It was only a matter of time: after being placed under receivership last October, The One is now set to be put up for sale, according to court documents filed in the Ontario Superior Court of Justice.

"Now is the appropriate time to market the project to solicit any and all potential forms of value maximizing transactions or investments that may be available in the market," said Alvarez and Marsal, the court-appointed Receiver, in a report dated May 28.

The Receiver says it, its counsel, and its proposed broker have been working on designing a sales and investment solicitation process (SISP) to find "any and all potential forms of value-maximizing transactions or investments," whether it be selling the project, selling components of it, or finding an agreement for a developer to complete construction.

A minimum bid threshold of $1.2B is being proposed for a sales transaction, which the Receiver says is the benchmark that has been required by the project’s senior secured creditors, KEB Hana Bank. The benchmark can be reached through a single or multiple transactions.

After requesting proposals from commercial real estate brokerages, the Receiver has selected JLL to market and solicit offers for The One, who would receive a flat commission of $1.9M for any third party transaction and a flat fee of $550K plus an additional amount, depending on the type of transaction. The listing team consists of Matt Picken, Bryce Gibson, Vienna Loo, Jared Cowley, and Tyler Randa, and the term runs until November 30, according to the broker agreement.

Although a minimum bid threshold of $1.2B is being proposed, the SISP would commence without a stalking horse bid in place, which the Receiver says is because the senior lenders want to see the results of the SISP first.

The Receiver has filed its application to the court seeking approval of the SISP and the court is set to hear the application on Thursday, June 6. If the SISP is approved, the sales process would begin immediately with a formal marketing process and initial due diligence period. A bid deadline would be set for July 30 and qualified bidders would then have until September 24 to submit their finalized bids.

According to the Receiver, the hope is that a successful bid will be found and approved by October 14.

If no satisfactory bid is found and the SISP is terminated, the senior secured lenders say they may facilitate the continued construction of The One through a credit bid — when a secured creditor bids its secured debt against the purchase price in a sale to acquire the secured collateral — or other restructuring transaction.

The "Reconfiguration Plan" And Current Construction Status

According to the Receiver, now is the right time to commence the SISP because the project has reached a "ready state," which the Receiver says was accomplished through several actions.

The Receiver says it has confirmed arrangements with the project's construction manager, SKYGRiD, and "substantially progressed" the contract, "such that any potentially interested parties will be able to understand the precise terms of the main construction contract for the project." The Receiver says it and SKYGRiD have also "spent considerable time liaising with subcontractors and trade suppliers" towards finalizing subcontracts soon, and that it has also consulted with project consultants to complete a revised draft budget, schedule, and cost to complete assessments, all of which would be important due diligence items requested by interested parties during the SISP.

Most significantly, however, is a "reconfiguration plan" the Receiver and senior secured creditors have now finalized for the upper levels of The One, above Level 61, which have yet to be constructed.

As originally designed, the upper levels would house only two or four units per floor, for a total of 69 units with an average size of 2,600 sq. ft. The reconfiguration plan will see 88 units added to the upper levels of the project by reconfiguring Levels 62 and 76 from a four-unit level to a six-unit level, Levels 63 to 75 from four-unit levels to 10-unit levels, and Levels 79 to 81 from two-unit levels to four-unit levels. This would increase the total amount of units from 415 to 503.

The Receiver says that in order to simplify the process and avoid negatively impacting the construction process, the floor layouts will follow the existing designs for the lower floors, and the creation of 88 additional units is "anticipated to generate substantial additional net realizable value."

The Receiver and project components are currently in the process of revising design drawings to reflect the reconfiguration plan, ahead of a submission to the City of Toronto.

Originally planned to rise 85 storeys, The One received approval from the City in June 2023 to go to 91 storeys, but it's unclear whether The One will go to that height, as the project is referred to as being 85 storeys throughout numerous court documents.

Currently, concrete pouring for Level 58 is in the preparation phase. Concrete pouring for Level 62, the first level affected by the reconfiguration plan, is expected to occur at the end of June. The One is now expected to complete construction in the second half of 2027.

The One

Iranian-Canadian Sam Mizrahi embarked on his mission to build The One soon after founding Mizrahi Developments in 2012, acquiring the site in 2014 and infamously completing demolition over a single weekend in 2015 before the City could declare the site, then occupied by the 114-year-old Stollery's clothing store, a heritage property.

Named after its address of 1 Bloor Street West, The One is beneficially owned by Mizrahi Commercial (The One) LP in a 50/50 venture between Mizrahi (through Sam M. Inc.) and Jenny Coco (through 12823543 Canada Ltd.), of Coco Paving Inc.

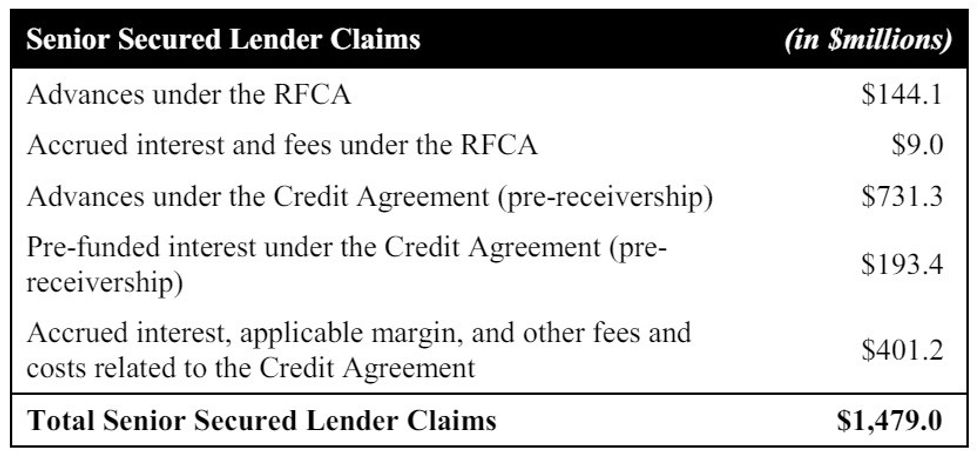

The One was placed under receivership on October 18, 2023 after Mizrahi defaulted on the loan agreement, with KEB Hana Bank claiming a total outstanding amount, from two separate credit facilities, of approximately $1.235B, plus interest. According to this week's report prepared by the Receiver, the outstanding amount had nearly hit $1.5B as of March 31.

Those totals do not include the amounts owed to other creditors on the project, such as Aviva Insurance, Coco International Inc., and China-East Resources Import & Export Co (CERIECO), which are collectively owed over $500M.

Over the years, The One has been at the centre of numerous lawsuits, including those initiated against Mizrahi by his former business partners and current business partner Jenny Coco. It has also been at the centre of a lawsuit between CERIECO and its law firm.

Outside of The One, Mizrahi is also currently engaged in a lawsuit he filed against Edward Rogers and his real estate fund, Constantine Enterprises Inc., pertaining to their luxury condo project at 128 Hazelton.

If you are a pre-sale purchaser on The One who would like to share your experience, you can reach me at: howard@storeys.com or HowardChai.24 on Signal.

- Colliers' Hart Buck & Jennifer Darling On The Uptick In Court-Ordered Sales ›

- Pace Developments Debt On Urban North Townhomes Exceeds $250M, Project To Be Sold ›

- Planned 55-Storey Tower In Vancouver West End Placed Under Receivership ›

- Senior Lender, Jenny Coco Trade Allegations Over Sales Process Of The One ›

- Mizrahi’s Yorkville Condo Project Hit With Receivership ›

- Receiver Petitions For Sales Of Mizrahi's Yorkville, Steeles Ave Projects ›