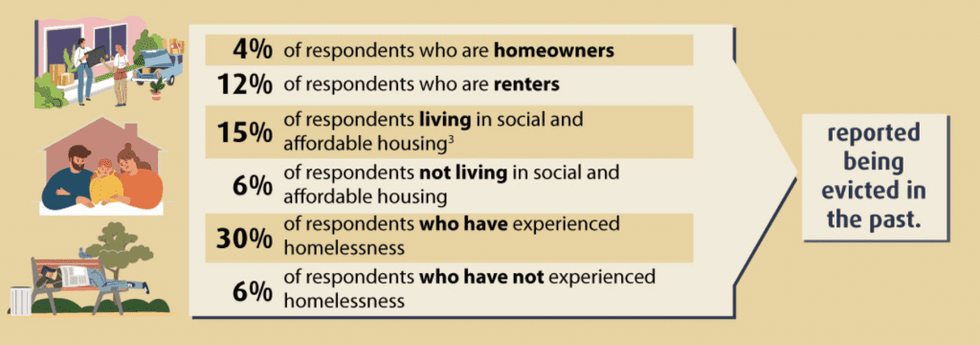

On Friday, Statistics Canada (StatsCan) released data on evictions in Canada that revealed some troubling themes. According to the findings, 7% of Canadian Housing Survey respondents have been evicted in the past, with the greatest proportion of evictees being Indigenous and Black.

Here are the full breakdowns.

In response, Scott Leon, a Researcher at the Wellesley Institute, shared some Toronto-specific data from 2020 that echoed StatsCan's. According to Forced Out: Evictions, Race, and Poverty in Toronto, neighbourhoods with a higher concentration of Black renters tended to have higher eviction filing rates. More specifically, the Wellesley Institute found that census tracts with 36% Black renter households had twice the eviction filing rates compared to census tracts with 2% Black households.

Circling back to StatsCan's data, the top reasons cited for evictions were: sale of property by landlord (37%), landlord wanting the unit for own use (26%), conflict between the tenant and landlord (13%), demolition, conversion, or major repairs by the landlord (10%), and tenant being behind on rent payments (8%).

With the majority of reasons for evictions being out of the tenants' control, it speaks to the lack of stability experienced by Canada's significant number of dedicated renters. It also reinforces the reality of abrupt and sometimes unlawful evictions in Canada -- something that some housing advocates argue is being motivated by the hotly-debated vacancy decontrol rule.

StatsCan's findings released on Friday are part of the 2021 Canadian Housing Survey (CHS). Another sentiment from that survey was that black-led households were less likely to own a home than any other group, with a homeownership rate of 37% in 2021. That number has dropped from 42% in 2018. Comparatively, the homeownership rate for households led by persons not designated as racialized was 69% in 2021. In addition, 40% of Black-led households reported economic hardship last year, which is higher than any other group. Three-quarters of that proportion cited COVID-19 as the reason for economic uncertainty.

Both the CHS and Wellesley Institute study reiterate information that we already know: marginalized groups, including racialized people and low-income earners, are most vulnerable to housing challenges and economic hardship, compounded by the global pandemic.

Moreover, while subsidized housing is linked to lower eviction filing rates, and could pose a stable, affordable housing option for vulnerable populations, the waitlists for social and affordable housing programs tend to have applicants waiting for years.