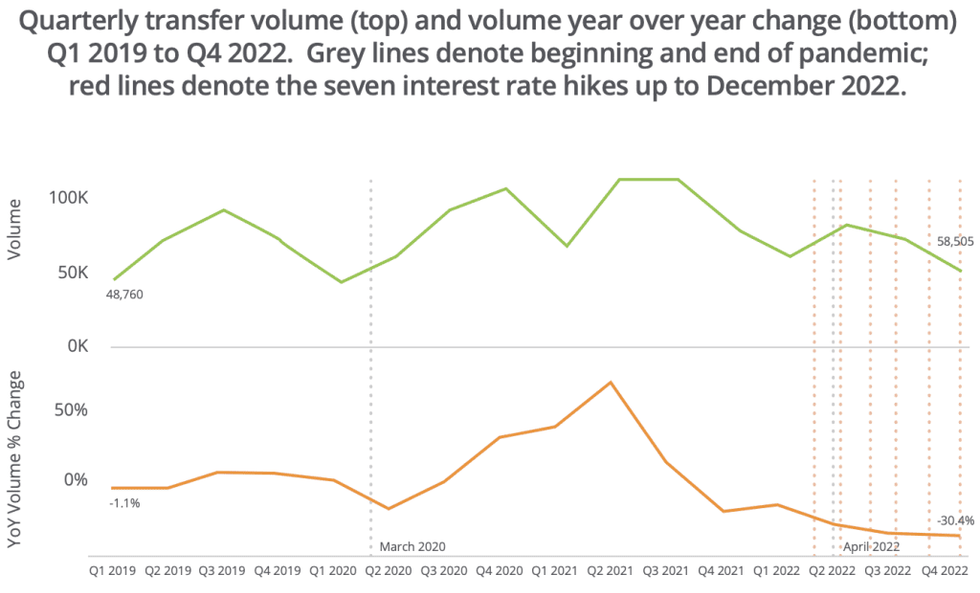

According to the data, transfer volumes reached "unprecedented heights" during the pandemic, peaking in late 2020 and again in the summer of 2021 as the initial market shock subsided. A third, albeit smaller, peak was seen in early 2022, but a decline began in Q3, likely due to the effects of the Bank of Canada's interest rate hikes. As of December 2022, the year-over-year declining trend appears to have plateaued.

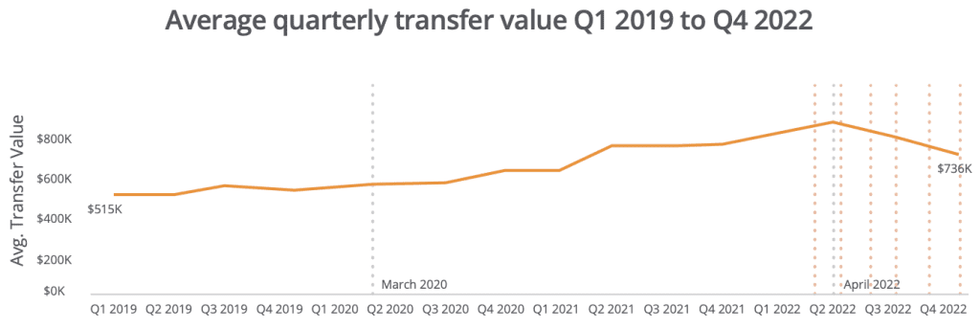

Average transfer values started to steadily rise in Q1 2021, but began to decline in July 2022 -- a descent that continued throughout the remainder of the year. After peaking at $900K in June 2022, the average land transfer value fell 23% to $736K in December.

"These indicators all confirm that the slowdown in the housing market has commenced as widely cited and will likely continue into the new year," the report noted.

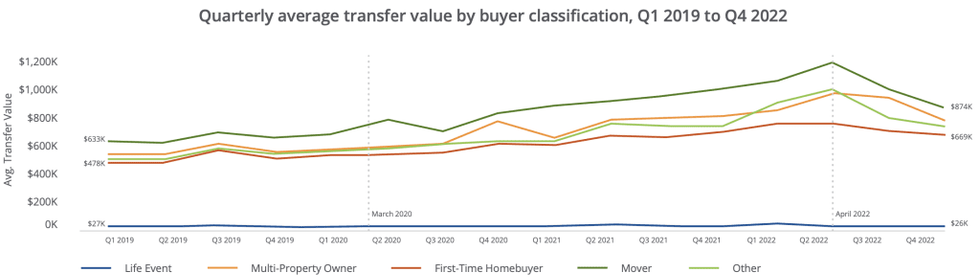

When looking at home purchase volumes by buyer segment, the data shows a fairly even allocation across first-time buyers, multi-property owners, and other buyers, such as those moving to Ontario from abroad. Activity across all buyer segments began to rise as the pandemic hit, peaking in Q4 2020 and once again in Q2 2021, as Ontarians adjusted their living arrangements.

During the latter peak, multi-property owners began to "pull ahead" of other buyer groups in terms of purchase volumes, Teranet says, a trend that continued into Q4 2022. That group is now the dominant purchasing group in the province in both condo and non-condo properties. In contrast, purchases by first-time homebuyers and movers have steadily declined since Q2 2022 as rising home prices and interest rates pushed them to the sidelines.

The report found that the mover segment of buyers -- those moving from one sole property in Ontario to another -- consistently paid the most for their home purchases. The gap in average transfer value between movers and first-time homebuyers sat at roughly $140K in 2019; it peaked at $430K in Q2 2022, but has since fallen to $205K as of Q4 2022.

While a mass exodus from urban areas to suburbia was widely reported during the pandemic, such a phenomenon only occurred in a significant sense amongst the moving-homes segment. A 135% annual increase in movers leaving the GTA was reported in Q2 2021.

There was also a marked increase in those choosing to leave the City of Toronto during the pandemic. Movers leaving Toronto for areas outside the GTA increased by nearly 200% year over year in Q2 2021.

However, the faction of Ontarians leaving urban areas remains a "small segment of the overall market," the report noted, adding that despite pandemic restrictions lifting and people returning to the office, there has not been an uptick in people returning to cities.

The final drop on Ontario's rollercoaster of a real estate market relates to refinancing. Activity dipped after the initial onset of the pandemic, but began to rise at the end of 2020 as home values jumped and interest rates remained low. However, once rate hikes began in March 2022, volumes dropped drastically, with Q4 2022 posting the lowest quarterly refinance volume in the past ten years.

Teranet noted that it will continue to monitor the trend, and anticipates "some increase in activity due to trigger rates coming into effect."