After a pandemic-induced lumber shortage pushed the price of building a home even higher, builders and homebuyers will be pleased to know that prices are finally coming back down to earth.

When the pandemic hit, lumber mills were forced to close. Then, with a nation of people stuck at home, many residents started tackling renovation projects, like building decks and fences or accommodating their new work-from-home lifestyles.

Subsequently, this past spring, the cost of basic lumber skyrocketed to $1,670.50 per thousand board feet on a closing basis -- six times higher than the pandemic low in April 2020, according to a new report from RE/MAX. In retrospect, homebuilders typically purchase two-by-fours in bulk, so a thousand board feet cost around $550 before the coronavirus pandemic.

Additionally, RE/MAX says, "due to soaring simultaneous global demand, wildfires in Western Canada, and historically low supply, the short-run dynamics supported surging prices, leading businesses to pass the costs onto consumers."

READ: Homes Under Construction in Canada at an All-Time High

But, as pandemic restrictions began to ease, the economy reopened, and life started to return to normal, the trend of home renovation and building projects eased, bringing lumber prices downward. Now, the building commodity is down approximately one-quarter year-to-date.

Not only are lumber prices moderating, but market analysts think more weakness is on the horizon thanks to a few factors, says RE/MAX.

According to the real estate giant, China has begun to release its inventory into global markets, adding a much-needed supply boost. There is also a declining industrial output from many of the country's largest mills. Additionally, the housing industry has accumulated stockpiles due to the fiscal stimulus efforts of the US and Canadian governments.

So, what exactly does this mean for Canadian real estate?

For starters, at the height of the temporary lumber boom, RE/MAX says it was estimated that the average 2,500-sq.ft. home would face nearly $30,000 in additional costs for lumber. The red-hot housing market also saw a record shortage of existing homes available. As a result, this increased the cost of new-home construction and raised the price tag for these newly built residential properties.

The rise in lumber also forced cost-conscious homeowners to hold off on any professional or DIY renovation project because the materials were simply too expensive.

Thankfully as prices moderate, RE/MAX says homeowners and homebuyers could see some added savings. However, there is one downfall. Companies are now being forced to sell their overpriced lumber stock at a loss, prompting retailers to initiate blowout price sales to move their merchandise.

While lumber prices have dropped, it doesn't mean Canada's housing market will avoid excessive price inflation. RE/MAX noted that prices for most products have already risen due to supply chain problems and logistical challenges.

In a recent StatCan report, durable goods have been pointed to as a major contributing factor in the rise of inflation since the onset of the pandemic “Durable goods rose at a faster pace in August (+5.7%) compared with July (+5.0%), with passenger vehicles (+7.2%), furniture (+8.7%) and household appliances (+5.3%) contributing the most to the increase,” reads the report.

In light of all of this, some industry observers have recommended waiting to begin discretionary building projects until there is relief on the price front. Meanwhile, others are looking ahead to the fall and winter markets, with the impression that prices could inch higher again.

According to RE/MAX, RBC Dominion Securities has noted that home-centre traffic and retail demand are trending higher, suggesting that "the correction in lumber has hit bottom, and prices could be back on the rise, albeit at a slower pace compared to earlier this year."

While this is undoubtedly good news, RE/MAX did point out that we shouldn't expect housing to be cheaper because of the current lower lumber prices. To see any significant price moderation in the housing market, there simply needs to be more supply.

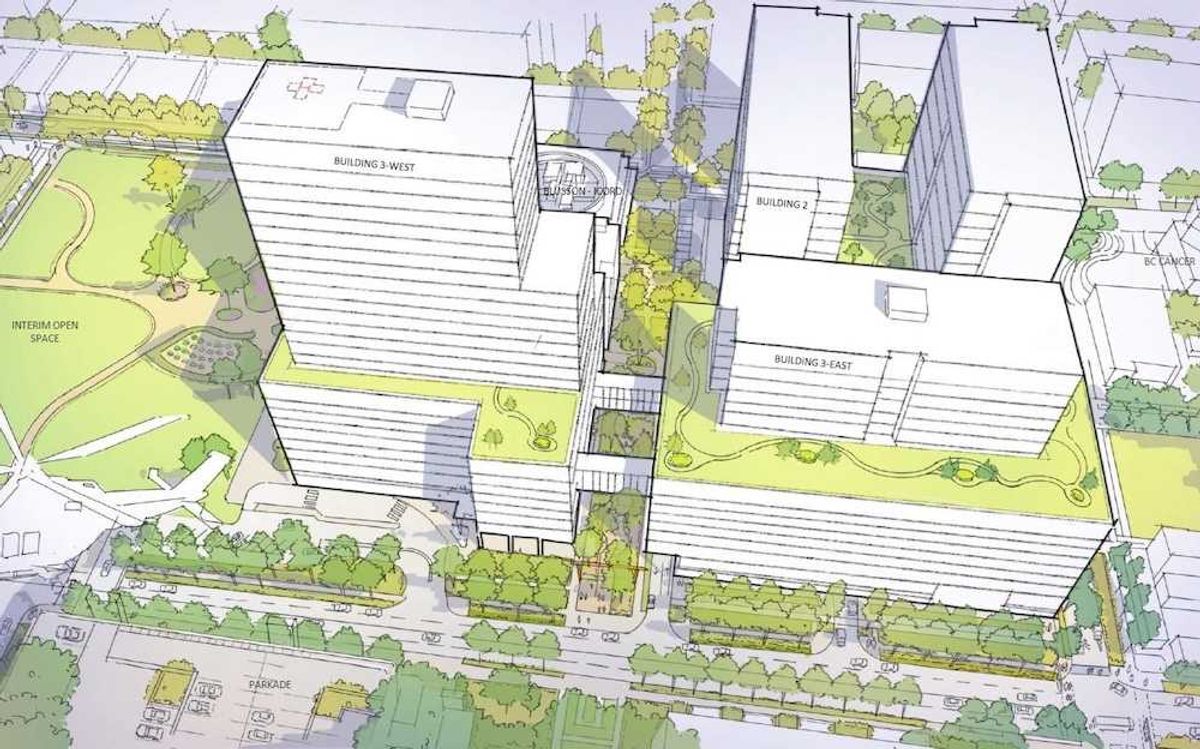

Not only can we anticipate an aggressive amount of new housing from the recently re-elected Liberals, but residential construction is currently at its most substantial level since the mid-1970s, with the number of new homes under construction at an all-time high.

In the past year, Canadian builders poured the foundations (defining a housing start) for the highest number of housing units (260,500) than at any time since 1977 -- representing a 26%, or a 53,600-unit increase, relative to the 2015-2019 average pace of 206,900 units. Currently, there are close to 320,000 housing units under construction nationwide.

During this same period, builders have completed 215,000 new units, with more housing completions (as many as 240,000) expected to be completed by 2022.