The coveted real estate market in Ontario’s cottage country is experiencing record lows of supply and soaring prices.

While we’ve seen the market slow its sizzle from the red-hot frenzy levels seen last year (well, since the onset of the pandemic, actually), sales in the Lakelands region continued to be strong, according to the Lakeland Association of Realtors.

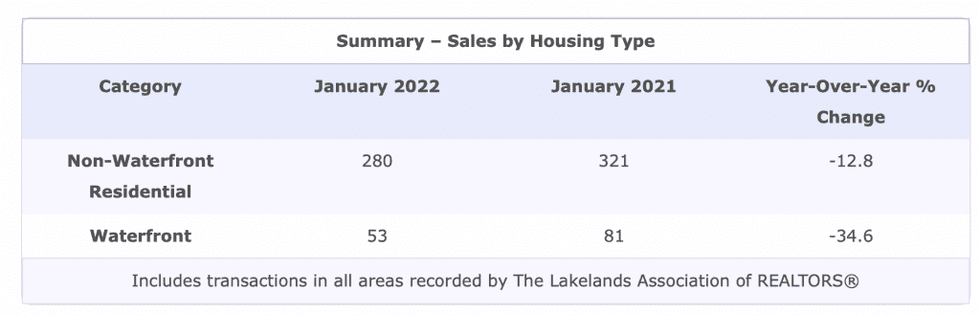

Residential non-waterfront sales activity recorded through the MLS® System for the Lakelands region totaled 280 units in January 2022. This marks a substantial decline of 12.8% from the same period in 2021. However, residential non-waterfront sales were still 1.3% above the five-year average and 8.4% above the 10-year average for the month of January.

When it comes to waterfront properties -- those more typically associated with vacation homes in cottage country -- it’s a similar story. Sales of waterfront properties numbered 53 units in January 2022. This marks a dramatic decline of 34.6% from the same period in 2021. With that said, waterfront sales were 16.2% above the five-year average and 20.7% above the 10-year average for the month of January.

For those in the market for a waterfront cottage in the Lakelands region, the reality is that the pickings are incredibly slim. Adding insult to injury, this naturally means that a piece of Ontario's pristine cottage country is pricier than ever.

"Despite an ever-intensifying supply shortage, sales of waterfront and non-waterfront homes still managed to come in above typical levels in January," said Chuck Murney, President of the Lakelands Association of Realtors. "New supply coming onto the market just isn’t enough to keep up with current levels of demand, which has drawn overall inventories down to their lowest levels on record."

According to the MLS® Home Price Index (HPI), the overall composite benchmark price was $675,700 in January 2022 in the Lakelands region, up sharply by 32% compared to January 2021.

“The waterfront cottage market continues to be in strong seller territory with even less inventory than usual this January and very strong buyer demand,” says Maryrose Coleman of Halloran & Associates and Muskoka District Rentals.

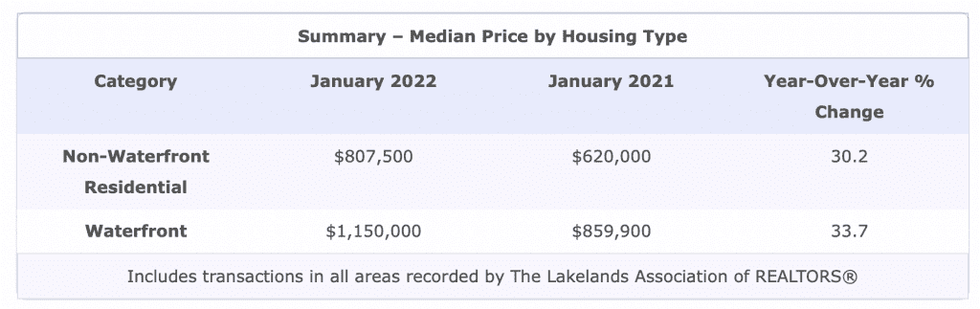

The median price for Lakeland region waterfront property sales in January 2022 was a record-breaking $1,150,000, up sharply by 33.7% from January 2021. The total dollar value of all waterfront sales in January 2022 was $82.1 million, falling by 3.3% from the same month in 2021.

It’s not just waterfront properties that are climbing in price.

“Non waterfront demand has also continued to be very strong with properties selling in multiple offers and well above list,” says Coleman. “A residential home in Bracebridge sold last week for $70k above a similar house a few doors down that sold late November.”

The median price for residential non-waterfront property sales in January 2022 was a record $807,500, up sharply by 30.2% from January 2021. The benchmark price for single-family homes was $692,500, a substantial increase of 32.4% on a year-over-year basis in January. By comparison, the benchmark price for townhouse/row units was $589,500, a jump of 35.2% compared to a year earlier, while the benchmark apartment price was $512,400, a substantial gain of 31.5% from year-ago levels. The total dollar value of all residential non-waterfront sales in January 2022 was $262 million, a sizable gain of 13.3% from the same month in 2021. This was also a new record for the month of January.

“Overall, inventories are at their lowest levels since our real estate board started keeping records with prices increasing by 30% year-over-year and new records being set daily,” says Coleman.

“While it’s early to predict, there are some signs of a similar frenzied market to what we saw in 2017, which was followed by a drop in both prices and sales activity later in the year. At this point I am confident this will not be repeated unless there is a major economic correction, or government intervention, as there is simply not enough inventory to support the demand in the market. As a wise sage once said, they aren’t making more waterfront property.....”