The housing crisis in Metro Vancouver (and Canada) can be summed up as a race between the pace of homebuilding and the pace of population growth. Right now, the latter is winning.

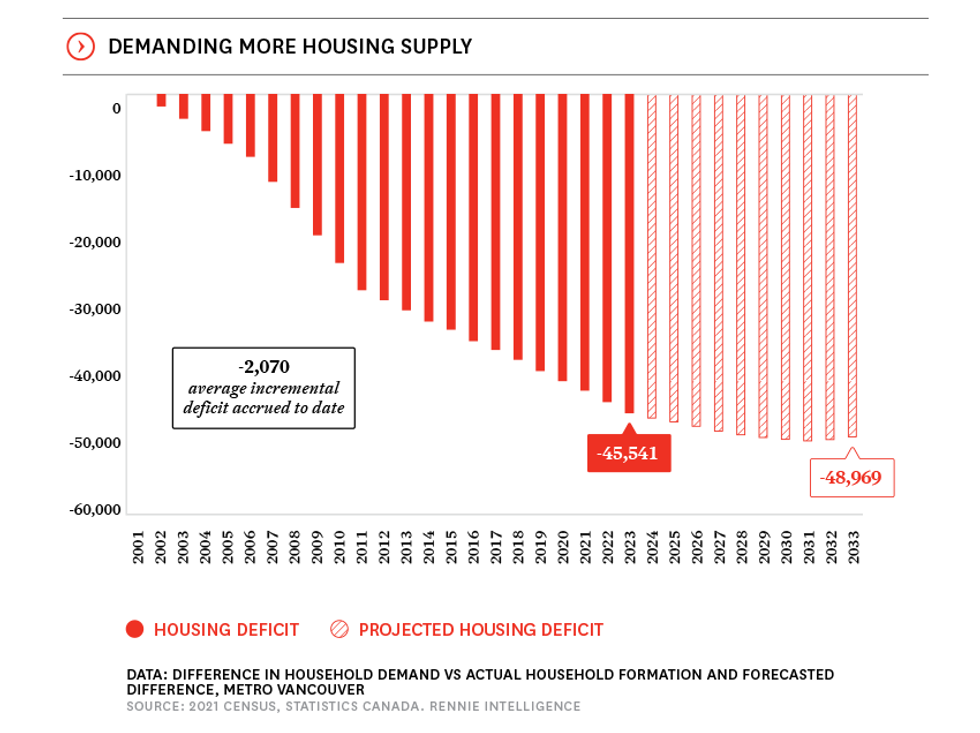

In a report published this week, real estate sales and services firm rennie found that the housing deficit in Metro Vancouver has now grown to 45,541 homes, bringing the deficit to over 45,000 for the first time, after surpassing 40,000 around 2020 and 30,000 in 2012.

Assuming an average of 2.4 people per home, the 45,541 homes represents enough housing for just under 110,000 people.

At this rate, rennie is projecting that the housing deficit will hit 50,000 by 2031, after which it is projecting a small decline.

"This millennium we've underbuilt by an annual average of just over 2,000 homes, on a net basis," said rennie in its report. "With demolitions in Metro Vancouver representing 16% of housing construction, this means we should have been building more than 2,400 additional homes each year."

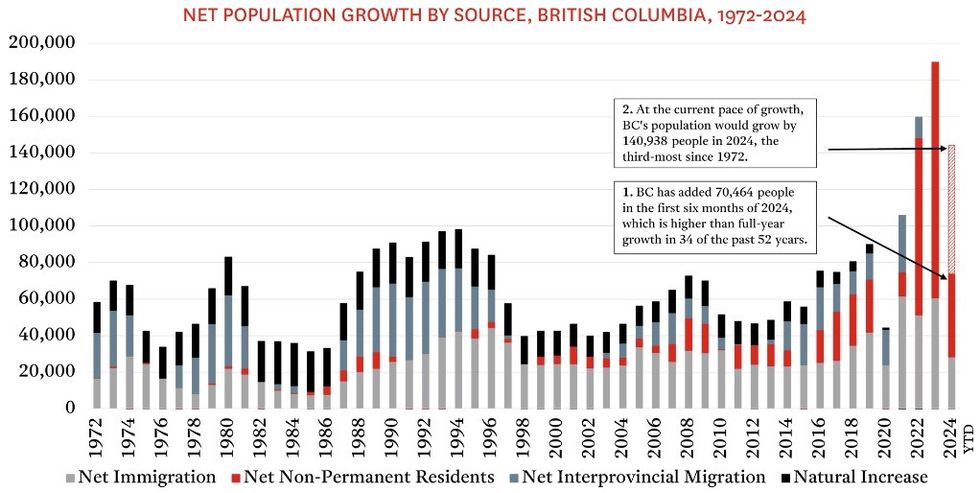

On the other side of the race is historic levels of population growth.

In just the first six months of 2024, British Columbia added 70,464 people, according to a rennie analysis also published this week, and that half-year total is greater than the full-year totals in 34 of the past 52 years.

At this rate of growth, British Columbia will likely end the year having added 140,938 people in 2024, which would represent the third-highest total since 1972. (The two highest totals were 2022 and 2023.)

Going forward, the Metro Vancouver region alone is expected to see the population growth at a rate of about 20% over the next 10 years, which amounts to about 600,000 people. From municipality to municipality, Surrey is expected to see the biggest population boom, at around 188,795 from 2023 to 2033, followed by Vancouver's 78,149 and Burnaby's 63,872.

"Though the pace of construction has increased in recent years, it pales in comparison to the additional demand brought from a growing population," said rennie's Head Economist and VP of Intelligence Ryan Berlin in a press release on Thursday. "Even as population growth is expected to slow in the coming years, the household formation deficit is still forecasted to grow over the next decade, to nearly 49,000 homes — which is equal to the entire dwelling stock of the Township of Langley."

As it relates to homebuilding, the pace of construction has slowed down significantly, as a result of various economic factors such as weakened consumer buying power and high construction costs. Looming over it all has also been the high cost of borrowing, which CMHC's Deputy Chief Economist recently said likely resulted in 30,000 fewer housing starts in Canada last year.

Inflation in Canada has now dropped to 1.6%, well past the Bank of Canada's target of 2.0%, making a 0.50%-cut next week a high likelihood. The race continues.