In line with a trend that began last summer, Canada's housing starts continued to decline in March driven by plummeting construction in Toronto and Vancouver, according to Canada Mortgage and Housing Corporation's (CMHC) latest monthly housing starts report.

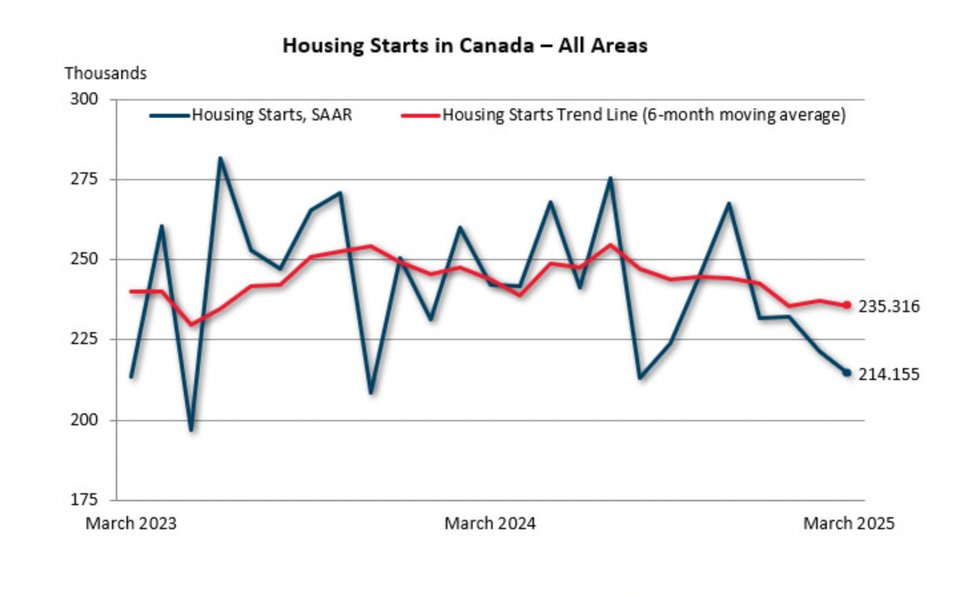

Compared to last month, the total monthly seasonally adjusted annual rate (SAAR) for housing starts across the country fell 3.3% from 221,405 units in February to 214,155 units in March. For the longer-term six-month average, the rate of new housing fell 0.7% in March to 235,316 units.

In municipalities with populations of 10,000 or more, housing starts fell 2.8% between February and March from 209,093 units to 203,285 units, but on a year-over-year basis, actual starts were down 12.5%, with only 14,924 unit recorded this March compared to 17,052 in March 2024.

The most dramatic declines were observed in the large metropolitan cities of Toronto and Vancouver where drop offs in the construction of certain unit types led to massive annual declines in housing starts. In Vancouver, decreases in multi-unit starts drove their year-over-year actual housing starts down 59% in March, while a falling off of both multi-unit and single-detached starts in Toronto caused overall starts to decline 65%.

This was also the case in February, when yearly housing starts in Toronto and Vancouver fell 68% and 48%, respectively.

On the other end of the spectrum, Montreal is seeing housing starts skyrocket on a yearly basis, with multi-unit starts driving a 138% jump compared to March 2024.

The continuing overall decline of housing starts occurs in tandem with record low home sales initially brought on by high prices and borrowing costs, exacerbated by tariff uncertainty, and now contending with the actual fallout of tariffs.

“Up until this point, declining home sales have mostly been about tariff uncertainty. Going forward, the Canadian housing space will also have to contend with the actual economic fallout," said Shaun Cathcart, the Canadian Real Estate Associations' Senior Economist, in reference to the association's latest statistics package. "In short order we’ve gone from a slam dunk rebound year to treading water at best."

According CREA's findings, on a non-seasonally adjusted basis, overall Canadian home sales fell 9.3% year over year in March — the lowest for that month since 2009.

The falling off of sales of both resale and new homes directly impacts housing starts by driving down demand and making it harder for projects to pencil.

In an interview with Senior Vice President of Communications, Research, and Stakeholder Relations at the Building Industry and Land Development Association (BILD) Justin Sherwood in November, Sherwood told STOREYS that new home builders are also getting squeezed by the cost-to-build crisis, further stymying Canada's ability to produce new homes at scale.

"Depending on the product, in the last two years, cost of construction has increased by roughly 20%, and municipal fees, taxes and charges have gone up over that same time period roughly 32% on an average apartment and by $42,000 on an average single-family home," Sherwood told STOREYS. "What you’re seeing is margins getting squeezed, and it’s becoming very very challenging to get new projects to work financially. If you can't make it work and you can't get the financing, it’s not going to translate into product that gets sold."