Inflation remains the overarching concern as the global economy recovers from the COVID-19 pandemic, according to a report from RBC Economics.

The report points to lingering policy support and low interest rates that continue acting as a balm to consumer and business confidence, and highlights the shadow of uncertainly associated with the new Omicron variant.

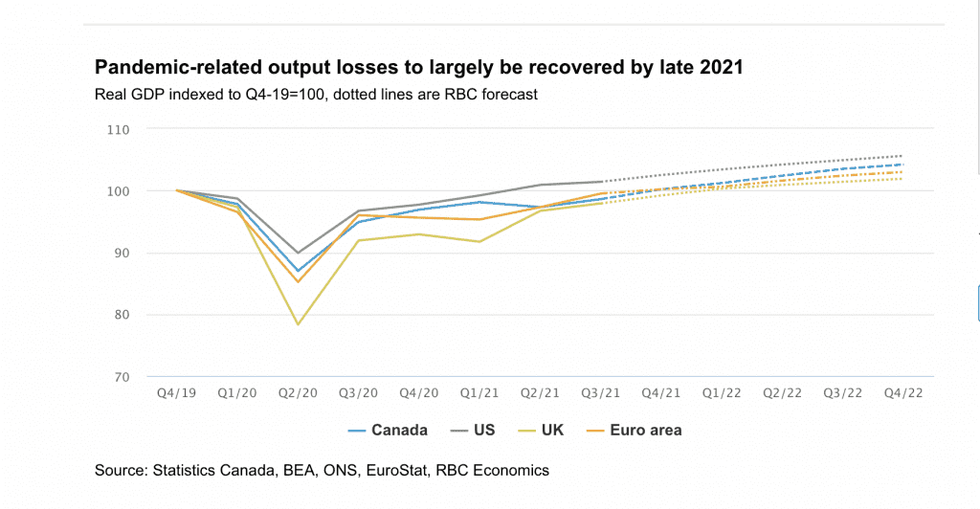

“In the advanced economies we cover, there have been many bumps on the road to recovery,” reads the report. “The discovery of the most recent variant of COVID-19, Omicron, cast another shadow on the outlook, though it remains unclear whether steps beyond travel restrictions and increasing vaccination rates will be required. Should broad-based curbs on activity result, it would delay when Canada, the US, UK, and Euro-area fully recover their pandemic-related losses into 2022.”

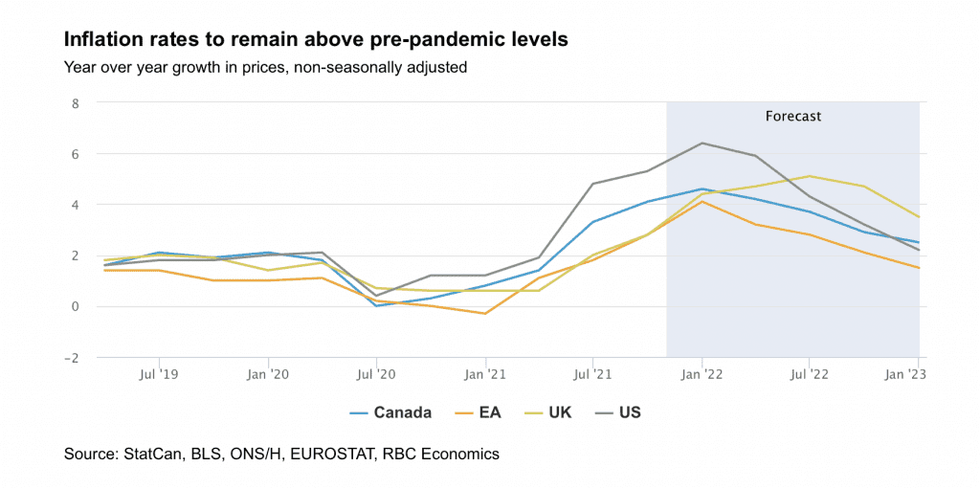

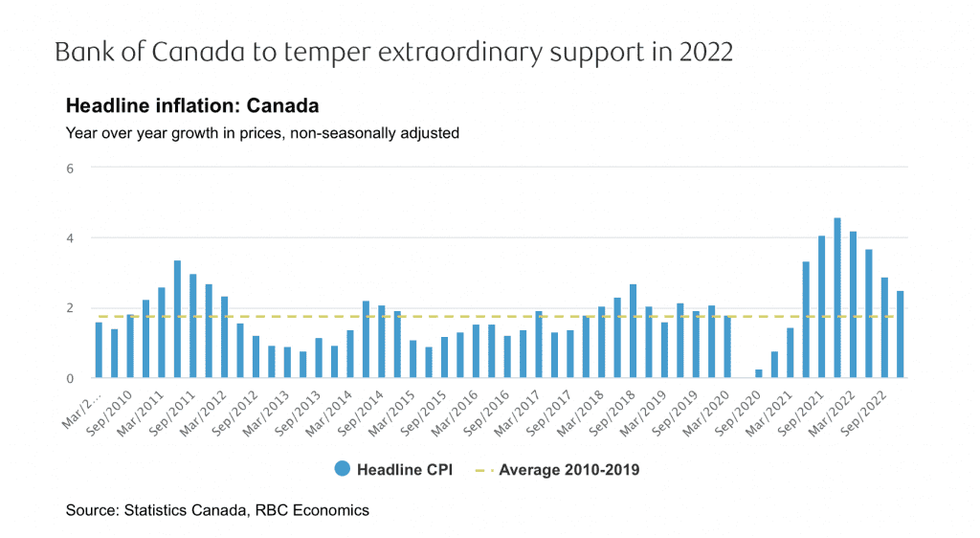

According to RBC, the sharp rise in inflation this year has characterized the global economy. Canada’s inflation rate hit a 19-year high in October, with price gains broadening, says the bank.

Especially with the new Omicron variant, 2022 won’t necessarily be clear sailing, cautions RBC.

“We are optimistic about the outlook but risks remain elevated given the uncertain path of the virus. Our baseline assumption is that given the high level of vaccinations in the countries we watch closely, future restrictions on activity will be limited,” reads the report.

There are, however, challenges that have the potential to stifle growth in 2022, says RBC.

“Supply chains are impaired, input costs have risen, labour shortages are widespread,” reads the report.

At the same time, demand remains strong, thanks to improving labour market conditions and elevated savings amassed during the pandemic and its restrictive measures.

“We expect supply chain bottlenecks and growth in business input costs to gradually ease next year, but labour shortages will remain and keep a cap on near-term GDP growth prospects,” continued the report.

While risks to the growth outlook have eased as inoculation rates have risen, RBC is bracing for potentially challenging inflation scenarios. The bank points to base effects associated with reopening, rising commodity prices, policy stimulus, and higher input costs as contributing factors to the boost in inflation rates.

“Some of these factors will ease as time passes, however, consumer demand is strengthening and additional production capacity is limited,” reads the report. “With more purchasing power chasing increasingly scarce supply of goods and services, inflation rates are likely to remain above central banks’ targets throughout 2022.”

According to RBC, many policymakers view the recent spike in inflation as temporary and are projecting a shift back to the 2% target through 2022. “Market-based inflation expectations have risen but remain relatively contained as investor anticipate central bankers will begin to pare back stimulus via higher interest rates,” reads the report.

As RBC outlines, central banks are setting policy based on outcomes and not timelines, with the general view that inflation will prove temporary and that stimulus is still needed to make a full recovery.

“Those outcomes – the absorption of spare capacity and inflation meeting target – have put the central banks we monitor on varying timelines to initiate rate increases. The Bank of England and Bank of Canada are expected to lead with the Fed following in H2-2022 and ECB in 2023,” reads the report.

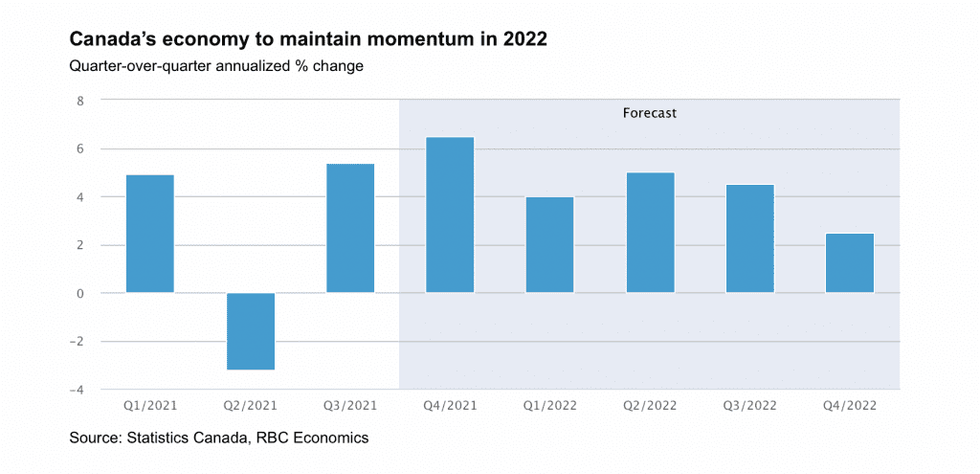

Like many countries, Canada’s pandemic recovery hit some speed bumps in 2021, acknowledges RBC, but the bank says the country likely exited on stronger footing. “After growing an estimated 4.7% in 2021, we expect the momentum to be sustained in 2022 and project the economy will post a 4.3% gain,” says RBC.

RBC's reasoning is that increased vaccinations means that any future pandemic-induced restrictions will be focused and short. Outside of COVID-related risks, supply chain disruptions, labour shortages, and rising input costs will act as headwinds to growth early next year, says RBC. While the bank says some of these challenges will fade as the global economy recovers, labour shortages are expected to persist “given long-run demographic headwinds to labour force participation from an aging population.”

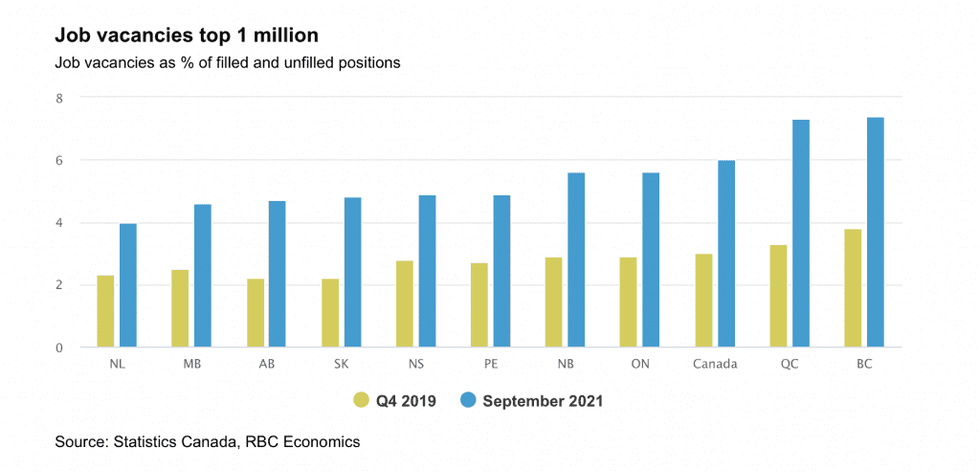

While the labour market recovery is underway, workers are needed.

"Job creation picked up pace in the second half of 2021 following the lockdown-related drop in the second quarter. By September, employment rolls exceeded pre-pandemic levels and the unemployment rate was 1 percentage point higher than its pre-pandemic low,” reads the report.

Professional and financial services have seen strong employment gains, while high-touch service industries experiencing losses. Job vacancies hit a record in September spread across a variety of industries, including higher-contact service industries like food and accommodation services. RBC forecasts that the strong demand for workers will support further employment gains and a lower unemployment rate in 2022. “The hurdle to hiring will be the supply of workers as lower levels of immigration during the pandemic and growing number of workers reaching retirement age weighs on the labour force. A likely result is upward pressure on wages,” reads the report.

The firming labour market will support consumers in the year ahead with spending power enhanced by elevated savings on household balance sheets, says RBC. “By our count, household balance sheets have almost $300 billion in excess savings, which over time will be spent on goods and services, used to repay debt or invest in financial assets and real estate,” says the bank.

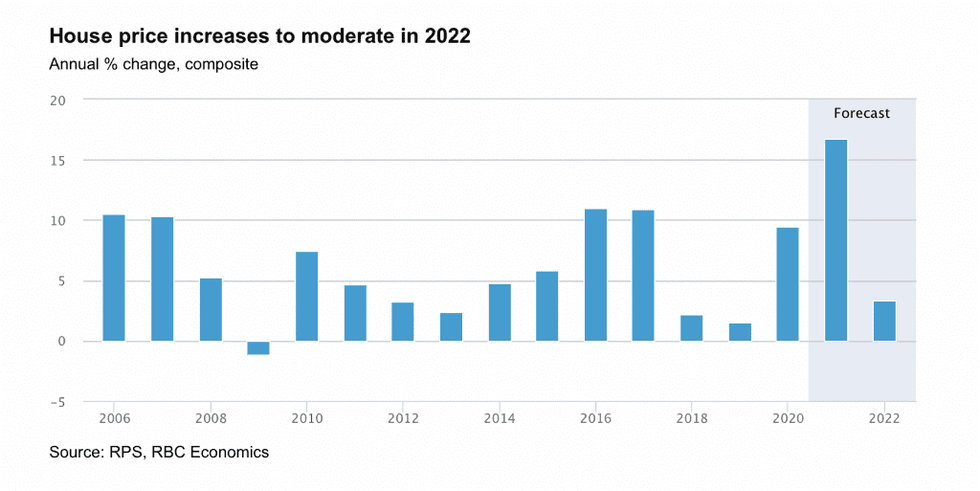

Canada’s housing price increases are expected to moderate in 2022, added RBC.

“The housing market got a second wind in the fall after cooling from extremely hot levels over the summer as buyers looked to lock in low mortgage rates,” reads the report. It points to the lack of supply that characterizes housing markets across the country as a catalyst for the country’s double-digit price increases. RBC projects that as the economy returns to more normal conditions, sellers will emerge which, combined with higher housing completions, will take some of the heat out of prices.

After 2021’s record year, Canada’s homes sales are projected to slow in 2022 to levels that are closer to the 10-year average pace, says RBC. “Prices, which increased by an estimated 17% this year, will also moderate with gains expected to come in at around 3%,” says RBC.

On the business front, RBC says Canada’s businesses will invest to meet firmer demand.

“Business optimism soared as the economy reopened with more than half of companies surveyed saying the outlook for sales continued to improve in the third quarter. Two-thirds of companies cited difficulties meeting demand and intense labour shortages,” says RBC.

The bank says businesses are operating with elevated levels of liquidity, and a growing number intend to invest in the year ahead. It points to imports of machinery and equipment that firmed in 2021 that will likely continue to rise. In response to labour shortages, many firms are beginning to invest in technology and automate processes and growth in online sales supporting the switch to ecommerce platforms.

“Labour shortages and firming wage demands, coupled with supply chain snarls and rising commodity prices have businesses looking for inflation to run hotter than before the pandemic,” reads the report. The latest Bank of Canada surveys showed almost half of firms expect Canada’s inflation rate to average more than 3% over the next two years, the highest share in at least 20 years.

The Bank of Canada lifted its inflation forecast and shifted its policy guidance in October opening the door to further reducing policy stimulus in 2022. The bank has already tapered its bond buying program this year. The bank expects inflation to moderate over the course of 2022 as base effects and supply constraints ease.

“However given the high level of uncertainty about the degree of excess slack in the economy and timing of easing in inflation pressures, we look for policymakers to be nimble and raise the overnight rate early in the second quarter to head off any persistent increase in inflation expectations,” reads the report. “Further increases will likely follow in the second half of the year and our call is that the bank will raise the policy rate by 75bps next year to 1%.”

According to RBC, Canada’s dollar is “not too hot, too cold but just right.”

The trade-weighted Canadian dollar is up 7.5% from its pandemic lows, helped by rising commodity prices and the Bank of Canada’s relatively hawkish stance. Against the US dollar, the loonie is up 9.4%. “We expect the currency’s run will come to an end in 2022 as interest rate dynamics shift in favour of the USD and energy prices provide less of a tailwind,” says RBC. "Neither factor however is likely to exert strong enough pressure to push the Canadian dollar from its 2021 range leaving the currency to trade around 80 US cents in 2022."