A new study from the C.D. Howe Institute finds that the answer to achieving housing affordability is not to focus homebuilding only in our largest cities, but rather to build more big cities.

The idea is that increasing development in Canada’s “superstar” cities like Toronto and Vancouver alone will only incentivize the movement of more people from “secondary” or smaller cities into major metropolitan areas, keeping already unattainable prices the same, or even increasing them.

Loss of individuals to large cities, the paper argues, is the exact opposite result needed to bring already less populous cities to life, and by extension, create more affordable housing.

“What is essential for improving housing affordability in big cities is to make [...] “secondary” [...] cities more attractive, allowing them to take advantage of agglomeration effects – the advantages from industries and people locating in urban settings – and supply housing at lower cost,” explains the report.

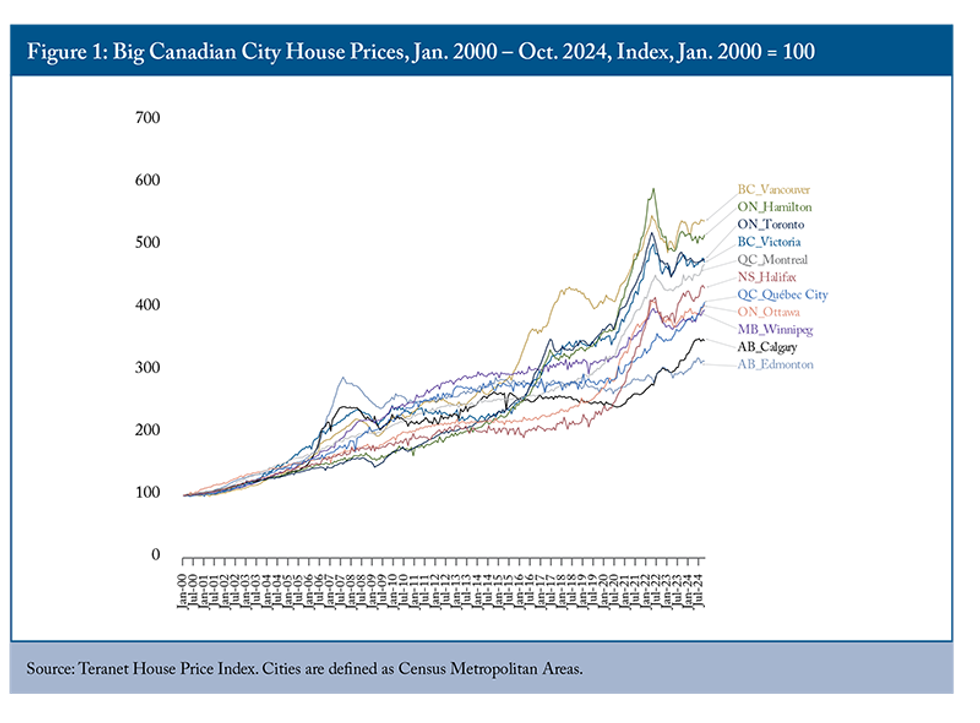

The study lays out the current situation: though they differ in severity depending on region, affordability issues are prevalent in major cities from coast to coast.

Across the board, home prices substantially increased during the period between the 08’, 09’ financial crisis and the earliest days of COVID-19. And in some of the country's largest cities, like Toronto, Vancouver, and Hamilton, amongst others, skyrocketing home prices were also accompanied by income growth that markedly failed to keep pace.

In Toronto, for example, the gap growth rate between home prices and GDP growth grew to 81.7% between 2009 and 2019. At the same time, Calgary saw the opposite effect, with GDP growth outpacing home prices, leaving them with a gap growth rate of -11.9% over the same period.

“Nevertheless, we are left with affordability issues in many Canadian cities,” says the report. “Felt most acutely in Toronto and Vancouver.”

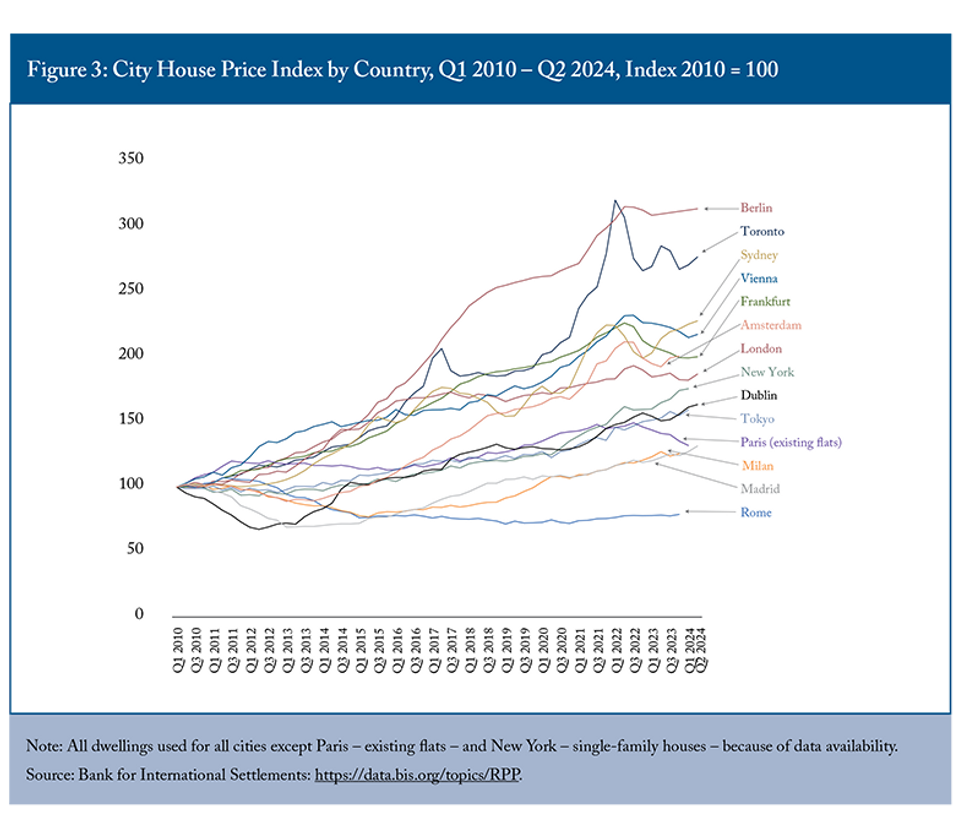

Compared to other developed countries' largest cities, Toronto is second only to Berlin in house price growth between 2010 and 2024, well ahead of cities like Sydney, London, and New York. But on the national scale, Canada leads the developed countries in terms of home price growth and the household debt-to-GDP growth ratio, while bringing up the rear when it comes to ratio of disposable income to home prices, finds the study.

To combat the resulting housing affordability crisis, the official approach has been to build more homes, particularly in our most populous cities – an approach the study criticizes.

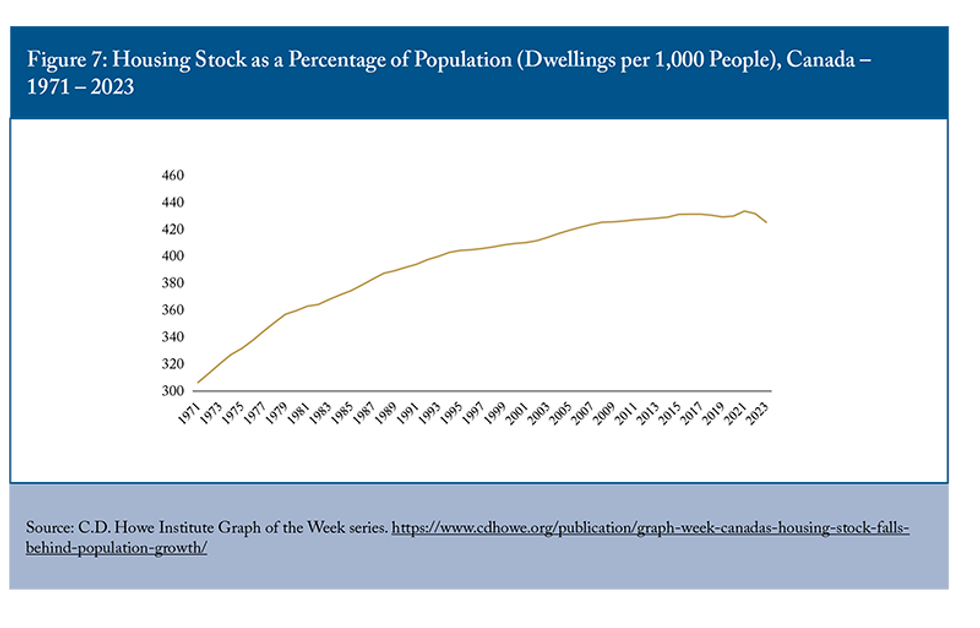

“Overall, we’ve been building more than is often recognized,” says the report. Save for the recent surge in immigration, Canada had a roughly 50-year record of matching population growth with housing, over which time we still saw substantial home price growth, specifically beginning in 2000. Even in 2024, the study finds, 17.5% of housing starts were in Toronto and 12.2% were in Vancouver – both exceeding their percentage of Canada’s population. But still no relief.

Instead, the study’s findings suggest the solution may lie in continuing to push for more housing supply everywhere, not just predominantly in our largest cities.

“We argue the way to decrease the relative cost of housing in our large cities, and increase housing affordability more generally across Canada, is to increase the attractiveness and growth potential of secondary cities,” posits the report.

So how would this work? Firstly, the report emphasizes the importance of all levels of government putting forth efforts to reduce regulations and building costs on the Big City side of things. The growing small cities approach only works if housing supply initiatives continue in places like Toronto and Vancouver.

But in terms of turning smaller cities like Kitchener/Waterloo and Kamloops into large cities that can attract their own growth, some policy changes include subsidizing infrastructure and funding world-class research at universities.

Post-secondary institutions are also “critical” for providing job training programs that generate labour ready to join the workforce, incentivizing businesses to move to these cities. The study makes an example of London, Ontario, home to Western University.

Additionally, the ability of a small city to attract business plays a key role in its expansion, making the provision of support for small and medium-sized businesses, which face higher financing costs, vital.