As we tread through the first month of 2025, economists are busy forecasting the trends set to characterize the new year. Top of mind is the housing market, and more granularly, the mortgage realities that will drive it.

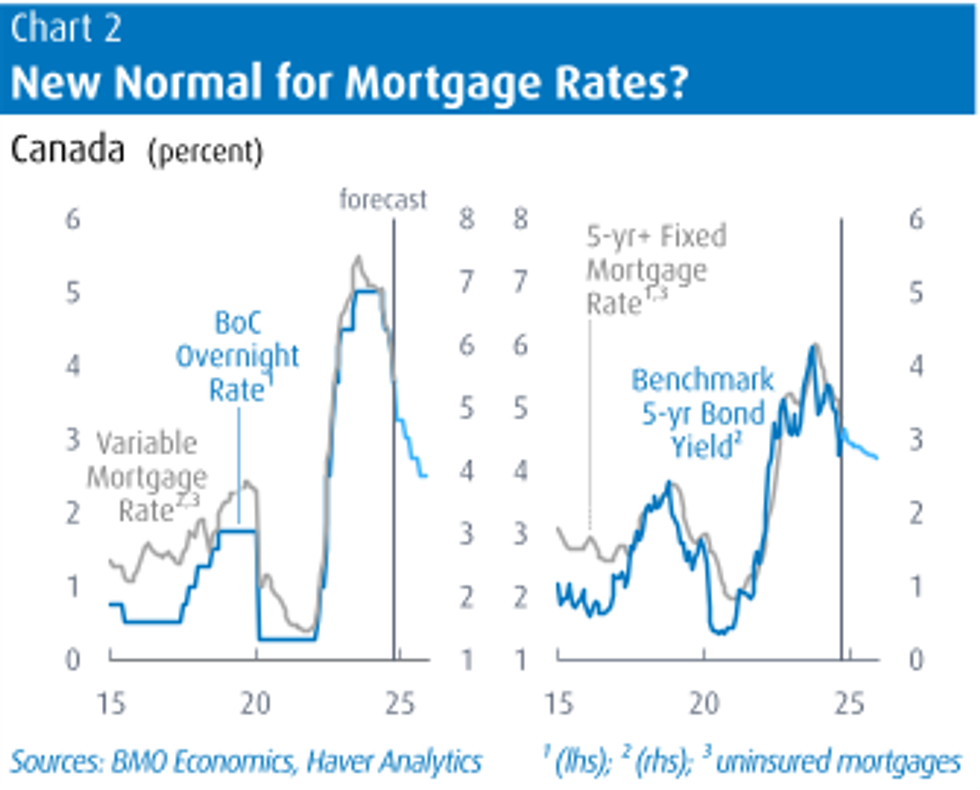

In particular, Director and Senior Economist for BMO Capital Markets Robert Kavcic is predicting that mortgage rates will hover at — or even dip below — 4% as the year unfurls, which would be a testament to the Bank of Canada’s continued easing of its monetary policy. We're ringing in 2025 with a policy rate of 3.25%, which is the lowest it’s been in over two years, and economists across the board are forecasting further easing in 2025.

READ: What’s In Store For Interest Rates In 2025, According To Every Big Bank

“There is scope for some further Bank of Canada easing in 2025, but most of the rate-cut cycle is complete. We officially see 75 bps of rate cuts this year spread out through September,” Kavcic writes in an outlook shared on Friday. “Importantly, the market has long priced this easing cycle into 3- and 5-year fixed mortgage rates, which have been sitting in the low-to-mid-4% range.”

“The market is currently pricing in roughly 50 bps of Bank of Canada easing in 2025, which suggests that these fixed rates could be bottoming out,” Kavcic adds. “There is room for variable rates — currently around 4.7% — to test the 4% level, which would be an important psychological and valuation barrier, but the Bank will have to continue easing.”

All said and done, BMO’s assumption is that, “mortgage rates of around 4% should be the norm for some time” — however, that’s “barring a major disruption on the macroeconomic front,” such as risks posed by tariffs imposed by the US government.

Alongside more palatable mortgage rates, the Feds’ new mortgage rules will have a part to play in putting the market into a higher gear, Kavcic says.

“Most notable are an increase in the price cap for insured mortgages, from $1 million to $1.5 million, which effectively reduces downpayment requirements in that price range; and an extension of 30-year amortizations to all first-time buyers (as well as buyers of new homes),” he adds. “Given that most low-end single-family homes and larger (e.g., 2+ bedroom) condos in the bigger cities have pushed into this price range, we should see some impact.”

Will 2025 Be Investor Friendly? There’s Doubt

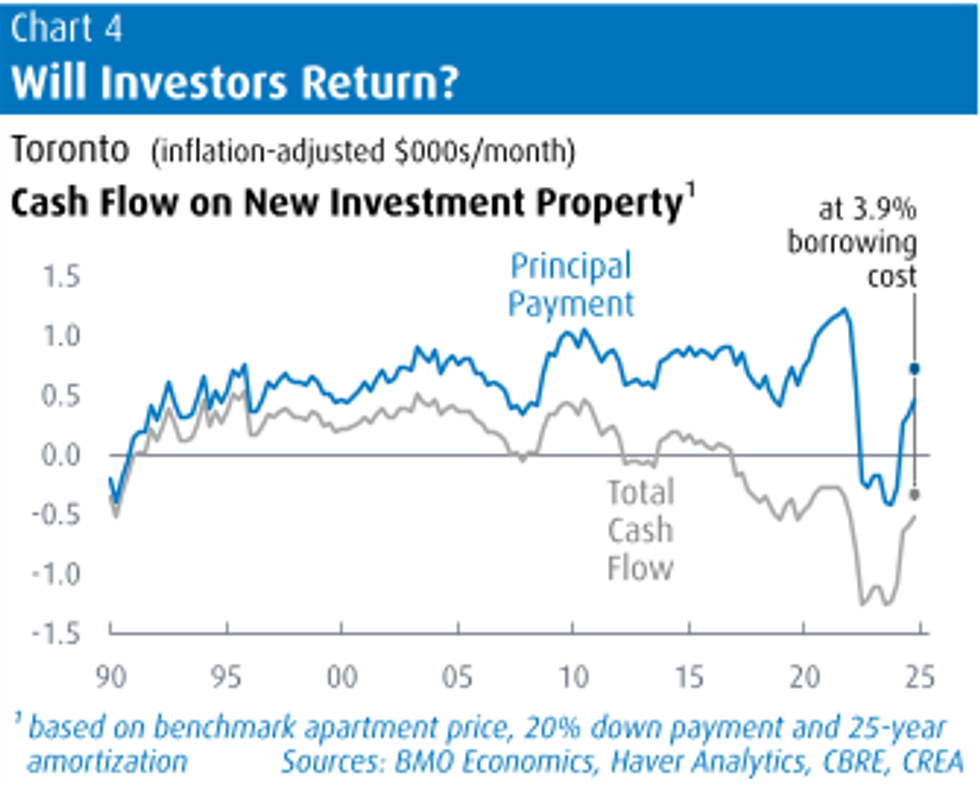

While the federal mortgage reforms will allow more homebuyers to etch their place in the market, for investors, the math still may not jive “[...] the arithmetic surrounding cap rates, borrowing costs and risk-free returns is still not compelling, although not the complete turnoff it has been over the past year,” says Kavic. “Expectations of outsized price growth have also vanished.”

Using Toronto’s market as an example, Kavcic also points out that “new investors would have been deeply cash flow negative through late-2022 and 2023, even failing to pay down any principal for a short period.”

Though lower mortgage rates and softer home prices "have set conditions back into the realm of what used to be reasonable," BMO's assumption is that “investors will remain shy given limited near-term capital gains potential, lack of liquidity, economic uncertainty, tougher tax treatment (versus dividends), difficult landlord-tenant conditions and a much weaker rent backdrop,” says Kavic.

“Valuations would need to push to the attractive side of the spectrum to account for these factors and bring investors back into the market more significantly.”

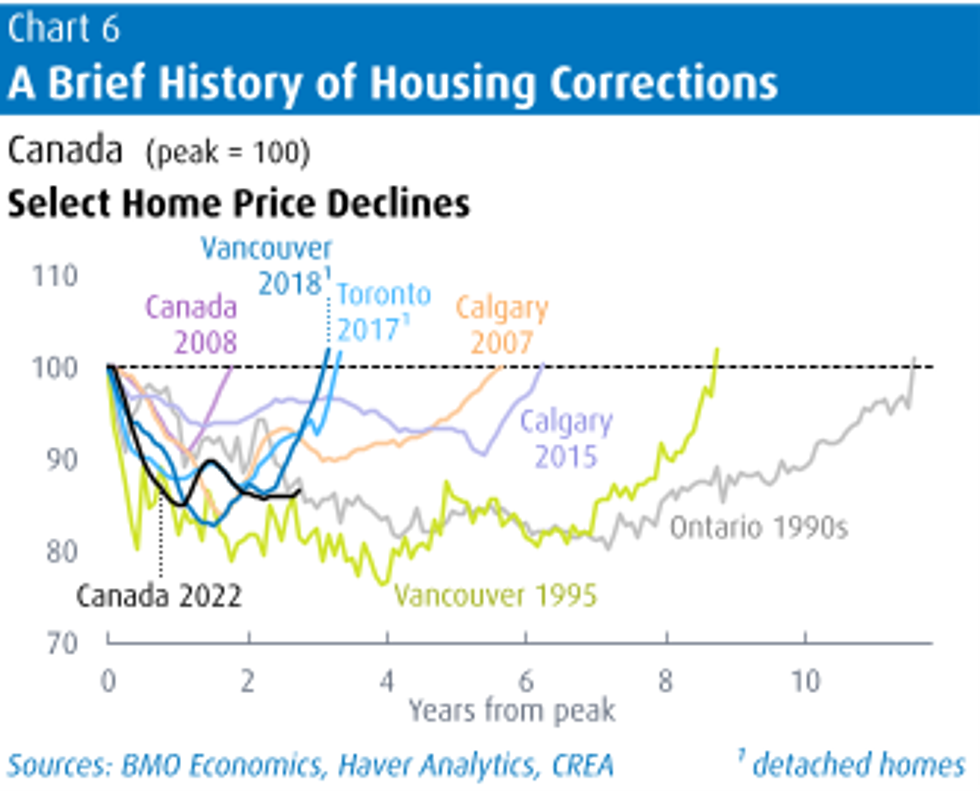

Meanwhile, valuations aren't anticipated to be attractive for some time — “think years, not months,” Kavic cautions, citing BMO's base-case scenario, which has resale prices (on a national basis) bouncing back to the “2022 highs” around 2029. And that's hinging on a stable economy, steady wage growth, and neutral interest rates. (Regionally, performance is expected to vary.)

“Seven years from peak back to peak is not all that uncommon. Such a duration would be in -line with some of the more drawn out price corrections seen in the past, but not as long as the deep and prolonged 1990s bear market,” he adds.

“We don’t expect those conditions to fully repeat, which included a deep and prolonged recession, fiscal and currency crises, and a mid-decade spike in real interest rates. But, that piece of history certainly rhymes: Housing valuations entered the 1990s at similarly stretched valuations; investors and ‘lack of supply’ drove the narrative; the peak of the Baby Boom turned 34 years old in 1993, just like their kids today; and robust international immigration flows were cut in half from 1989 to the mid-1990s.”