After a spectacular rise that saw frenzied real estate conditions for close to two years, Canada’s housing market has lost all momentum. A new report from Moody’s Analytics forecasts that -- given increased borrowing costs, elevated inflation, and a softening labour market -- home prices will see a peak-to-trough decline of about 10% by early 2024.

However, the report also notes that there may be some reprieve on the horizon.

“Although the reduction in demand due to affordability will lead to price declines in the near term, demographics will provide a sizable tailwind in the medium and long run as many members of the millennial generation are now in their prime years for starting families and buying homes.”

Suffice to say, we’re nowhere near tailwind territory yet.

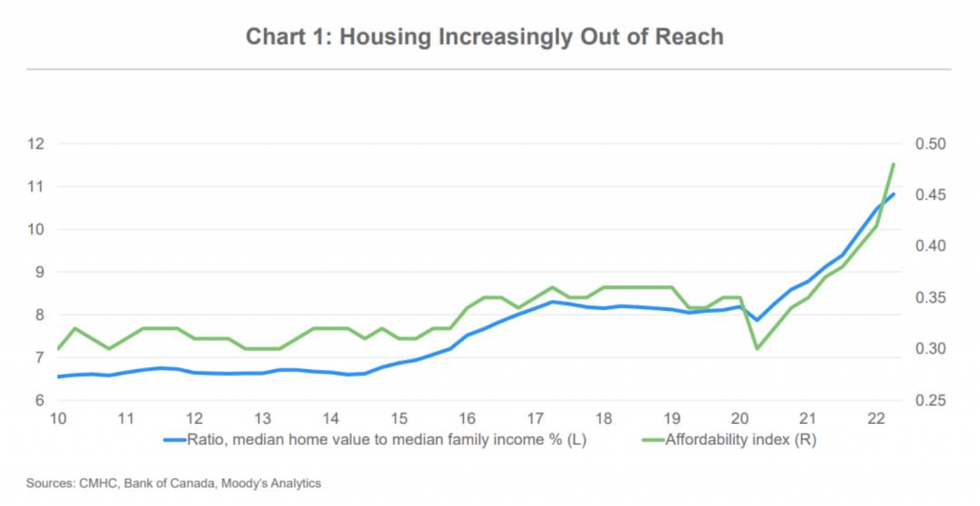

The high interest rate environment (compounded by today’s Bank of Canada decision) has put a strain on housing affordability, with the five-year mortgage rate up 5.6%, or more than 200 basis points, since the start of the year and at its highest level since January 2009. As such, the ratio of average homeownership costs (of which mortgage debt service is the largest component) to average household disposable income (as measured by the Bank of Canada’s affordability ratio) is at its highest level since the late 1990s.

Meanwhile, the RPS Metropolitan Composite index -- which takes into account the weighted average of 13 major metropolitan areas -- saw a second-straight month of decline in August, prompting home prices to dip 13.8% year over year to its slowest pace in a year and a half.

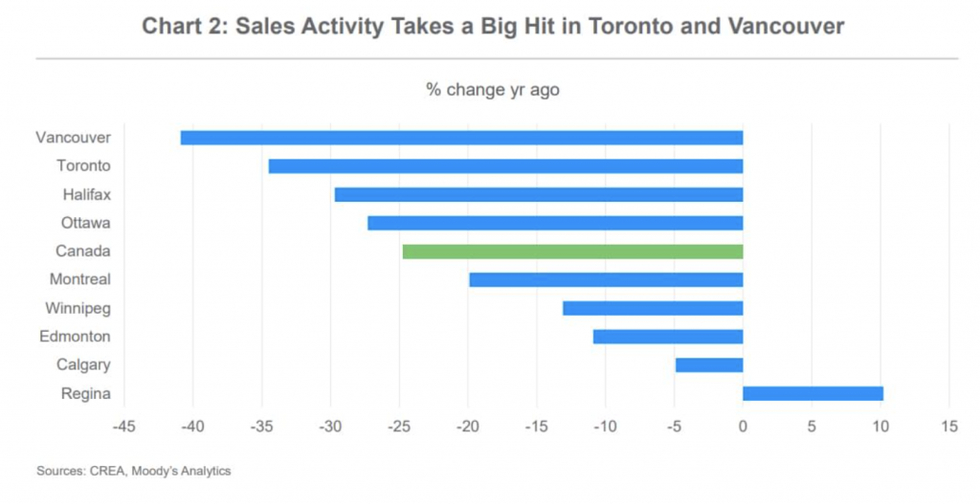

Total sales have plummeted most dramatically in Vancouver and Toronto, dropping by nearly two-fifths and nearly one-third in each region respectively between early 2021 and August 2022. Sales have decelerated less so in Montreal, the Prairie Provinces, and most of Atlantic Canada, with sales still above pre-pandemic levels in the latter two.

In all markets, housing supply continues to underwhelm, with August’s inventory-to-sales ratio at 3.5 months of sales, up from 1.6 months in January, but still a far cry from a balanced market (generally considered to be five to six months of inventory).

Despite lingering supply-side challenges, homebuilding activity is strong, with housing starts -- totalling 267,443 units in August -- down only slightly YoY. Meanwhile, new homes under construction topped 340,000 units, reaching a historic milestone.

With that said, the ratio of permits to starts -- with permits outpacing starts -- implies that “permits are not being readily converted into starts, implying that crews are delaying or abandoning projects because of unfavorable economic outlooks or supply-side constraints,” notes the report, adding that “the climbing ratio may be more indicative of residual building-material bottlenecks.”

The ratio of starts to completions is similarly less than ideal, indicating that starts are outpacing completions for single-family and multi-family projects. However, this is chalked up to the reality that these housing types take longer to finish.

In addition, construction timelines have faced significant supply-chain issues this year, and such issues are likely to persist. The Canadian Home Builders’ Association reports that projects were held up by 10 weeks, on average, in the first quarter of 2022 alone.

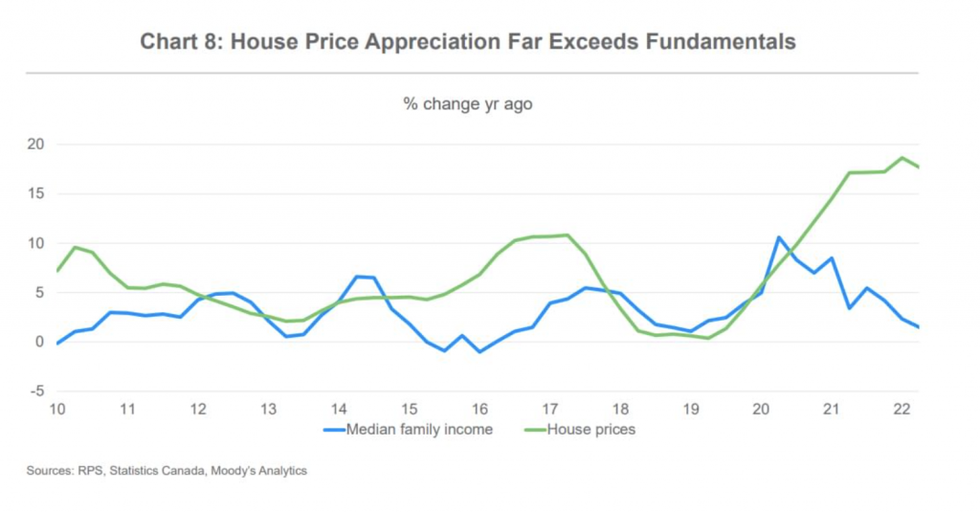

The pandemic saw demand and price growth for single-family homes expand dramatically, and the price appreciation was particularly strong in the suburbs and rural areas. “The causes are both structural and cyclical,” notes the report, pointing to both record-low interest rates and demographic trends, including millennial homebuyers and baby boomers opting not to downsize. This momentum didn’t falter until midway this year.

More recently, price growth remains strong by historical standards, but there is no mistaking that the high interest rate environment is exerting downward pressure. This is particularly apparent when examining house price dynamics between January and August 2022. With each month, there were fewer metropolitan areas that showed annualized house price growth equaling or exceeding year-over-year growth.

Today, the Bank of Canada hiked its Overnight Lending rate by 50 basis points, bringing it to 3.75%. This is the six-straight increase since March, and will undoubtedly put more strain on affordability and housing demand, while stalling hiring and driving the unemployment rate up -- potentially edging it closer to 6% by next year.

But with the end of the hike cycle presumably on the horizon, Moody’s report includes a forecast that the housing market will rebound in late 2024. It also notes that given the fact that home prices exploded during the pandemic, “the pullback is part of the economy’s normalization.”

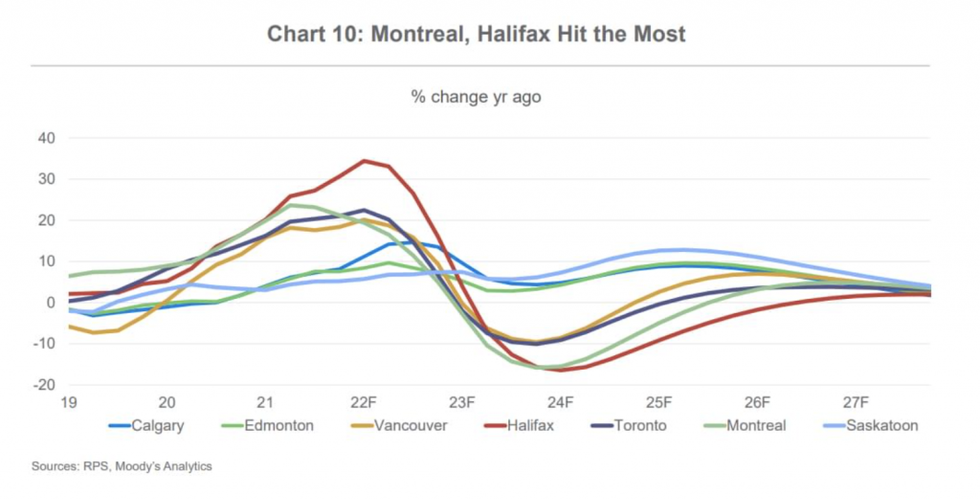

Over the next five years, Moody’s anticipates metro areas across Canada will experience significantly slower house price growth. However, undervalued housing markets, particularly in Alberta and Saskatchewan, are expected to fare better than others because of their inherent affordability. In fact, price appreciation is expected to strengthen in certain markets within those provinces, including Calgary, Edmonton, and Saskatoon.

Conversely, overvalued markets -- such as Toronto’s and those in the surrounding Golden Horseshoe region, as well as those in BC and Quebec -- are expected to see downward pressure on housing prices to varying degrees, and the most significant corrections.

Of Toronto and the Golden Horseshoe, Moody’s report notes that “house prices have also shown less sensitivity to overvaluation in the historical data since 2005, so they will likely experience less downward price pressure.”

To close, the report addresses the variables that could amplify the stress in the housing market, including mounting household debt, inflation shock, and supply-side constraints. On the upside, it notes that “household balance sheets are strong overall, with savings exceeding pre-pandemic levels for many households. Many young adults continue to aspire to become homeowners, provided they can find homes to buy within their price range.

“Overall, the risks are equally balanced, with demographics providing structural strength and interest rates and supply-chain bottlenecks presenting cyclical challenges.”